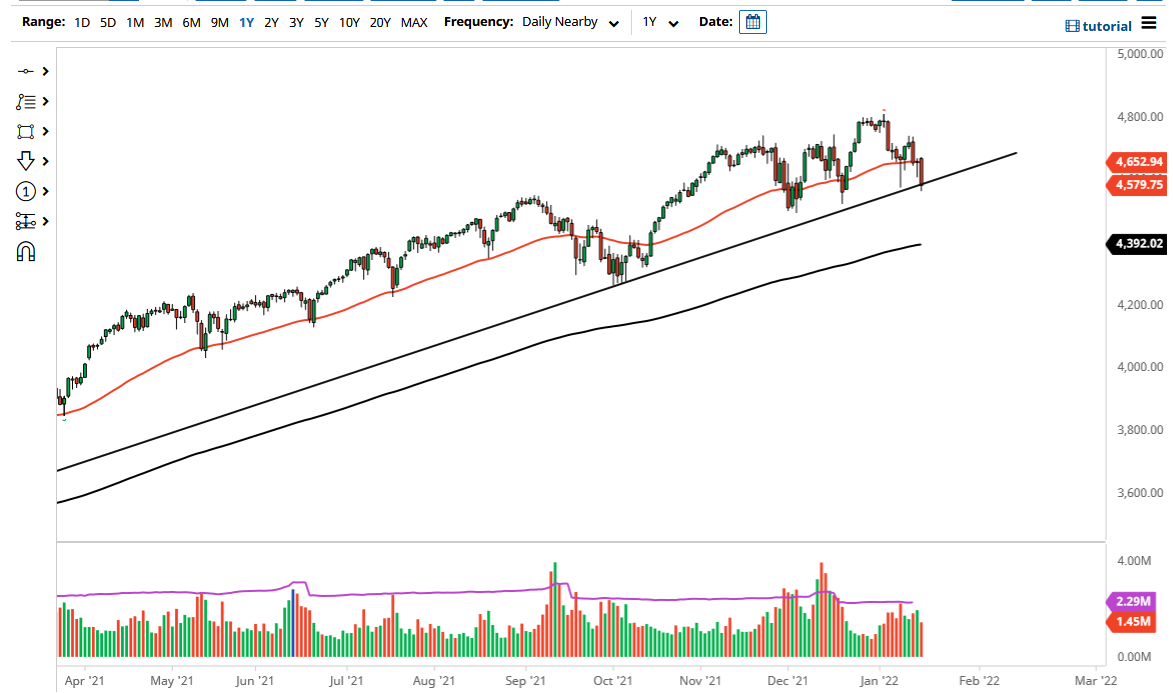

The S&P 500 sold off rather drastically on Tuesday to reach down below the 4600 level. Just as importantly, the market seems to have tested a major downtrend line, which is a big deal in and of itself. This trend line goes back well over a year, so it is worth paying attention to.

At the top of the candlestick, the 50 day EMA comes into the picture, offering a potential resistance barrier. That being said, if we can take out the top of the candlestick for the Tuesday session, that would be a huge victory for the bullish traders out there, and perhaps have more momentum flowing into the market. Ultimately, I think this is a market that will find a lot of noise over the next couple of days as we are starting to see traders out there freak out about the idea of the Federal Reserve tightening monetary policy. It is very unlikely that the Fed will be able to raise interest rates four times like some people are claiming, due to the fact that it would essentially be tightening into a slowdown. I believe at this point some people are starting to pick up on this.

Nonetheless, if we do break down from here, the 4500 level is the next area that I would pay close attention to, as it is a large, round, psychologically significant figure, and an area that has seen action previously. If we break down below the 4500 level, I wouldn't short this market, but I would be a buyer of puts as it would show sufficient weakness to at least do that. I do not short the US indices, because they are far too manipulated by not only the Federal Reserve, but firms on Wall Street itself. I know most analysts will tell you that, but the reality is that the Federal Reserve steps in and save Wall Street every time it starts losing money. This has been the game for at least 13 years, so at this point what I do is buy puts, but what I won't do is “short the market.” Otherwise, if you do not have that ability, a breakdown would be a potential opportunity to buy on some type of major dip and find value.