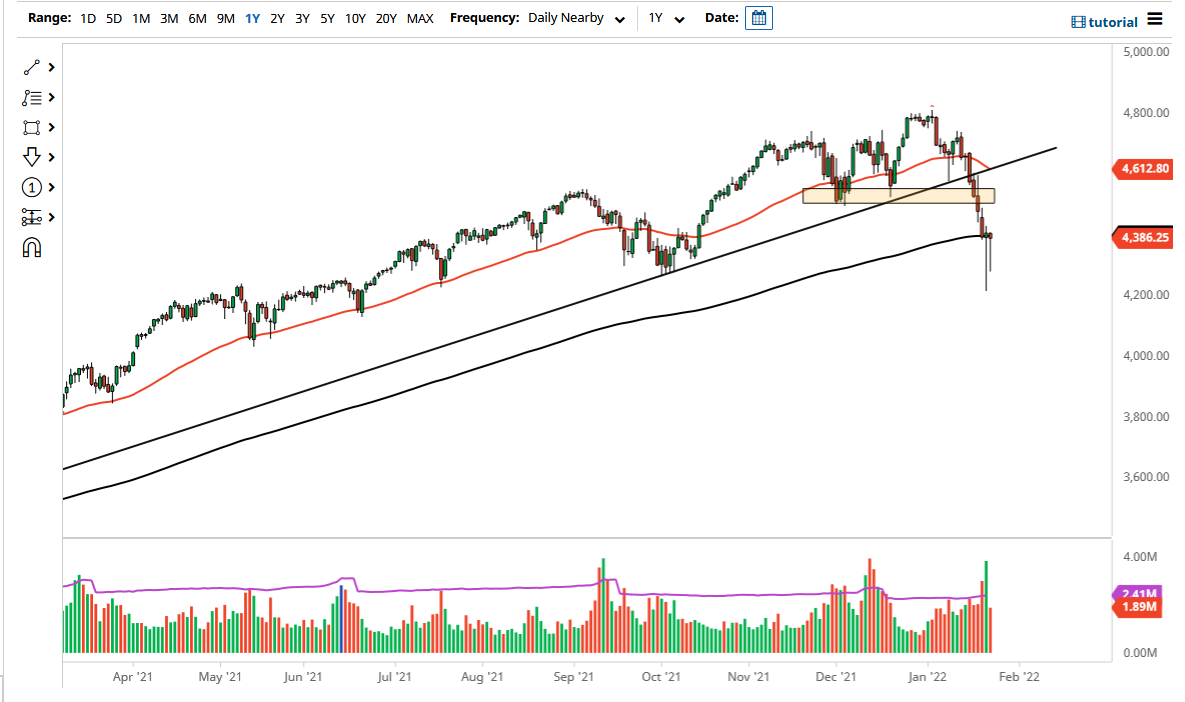

The S&P 500 fell initially on Tuesday, but then turned around to show signs of life again. That being said, the market is very likely to continue seeing volatility, as the Federal Reserve pulling the punch bowl away could be the biggest story of the year. We will have to wait to see what Jerome Powell says and whether or not he acknowledges that the selloff in the stock market has caught his attention. It will be interesting to see how this plays out because you could make an argument either way.

It is worth noting that the market has been all about liquidity over the last 13 years, so we'll have to see whether or not we continue to see the Federal Reserve acknowledge that it is the main reason the markets have gone higher and whether or not it even cares. Recently, Jerome Powell has suggested that the markets were less important than inflation, but there is the narrative right now that the Federal Reserve may be tightening into a slowdown, which is a mistake that they have made more than once.

It will be interesting to see whether or not he blinks. The first sign of dovishness will almost certainly send the market higher, and thereby send this one straight up. If they start talking about concerns about the stock market, that is exactly what traders will want to see. However, if they completely ignore the topic altogether, that will almost certainly send markets much lower. In that scenario, it would not be a huge surprise to see the 4200 level broken quite rapidly as it will be a bit of a freefall.

If that happens, I am probably going to buy puts, but I would not get overly aggressive to the downside. I anticipate a move down to the 4000 handle if that does happen, but I would anticipate a certain amount of pushback in that general vicinity. Either way, I think what we are going to hear is a lot of noise. Because of this, you will need to be very cautious about your position size, and I think you are better off waiting until the end of the day to see where the chips fall.