This decline is natural after strong and sharp gains for the currency pair, which moved on its impact towards the resistance level of 116.35, its highest in five years, at the beginning of 2022 trading. The US dollar rose again during the last session of last week's trading but was hurtling after incurring heavy losses against all the major currencies. Some analysts warned that the downward correction could extend further in the coming weeks and months. The exchange rates of the US dollar were stable on Friday, but it still witnessed its biggest weekly decline since September. This came after the comments of Federal Reserve Chairman Jerome Powell, on Wednesday which was followed by a wave of selling that was seen by many as profit taking by speculative traders.

The recent losses were significant, but some warn that they may extend further in the short term now that market rates are fully aware of the possibility of three to four US rate hikes this year. The dollar had risen for six months before that, as market participants built their biggest bet on the currency since the start of the coronavirus crisis, although it came under pressure last week after Chairman Powell appeared to endorse market expectations about a central bank rate.

There are many factors that could weigh on it even more in the near term. We believe that the Fed's increasingly rapid shift towards a more hawkish policy stance will eventually push the dollar higher against most other currencies this year.

We see investors' assumptions about the future peak of US interest rates likely to be too low, citing market pricing that recently suggested that the Fed fund rate is likely to exceed 1.75% by the first months of 2024. Capital Economics told clients that US borrowing costs are likely to rise further than this, and sooner than investors give credit, makes market-wide recognition a potential catalyst for the next trajectory of higher dollar exchange rates later this year.

While some have warned that additional profit-taking could keep the dollar on its back foot for a while, many analysts and economists still expect the US currency to advance further against other major currencies for 2022 in general. While future upgrades to the Fed rate forecast could push the greenback back in late 2022, dollar bulls may be vulnerable to any signs of an inflation reversal, given that the effects of the statistical base will affect the annual rate during most of this year. Meanwhile, the US dollar will also be weak over the coming weeks if upcoming policy decisions from the Bank of Japan and the European Central Bank confirm that inflation pressures are also starting to make policy makers in Tokyo and Europe nervous.

This comes after Reuters reported on Friday that BoJ policy makers at this month's meeting are likely to discuss when and how to start raising interest rates due to recent increases in Japanese inflation. Almost every country on the planet like Japan is experiencing inflationary pressures, but you have to look it up more seriously in Japan and the data still points to a different inflation picture. There is a BoJ policy meeting this week and we would be very surprised to hear Governor Kuroda give this story so much credibility at all.

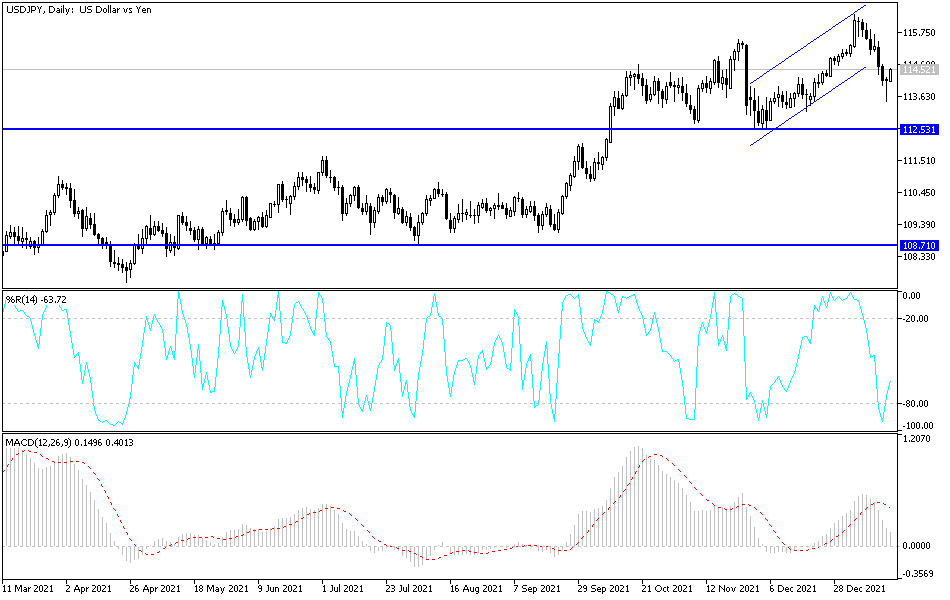

According to the technical analysis of the pair: On the daily chart below, there is a clear breakout of the bullish channel for the USD/JPY currency pair. As mentioned before, the return of the currency pair towards the support level 113.30 will increase the bears’ control to move further downward. The next most important support levels may be 112.80 And 111.90, of which I prefer to go back to buying the currency pair. To return to its stronger bullish channel, the bulls will move towards the psychological resistance 115.00 again. Today is a US holiday and the currency pair will be affected more by whether or not investors take risks.