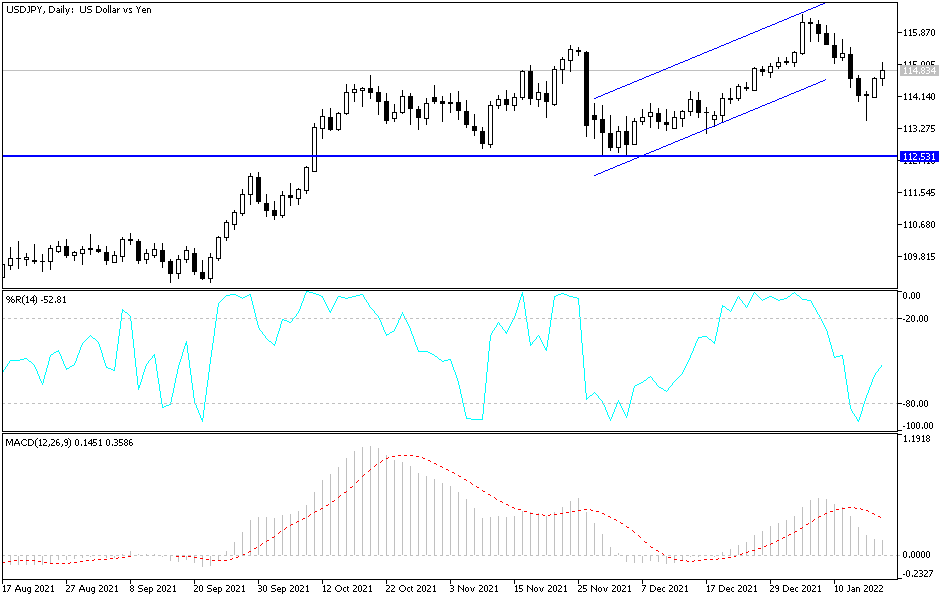

For the third day in a row, the price of the USD/JPY is back to a bullish rebound, after it tested its impact in early trading today. The resistance level is 1150.00 again, after profit-taking sales, which pushed the currency pair towards the support level 113.48 and in the first week of trading for 2022. The currency pair rebounded strongly towards the 116.35 resistance level, its highest in five years. The US dollar is still supported by confirmed expectations that the date for raising interest rates is imminent, to counteract US inflation, which has reached its highest level in 40 years.

In turn, the Japanese government is preparing for social restrictions in Tokyo and other areas as more people are infecting the Omicron type of coronavirus. Japan has never been closed during the pandemic but has instead focused on asking restaurants and bars to close early. Crowds returned in many parts of Japan, as people packed shops and events, while cases of the COVID-19 virus rose. For his part, the government spokesman said Tuesday that the order will be completed this week and is likely to go into effect on Friday in Tokyo and nine other regions, including Chiba, Kanagawa, Aichi, and Kumamoto.

An order was issued earlier this month for the prefectures of Okinawa, Yamaguchi, and Hiroshima. Other areas seeing a rise in infections, such as Osaka, may be added at a later date. "Injuries are increasing at an unprecedented speed," Chief Cabinet Secretary Hirokazu Matsuno told reporters. He added that concerns are growing about the infection spreading too quickly, which could lead to severe stress in hospital systems.

He acknowledged that additional measures may be needed if the number of people required to undergo quarantine or hospital treatment increases. About 80% of Japanese have received two injections of the vaccine, while only 1% have received a booster dose. The government has promised to speed up the reinforcements, but most people won't get them until after March or later, according to the current schedule. The third dose is especially recommended against omicron, which causes more penetrating infection than early forms of the virus.

The ruling Liberal Democratic Party is keen to avoid public discontent over its handling of the coronavirus pandemic, which is widely seen as behind the ouster of the former prime minister. Parliamentary elections will be held nationwide in a few months. Bars and restaurants that adhere to government restrictions are eligible for assistance. But some say that was not enough.

Overall, more than 20,000 new cases were reported on Monday nationwide, showing cases are rising rapidly due to the omicron. Most experts believe the number of cases is understated because testing is not widespread. There are now about 134,000 people in quarantine or hospital due to COVID-19. About 18,400 people have died from COVID-19. The newly reported daily cases in Japan are close to record numbers recorded in August and September last year.

According to the technical analysis of the pair: There is no doubt that the return of the price of the USD/JPY currency pair around and above the 115.00 resistance, as I mentioned before, will support the return of the bulls’ dominance. The lowest levels are important to think about buying the dollar yen again. On the other hand, the closest targets for the bulls are currently 115.35 and 116.20, respectively. The currency pair will be affected today by the Bank of Japan's announcement of its monetary policy decisions. There is no important influential data from America today.