This week I will begin with my monthly and weekly forecasts of the currency pairs worth watching. The first part of my forecast is based upon my research of the past 20 years of Forex prices, which show that the following methodologies have all produced profitable results:

- Trading the two currencies that are trending the most strongly over the past 6 months.

- Trading against very strong weekly counter-trend movements by currency pairs made during the previous week.

- Carry Trade: Buying currencies with high interest rates and selling currencies with low interest rates.

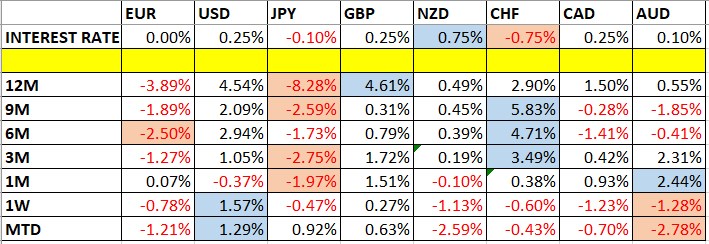

Let us look at the relevant data of currency price changes and interest rates to date, which we compiled using a trade-weighted index of the major global currencies:

Monthly Forecast February 2022

For the month of February, I forecast that the EUR/USD currency pair will fall in value.

For the month of January, I made no forecast.

Weekly Forecast 30th January 2022

In my previous forecast last week, I made no weekly forecast, as there were no unusually strong counter-trend movements. Fading strong weekly counter-trend price movements is the basis of my weekly trading strategy.

I again make no weekly forecast, as there were no strong counter-trend price movements last week in the Forex market.

The Forex market saw an increase in its level of directional volatility last week, as I had expected, with 48% of all the important currency pairs or crosses moving by more than 1% in value. Directional volatility is likely to remain at a similar level this coming week as there are several policy releases due from major central banks plus US non-farm payrolls data.

Last week was dominated by relative strength in the US dollar, and relative weakness in the Australian and New Zealand dollars.

You can trade our forecasts in a real or demo Forex brokerage account.

Key Support/Resistance Levels for Popular Pairs

I teach that trades should be entered and exited at or very close to key support and resistance levels. There are certain key support and resistance levels that can be watched on the more popular currency pairs this week.

Currency Pair | Key Support/Resistance Levels |

|---|---|

AUD/USD | Support: 0.6963, 0.6926, 0.6885, 0.6774 Resistance: 0.7051, 0.7100, 0.7170, 0.7188

|

EUR/USD | Support: 1.1089, 1.1056, 1.0954, 1.0915

Resistance: 1.1195, 1.1229, 1.1250, 1.1261 |

GBP/USD | Support: 1.3375, 1.3340, 1.3304, 1.3273 Resistance: 1.3441, 1.3490, 1.3576, 1.3602 |

USD/JPY | Support: 115.02, 114.79, 114.55, 114.23 Resistance: 116.01, 116.29, 116.79, 119.04 |

AUD/JPY | Support: 80.40, 79.81, 78.59, 78.14, 77.37 Resistance: 80.79, 81.33, 81.76, 82.08 |

EUR/JPY | Support: 128.30, 127.44, 126.88, 126.65 Resistance: 129.31, 130.00, 130.62, 130.84 |

USD/CAD | Support: 1.2748, 1.2714, 1.2645, 1.2535 Resistance: 1.2812, 1.2901, 1.2959, 1.3025 |

USD/CHF | Support: 0.9291, 0.9249, 0.9229, 0.9201 Resistance: 0.9370, 0.9387, 0.9438, 0.9470 |

Let us see how trading reversals from one of last week’s key levels could have worked out:Key Support and Resistance Levels

AUD/JPY

I had expected the level at 82.08 might function as resistance, as it had acted previously as both support and resistance. Note how these “flipping” levels can work well. The H1 chart below shows how the price rejected this level with a very large, dramatic outside bar towards the end of last Wednesday’s New York session, marked by the down arrow in the price chart below. This trade has been nicely profitable, achieving a maximum positive risk reward ratio of almost 2 to 1 based upon the size of the entry candlestick.

That is all for this week. You can trade my forecasts in a real or demo Forex brokerage account to test the strategies and strengthen your self-confidence before investing real funds.