The recent gains of USD/JPY that pushed it towards its highest level in five years, to reach the resistance level of 116.35, may be followed by short deals to take profits. USD/JPY fell back to the support level 115.62, but the US dollar received a new impetus from the announcement of the minutes of the last meeting of the US Federal Reserve, which confirmed that the date for raising US interest rates is very close.

The minutes of the latest FOMC meeting revealed that Fed members are preparing to start reducing the size of the US central bank's balance sheet shortly after raising interest rates. The minutes of the December 14-15 meeting, released yesterday, showed that participants had preliminary discussions about the appropriate circumstances and timing of reducing the Fed's nearly $8.8 trillion portfolio of Treasury and mortgage securities.

While the previous balance sheet run-off started nearly two years after the rate hike, participants argue that the appropriate timing this time around is likely to be closer to the timing of a rate hike. The minutes of the meeting also stated, “They indicated that the current conditions include stronger economic expectations, higher inflation, and a larger budget, and thus can ensure an acceleration of the pace of policy price normalization.”

The minutes noted that many participants also saw the appropriate pace of balance sheet flow likely to be faster than during the previous normalization cycle. Discussions about reducing the size of the US central bank's balance sheet came as the Federal Reserve also agreed to accelerate the pace of cuts in asset purchases, with the program currently scheduled to expire in mid-March.

Many economists expect the Fed to start raising rates once the asset program ends, with CME's FedWatch Tool currently indicating a 71.0% chance of a rate hike at the March 15-16 meeting. The minutes indicated that the participants in the meeting generally agreed that it may be justified to raise interest rates sooner or at a faster pace that was previously expected given the expectations of the economy, labor market and inflation.

“Some participants felt that a less accommodative policy stance was likely to be warranted in the future, and that the committee should convey a strong commitment to addressing elevated inflation pressures,” the minutes read. The Fed added, “These participants noted, however, that a deliberate approach to policy tightening would help the Committee evaluate incoming data and be in a position to respond to the full range of plausible economic outcomes.”

Commenting on the minutes, Paul Ashworth, chief US economist at Capital Economics, said it makes sense that quantitative tightening would be faster this time, because the balance sheet is much larger than the previous peak and economic conditions are much stronger.

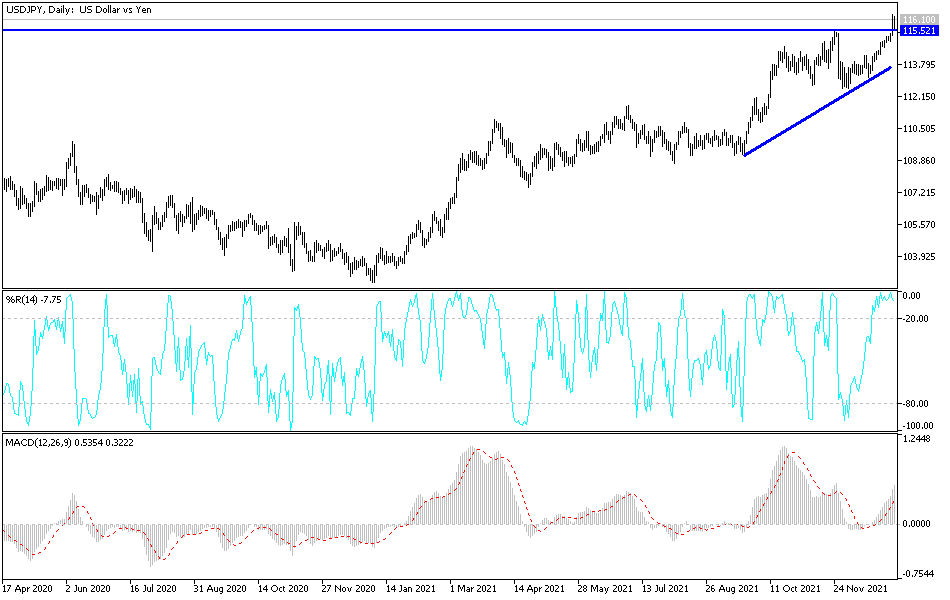

USD/JPY Technical Analysis: The recent gains of the USD/JPY currency pair according to the performance on the daily chart, the technical indicators moved towards overbought levels. Unless the dollar gains additional momentum, the profit-taking may start soon. I prefer to think of selling the currency pair from the resistance levels 116.85 and 117.30, respectively. The general trend of the currency pair is still bullish and with the correction it may first collide with the levels of 114.90 and 113.85, respectively.

Today, the USD/JPY currency pair will react to investors' appetite for risk or not, in addition to the announcement of the number of US weekly jobless claims, in addition to the ISM Services PMI reading.