The US dollar rallied from the 50-week EMA against the Indian rupee in January and has seen strength against almost all currencies. Because of this, the Indian rupee will not be any different, and it will be interesting to see what the Reserve Bank of India does, as it tends to manipulate the currency due to its own internal issues. Currently, the interest rate in the subcontinent comes in at 4.25%, but with the Federal Reserve hell-bent on tightening, it will shorten that gap. In other words, the US dollar needs to be repriced.

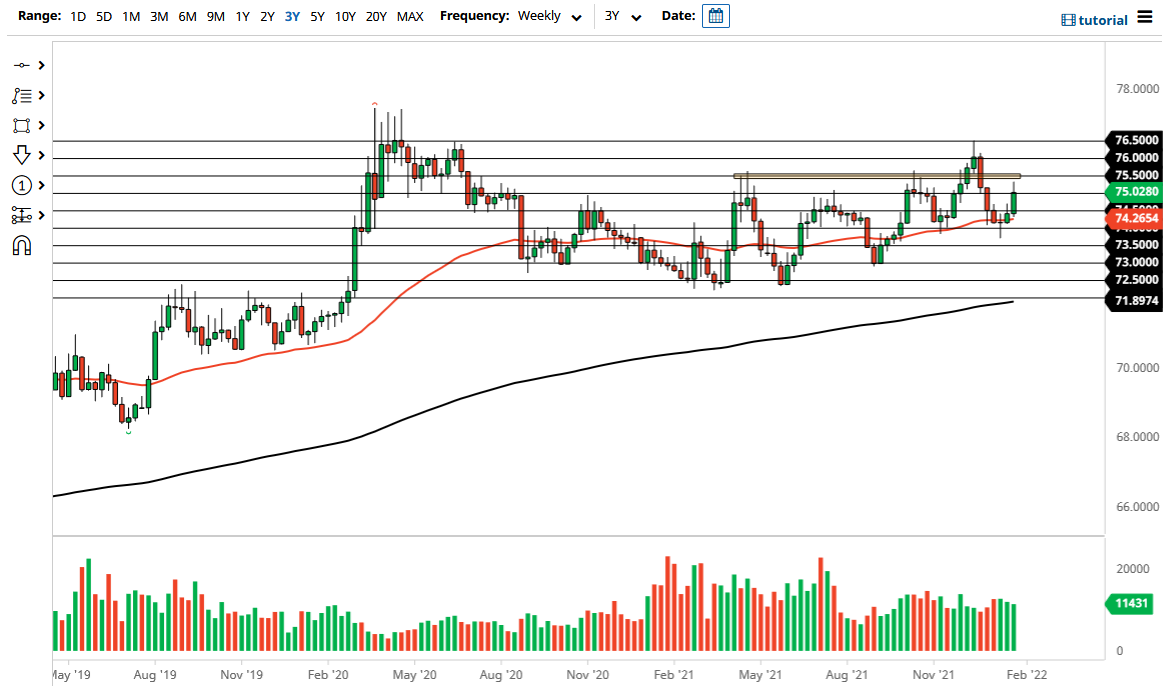

With that being the case, it is not a huge surprise to see that the greenback tried to get to the ₹75.50 level during the last week of January, but it is also worth noting that it did hold. I think that is going to be the key, whether or not we can break above the ₹75.50 level, because it opens up the possibility of the market heading back towards ₹76.50, an area that had offered a lot of resistance.

Regardless, there is a lot of upward pressure on the US dollar in the meantime, and I think that will continue to be the case. Emerging market currencies such as the Indian rupee will be looked at as less desirable, especially if the interest rate differential starts to shorten. Having said that, I do think that longer-term the Federal Reserve will probably have to reverse policy, but that will not be during the month of February, nor will it be in the preceding couple of months. After all, they have not even started yet, and even though the markets are freaking out in general, the reality is that there is a lot of excess liquidity still in the market that needs to be soaked up, which typically is dollar positive as it drives up demand for greenbacks around the world.

This is not to say that I believe this market is simply going to slice through a bunch of resistance levels, but I do think that if you get short-term dips during the month of February in the USD/INR pair, they will probably end up being buying opportunities. I think that there is a little bit of a short-term “floor the market” at the ₹74 level.