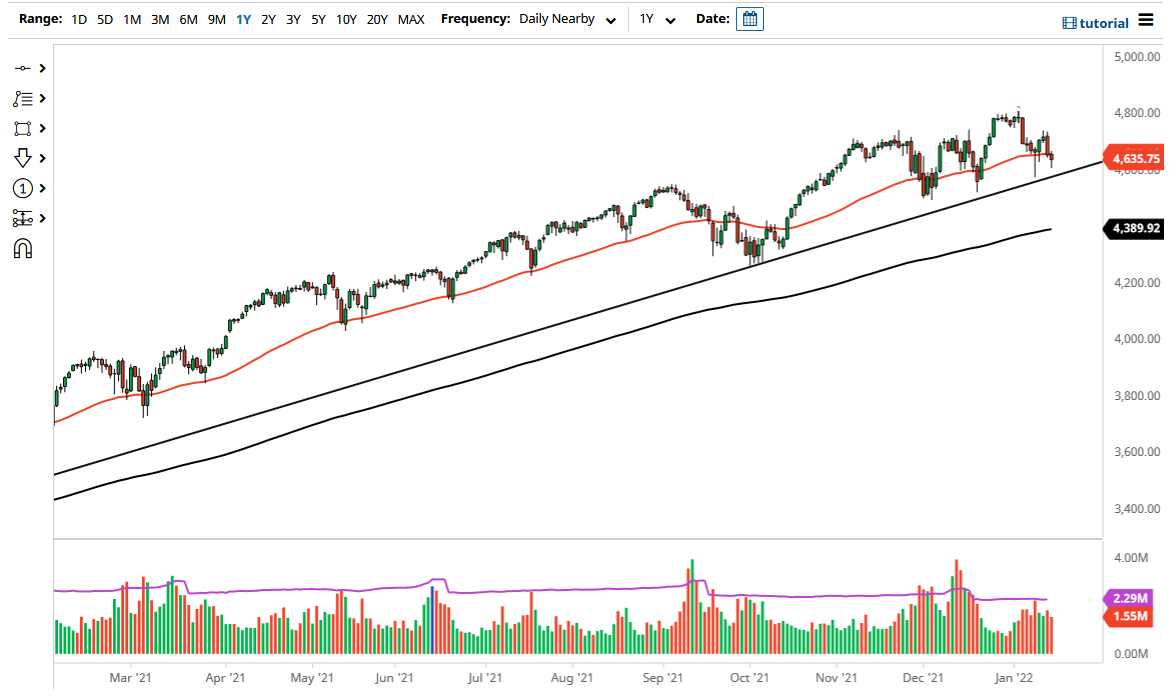

The S&P 500 fell a bit on Friday, but it must be stated that we found a bit of support at the 4600 level. This is much better than anticipated, as the markets have been freaking out over the idea of the Federal Reserve hiking interest rates. This is especially bullish due to the fact that Monday is Martin Luther King Day, so the underlying index itself will be moving. There will be shortened futures market hours, but that is not enough to get things going from a longer-term standpoint.

When I look at this chart, it suggests to me that we are going to continue to see the uptrend line hold things together, as it looks like we are ready to see plenty of value hunters. In fact, the daily candlestick ended up being a hammer, which is a bullish sign that a lot of people will pay close attention to as well. In other words, if we broke above the top of the hammer, then technically that is a buy signal. At that point, the market would then go looking towards the 4700 level above which has offered a little bit of resistance. After that, then the market is very likely to go looking towards the 4800 level after breaking out.

It is worth noting that the 4800 level has been significant resistance, as it has behaved a bit like a “brick wall” in the market. The market continues to see a lot of volatility based upon the Federal Reserve and the potential for interest rate hikes, but I think at this point in time the market is starting to digest that idea and it may continue to rally a bit from here. That being said, the market is likely to hear plenty of noise, but ultimately it looks as if we are settling down. Because of this, I think we are seeing a shift in where money is going, but the index itself should continue to show signs of bullish pressure. Ultimately, this is a market that I think buying dips will be the way to go going forward but if we were to break down below the 4500 level, then I might be a buyer of puts. That being said, I like the price action on Friday.