The recent sale of the US dollar against the Japanese yen (USD/JPY) stopped at the 113.46 support level, the lowest in a month. The currency pair returned to recovering to the 114.15 level before settling around the 113.90 level at the time of writing the analysis ahead of the most important event for global financial markets. With inflation punishing consumers and threatening the economy, the Federal Reserve today is likely to signal its intention to begin raising interest rates in March for the first time in three years. The Fed's challenges will only get tougher from there.

Among US central bank officials, there is broad support for an interest rate increase - support that comes much sooner than officials expected just a few months ago. But then their policymaking will become more complex and could lead to internal divisions, especially with several new officials joining the Federal Reserve.

The question is: How often should the Fed raise interest rates this year? When should you start dumping his massive stockpile of bonds, a move that would contribute to a tightening of credit? And how should the Fed respond if inflation falls later this year, as many officials expect, yet remains well above its 2% annual target?

Some economists have expressed concern that the Fed is already acting too late to combat high inflation. Others say they worry that the Fed may act too aggressively. They argue that too many rate hikes would risk causing a recession and in no way slow inflation. From this point of view, higher rates often reflect congested supply chains that Fed rate hikes cannot handle.

When the Fed boosts the short-term interest rate, it tends to make borrowing more expensive for consumers and businesses, slowing the economy with the intent of reducing inflation. Fearing the possibility of higher interest rates, investors were dumping stocks with abandon. Last week, the sell-off pushed the S&P 500 index to its worst weekly loss since the pandemic broke out in March 2020. The Nasdaq is down more than 10% from its peak, which is a complete "correction".

This week's Federal Reserve meeting, which ends today with a policy statement and press conference with President Jerome Powell, comes against a backdrop of rising inflation and an economy once again swept by a wave of COVID-19 infections. Over the past year, consumer prices have risen 7%, the fastest pace in nearly four decades.

Powell admitted that he failed to anticipate that high inflation would continue, having long said he believed it would be temporary. The increase in inflation has extended far beyond those affected by the lack of supply - apartment rents, for example - indicating that it can continue even after goods and parts flow more freely.

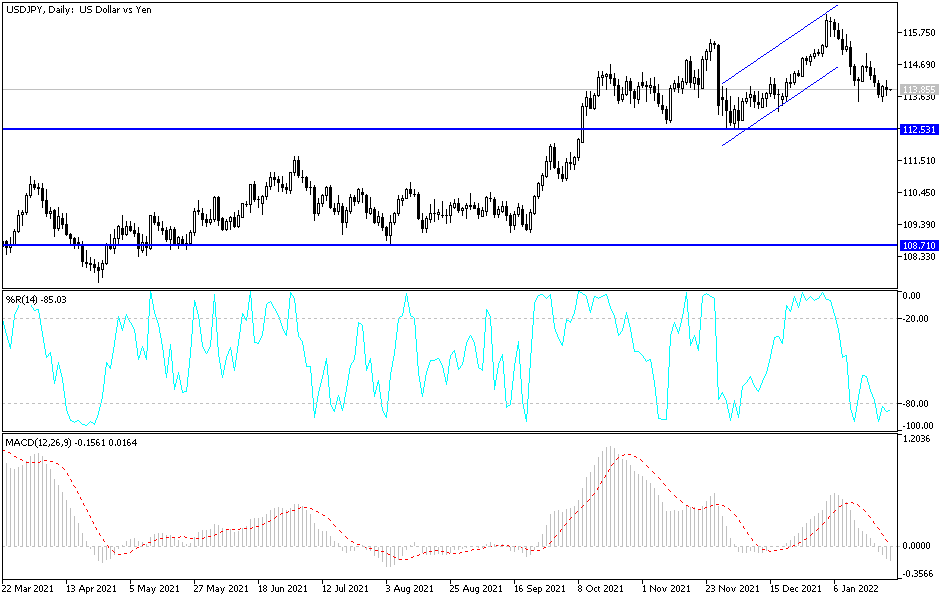

According to the technical analysis of the pair: On the daily chart, the USD/JPY currency pair is moving within a descending channel that was formed recently. The general trend will turn into a strong bearish one if the bears move towards the support level 113.00. The breach of the level supports more selling operations, as the technical indicators turned the direction towards lower. On the other hand, the resistance 115.00 will be the key to driving the bulls strongly for the currency pair. I still prefer buying the pair from every bearish level, especially below the 113.00 support. Forex investors will focus today on the decisions of the Federal Reserve and the statements of its governor, Jerome Powell. Any surprises for the bank to raise interest rates will cause strong fluctuations in the markets and the pairs of the US dollar.