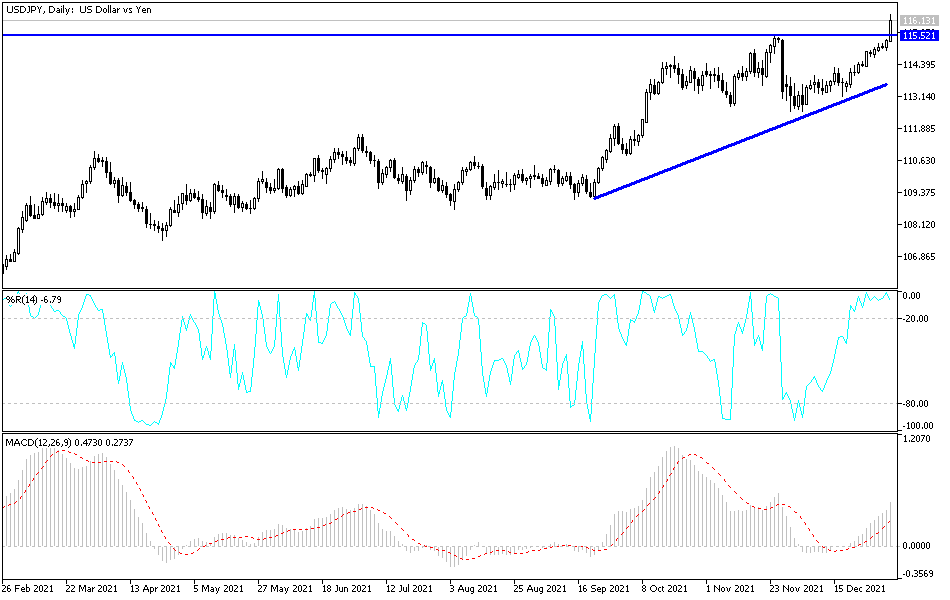

The Japanese government provided more stimulus plans to counter those effects, which may topple Japan's position as the third largest economy in the world. The share of the USD/JPY currency pair rebounded towards the resistance level 116.35 and achieved gains of more than 100 pips during yesterday's trading session only. Recent gains have moved the currency pair towards its five-year high. The currency pair may maintain its gains until interacting with the announcement of the minutes of the last meeting of the US Federal Reserve today, and then the announcement of US job numbers last Friday.

Yesterday it was reported that growth in US manufacturing in December slowed to an 11-month low as companies continued to grapple with supply chain problems. The Institute for Supply Management, a trade group for purchasing managers, reported that its ISM manufacturing activity index fell to a reading of 58.7 in December, 2.4 percentage points lower than November's reading of 61.1. Any reading above 50 indicates growth in the manufacturing sector, which posted 19 straight months of growth going back to the spring of 2020 when the pandemic struck. The December reading was the lowest since matching 58.7 in January 2021.

The slowdown in December reflected a decline in both new orders and production. While December's performance still reflects strength in manufacturing, there have been concerns that the current global spike in COVID-19 cases, largely a highly contagious omicron variant, could add to a manufacturing decline in the coming months.

Omicron was only identified in late November and soon became the dominant virus. Commenting on this, Andrew Hunter, chief US economist at Capital Economics, said that “the rise in local virus cases to more than one million cases per day may deal a greater blow to industrial production as a large number of workers are forced to stay at home.” Inflation pressures in US manufacturing showed signs of abating at the end of 2021, although producers are still grappling with higher prices and long delivery times.

Friday's US jobs report may be particularly important for how the currency pair trades because a strong year-end labor market may encourage the market to anticipate an initial interest rate hike from the US Federal Reserve with more confidence. Soon in March or April, a prospect that hasn't been fully priced in by the interest rate markets. Valentin Marinov, foreign exchange analyst at Credit Agricole CIB warns, “The potential growth threat to the US economic recovery during the winter months may be the return of the Covid pandemic, which could delay the full reopening of the critical service sector and thus delay a more meaningful normalization of Fed policy until the quarter. The second of 2002. Furthermore, we note that the US dollar is looking overbought and overvalued, according to our internal metrics.”

Recently the US Federal Reserve accelerated the process of ending its $120 billion quantitative easing program in December until the process ends in March. Its updated economic forecasts warned that US interest rates could rise on three occasions next year, which would take the end of a higher range of money rates. Federal to 1%. Despite this, the dollar fell against many currencies.

According to the technical analysis of the pair: The technical indicators moved towards overbought levels, and unless the dollar gains additional momentum, the profit-taking may start soon. I prefer to think of selling the currency pair from the resistance levels 116.85 and 117.30, respectively. The general trend of the currency pair is still bullish and with the correction it may first collide with the levels of 114.90 and 113.85, respectively.