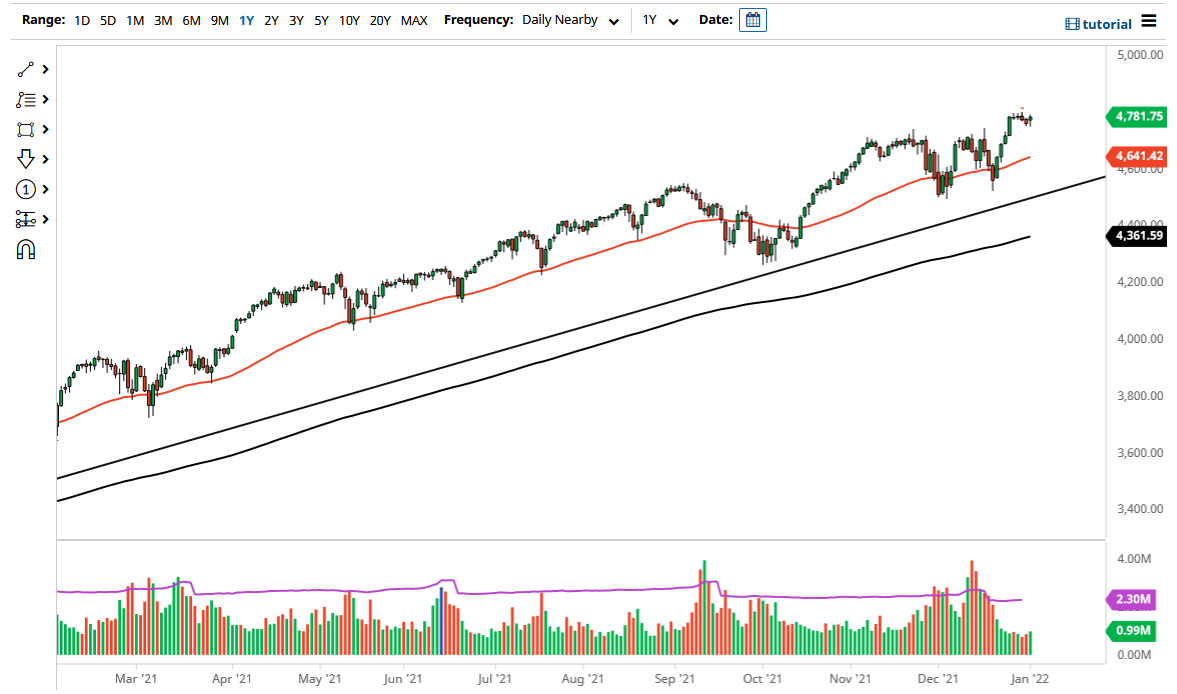

The S&P 500 pulled back initially on Monday, only to turn around and show signs of life again. Because of this, it looks as if the market is going to try to continue the overall uptrend, which has been rather strong as of late. In fact, you could even make a bit of an argument for a bullish flag.

That being said, we clearly cannot short this market anytime soon. The market is likely to continue to hear more noise than anything else, especially as we have the jobs number coming out on Friday. That obviously has a major influence on stock markets in America, and it also will be the first hurdle to clear as far as a major news announcement is concerned. Nonetheless, this is that the time of year where people have to put money back on their books in order to take risk on. By doing so, the market allows for a little bit of a pullback in the short term, but longer term we should continue to see more upward pressure than anything else. The 50 day EMA currently sits at the 4641 level and is curling higher, so that is something worth paying attention to as well.

Based upon the “bullish flag” that has somewhat formed, we could be looking at a 250-point move before it is all said and done, which puts us right at the psychological figure of 5000. That is my longer-term target, but I do not think we will get there as easily as we have risen in the past. Nonetheless, I certainly would not be a seller of this market and I see the 4500 level as a major floor in the market as it had recently been a bit of a “double bottom.” If we were to break down below there it would obviously be very ugly, but even then I would not short this market. I would be willing to buy puts at this point, just simply because I can take advantage of the downside without wrecking my account on some random comment from Jerome Powell in order to save Wall Street. Buying the dips should continue to work going forward, and that is exactly how I am going to continue to play this market.