This is ignited by the June shift in monetary policy of the Federal Reserve (Fed) which is still ahead of the financial markets heading towards it. The dollar exchange rates were a conflicting picture at the end of the 2021 trading year, after the dollar achieved lukewarm gains on the Japanese yen. This gave way to the rest of ten major currencies, including the pound sterling, which enabled the price of the pound to rise temporarily above 1.35 . The USD/JPY currency pair closed the trading of the year 2021, stable around the 115.08 level, and last week’s gains around the 115.20 resistance. The pair jumped to the 115.52 resistance, its highest in years, but it did not feel very comfortable with that, as at this time the new Corona variable “Omicron” was announced, where concerns have now returned.

On the other hand, the dollar was higher against the Polish zloty, the Turkish lira and the Russian ruble, but fell more than half a percent against the Chinese renminbi, which pushed the US dollar / Chinese yuan exchange rate below 6.35 and towards its lowest level in 2021 at 6.3322. The gains noted above brought the 2021 USD/CNR down to -2.5% and made the CNY the best performer of all currencies for the year with little except for the Canadian dollar coming close to matching it.

In general, monetary policy divergence may be one of the main drivers in the forex market. Overall, currencies with central banks that are expected to continue to tighten aggressively are likely to do better. With few exceptions, the US dollar has swept the opposition board since June when the Fed first indicated that it had begun considering ending its massive $120 billion quantitative easing program and the future decision to start raising interest rates.

A plan for this tapering of the bond-buying program has since been announced and subsequently accelerated between early November and late December. This month the Fed also gave advance notice to financial markets that interest rates could rise as soon as March next year. Overall, the United States has left the epidemiological shock behind, while Europe is largely behind. This difference will become increasingly evident in 2022. A very loose fiscal policy stance, in relative terms, may force the Fed to tighten policy more than other G10 central banks.

The Fed is set until June 2022 in order to completely wind down its bond-buying program, with interest rates set to remain near zero for some time for however how long it takes the US economy to return to pre-pandemic employment levels. The December policy decision saw the Federal Reserve announce a plan to complete the tapering process in March 2022, and also came along with new economic forecasts that indicated the federal funds rate could rise three times next year. Starting in March or April.

Expectations are still that the US dollar will be flat over the course of 2022 due to healthy global growth and interest rate hikes by other central banks (such as the Bank of Canada) keeping pace with the Fed. In the short term, we expect the dollar to continue to strengthen.

The focus of the Fed's policy follows official statistics that showed US inflation rising to more than 6% during October and November, as prices of many goods and services continued to rise due to pandemic-related disruptions in supply chains and other factors. It marks a sharp and timely shift around the policy stance adopted by the Fed in December 2020 that the bank adopted through June, one that sought to maintain exceptionally stimulus monetary policy until certain preconditions around employment and inflation.

The Fed previously wanted to see "substantive incremental progress" made toward the Fed's "maximum employment and price stability targets" before even considering reducing monetary support for the US economy. However, the number of officially unemployed decreased from 10.7 million to 6.9 million between December 2020 and November 2021, while the number of individuals whose work was temporarily disrupted by the pandemic decreased from 15.8 million to 3.6 million.

Meanwhile, since December 2020, US inflation has kept increasing above the Fed's 2% target and played a key role in prompting the FOMC to consider the idea of raising US interest rates.

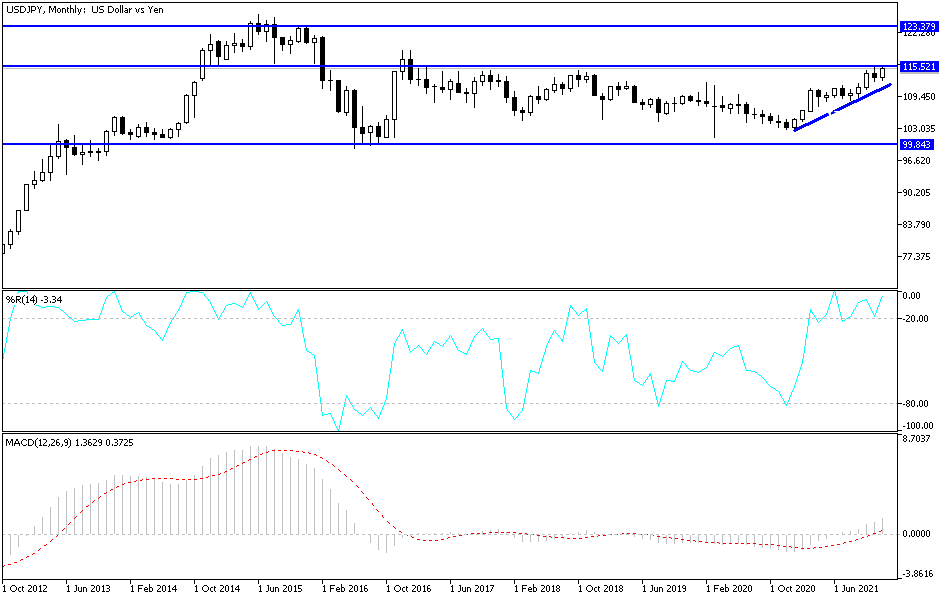

USD/JPY Technical forecast for the year 2022:

The price of the US dollar against the Japanese yen currency pair USD/JPY will continue to represent the competition of safe havens to achieve the largest amount of gains in the event that the global concern over the Corona pandemic and its effects on the future of the global economic recovery and central bank policy continues. On the monthly chart, the resistance levels 118.60 and 123.40 will remain the most important for an upward trend that occurred for the currency pair. On the downside, the support levels 111.20, 108.20 and 104.30 will remain the most important for the year 2022 trading.

The policies of global central banks, especially by the Federal Reserve, to eradicate the epidemic and global geopolitical tensions, and by Especially between China and the United States will be the most important factors affecting the dollar-yen pair for the year 2022.