For four trading sessions in a row, the price of the USD/JPY currency pair is moving amid profit-taking sales towards the 115.05 support level. This is after testing at the beginning of the new year's trading the 116.35 resistance level, its highest in five years. The US dollar's gains eased after a mixed US payroll figure was announced at the end of last week. This week, the US dollar will react strongly to the announcement of US inflation figures and Jerome Powell's testimony.

We expect December core CPI to rise 0.4% and core inflation to rise 0.5% (0.37% and 0.46% to double digits, respectively). We expect energy prices to fall 0.7% month over month - the first decline in six months - due to cuts in gasoline, natural gas, and heating oil prices. On the other hand, food inflation is likely to remain strong, as we are looking forward to a rise of 0.5% in December. Inflation rates in the United States have risen to more than six percent in recent months and combined with a strong and continuing recovery in the US labor market, spurred by a rapid turnaround by the Federal Reserve, put the bank on the right track to raise interest rates.

Investors concerned about the lack of a 'narrative drive' for long views of the US dollar are looking at two very strong themes that should work in favor of the dollar in the first half of 2022. First, quantitative tightening is very supportive, says Biban Rai, analyst at CIBC Capital Markets. It is also important to understand the channel through which the QT thread will work in favor of the US dollar. Second, the market is still pricing too low for the final interest rate for the next rate hike.”

The minutes of last week's December meeting showed that there was substantive debate last month about when and how the Federal Reserve should shrink its expanded $8.8 trillion balance sheet while revealing for the first time that this process known as "quantitative tightening" could begin relatively soon after.

All in all, many US dollar exchange rates have risen sharply in the wake of last Wednesday's Federal Reserve meeting minutes and explain along the way why Tuesday's US inflation data will be important to the dollar.

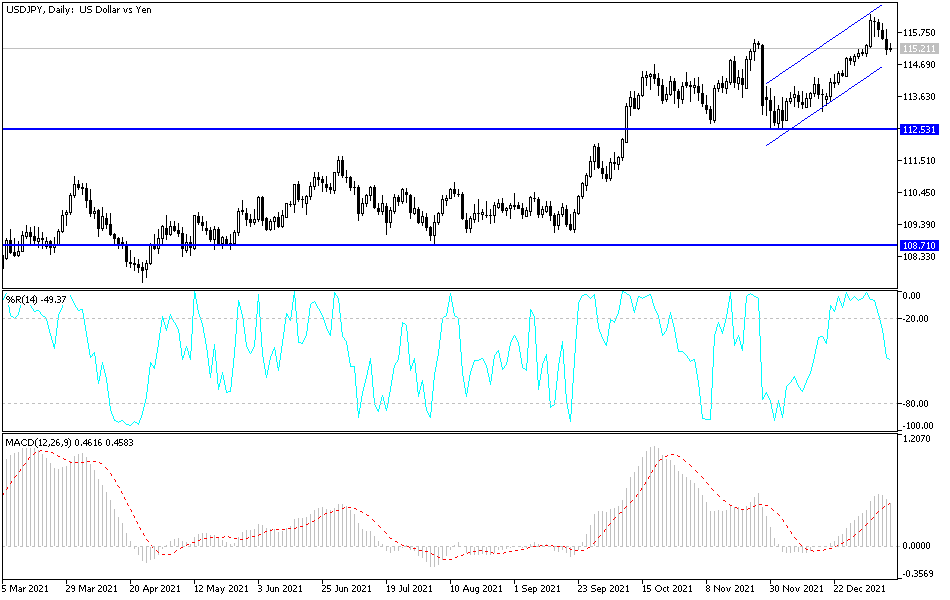

According to the technical analysis of the pair: According to the performance on the daily chart, in the event that the USD/JPY currency pair moves towards the 114.40 support level, the current ascending channel may be broken. The bears’ control may increase to move towards the 113.25 support level, which confirms the change of the general trend to the downside. On the upside, the return of the breach of the last resistance 116.35, which reached the ceiling of the upper line of the channel, will increase the bulls' dominance for a longer period. So far, I still prefer to sell the currency pair from every bullish level.

Today's USD/JPY will be influenced by whether investors take risks as well as the reaction from Federal Reserve Governor Jerome Powell's testimony.