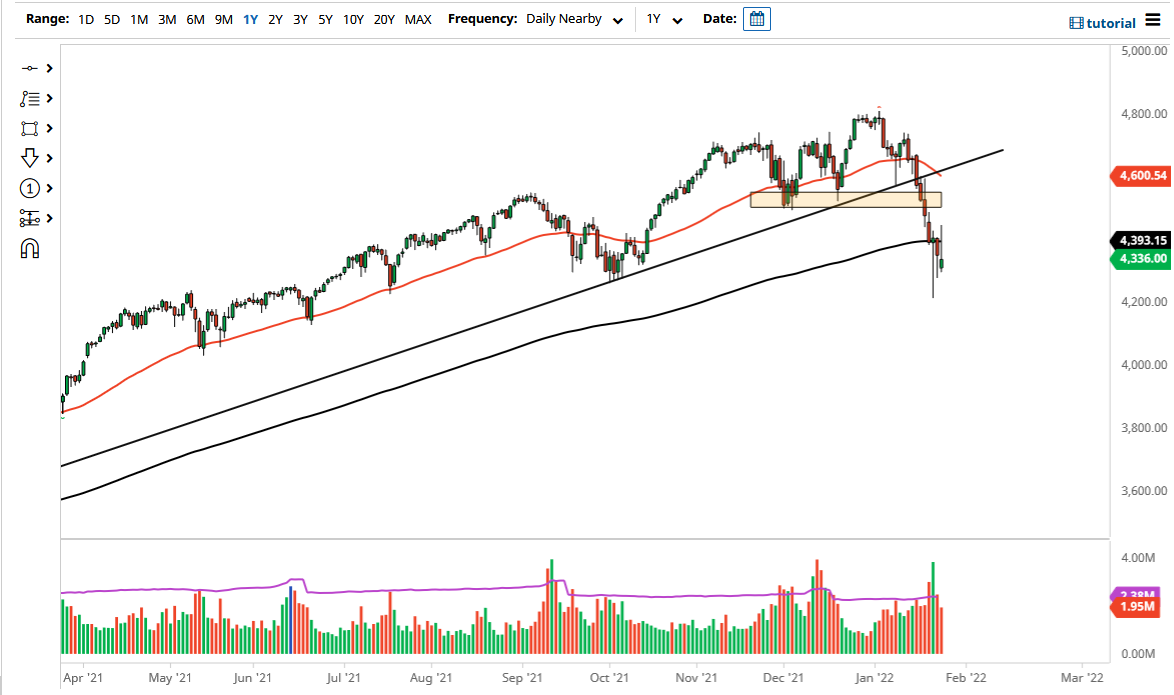

The S&P 500 spent most of the day going higher as traders are hoping that “Uncle Jerome” would come in and save everyone. However, he chose not to and we will see the markets continue to struggle as they have been quick to move based upon liquidity more than anything else. With this being the case, I do think that we will continue lower, and although the market had looked rather bullish at one point, we gave back those gains and then fell rather precipitously. Furthermore, we were selling into the close, which is never a good sign.

With that being said, if the market were to break down below the 4200 level, I think we will see even further downward pressure. Breaking down below that level then opens up a bit of a “trapdoor” down to the 4000 handle. After that, we will get a real free-for-all to the downside. Having said that, if we can turn around and take out the highs of the trading session on Wednesday, that would be an extraordinarily bullish sign, but this is a market that does not see much in the way of positivity at the moment. This will be the case as long as Wall Street throws a tantrum when it comes to interest rates, so I think the negativity will continue.

It has been about liquidity for ages now, and we need to keep an eye on what the Fed does. It is obvious at this point that the market is going to continue to struggle, and it is likely that sellers will come in and jump all over this market every time they get an opportunity to do so. Furthermore, this is a market that I think will continue to be very noisy regardless, so it is very likely that we will have confusion to say the least. We have broken down for a reason, and that reason has not changed during the session, so it certainly looks as if there will still be plenty of dour traders out there that are willing to express their opinion in the market. I will be buying puts instead of shorting, but there is no interest on my part whatsoever in trying to buy this market on a bounce until something fundamentally changes or we get a bit of a longer-term basing pattern.