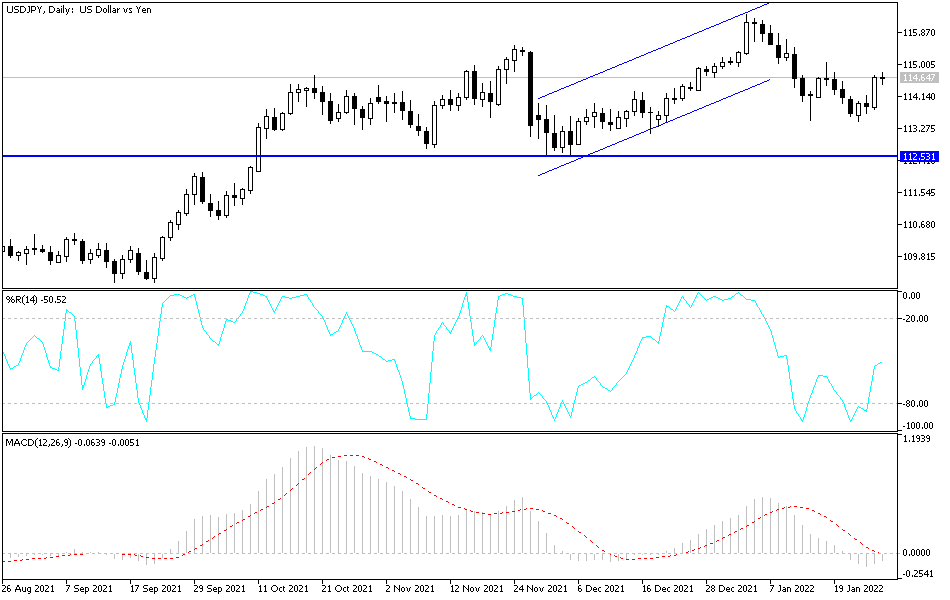

Despite the US Federal Reserve's indications yesterday that it is determined to raise US interest rates starting next March, USD/JPY naturally returned to rise to the resistance area 114.78 at the beginning of the week's trading. It was on a decline towards support level 113.47. The gains for the currency pair may not last long because the markets were already pricing the signals of the US central bank. With the current fears of the rapid spread of Corona’s variables and global geopolitical tensions, investors may return to buying safe havens again, and the Japanese yen is one of the most important ones.

Yesterday Federal Reserve Chairman Jerome Powell said the US central bank was ready to raise interest rates in March and did not rule out moving at every meeting to tackle the highest inflation in a generation.

Powell said in a virtual press conference also that “the committee is considering raising the federal funds rate at the March meeting” if there are conditions to do so, while noting that officials have not made any decisions on the course of policy because it must be “smart.” He was speaking after the FOMC concluded its two-day meeting with a statement declaring that "soon it will be appropriate to raise the target range for the federal funds rate," noting inflation well above its 2 percent target and a strong US job market.

In a separate statement, the US central bank said it expects to begin the process of reducing the balance sheet after it began raising interest rates. Powell said that no decision was made at this meeting about the pace of the run-off or when it would begin. This tough pivot, on the back of the turmoil in stocks, comes amid repeatedly surprising consumer inflation readings of 7 percent - the largest since the 1980s - and a tight labor market that has pushed unemployment down faster than expected to nearly pandemic level.

Accordingly, the yield on the 10-year Treasury rose sharply as Powell spoke while stocks fell, and the dollar rose.

The US interest rate hike will be the first of its kind by the US central bank since 2018, with many analysts expecting a quarter point increase in March to be followed by three more this year and additional moves after that. Critics say the Fed has been too slow to act and is now behind the curve in tackling inflation, although key market metrics do not support this view. Some Fed officials have even publicly discussed whether they should raise interest rates more this year than expected.

"We will need to be smart to be able to respond to the full range of reasonable outcomes," Powell added. "We will remain alert to risks, including the risks of continued higher-than-expected inflation, and be prepared to respond as appropriate."

According to the technical analysis of the pair: The recent price shift of the USD/JPY currency pair is important to the upside, and the bulls are waiting to break through the resistance 115.20 to confirm the technical control and thus return to the vicinity of the ascending channel that the pair lost recently. I still prefer to sell the currency pair from that resistance and from above it. On the other hand, the bears' stronger control awaits the psychological support 113.00, which is the clearest vision on the daily chart. The currency pair will react strongly today to the release of US economic data, GDP growth rate, weekly jobless claims, durable goods orders, and US pending home sales.