Today's USD/TRY Signal

Risk 0.50%.

None of the buy or sell orders were activated on Thursday's recommendations

Best buy entry points

- Entering a long position with a direct order from the current levels 13.32.

- Place your stop-loss point below the 13.06 support levels.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

Close half of the contracts with a profit equal to 75 pips and leave the rest of the contracts until the strong resistance levels at 13.79.

Best-selling entry points

Entering a short position with a pending order from 13.75 levels.

The best points to place the stop loss above 13.99 levels.

Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

Close half of the contracts with a profit equal to 75 pips and leave the rest of the contracts until the support levels 13.28

The Turkish lira rose during the early trading of the day to reach its highest level in ten days. Investors followed the statements of Turkish President Recep Tayyip Erdogan to his supporters in one of the states bordering the Black Sea, where the Turkish President insisted on his country's adherence to lowering the interest rate. Erdogan insisted that the size of inflation will decrease by dependence. He added, "The exchange rate will stabilize, inflation will decrease, and prices will decrease as well. All of these things are temporary." The Turkish president's comments come a day after a Reuters poll showed expectations that inflation in the country will reach its highest levels in 20 years. It is noteworthy that the Turkish Central Bank fixed the interest rate this month, after a series of cuts that continued over several months, amounting to a total of 500 basis points.

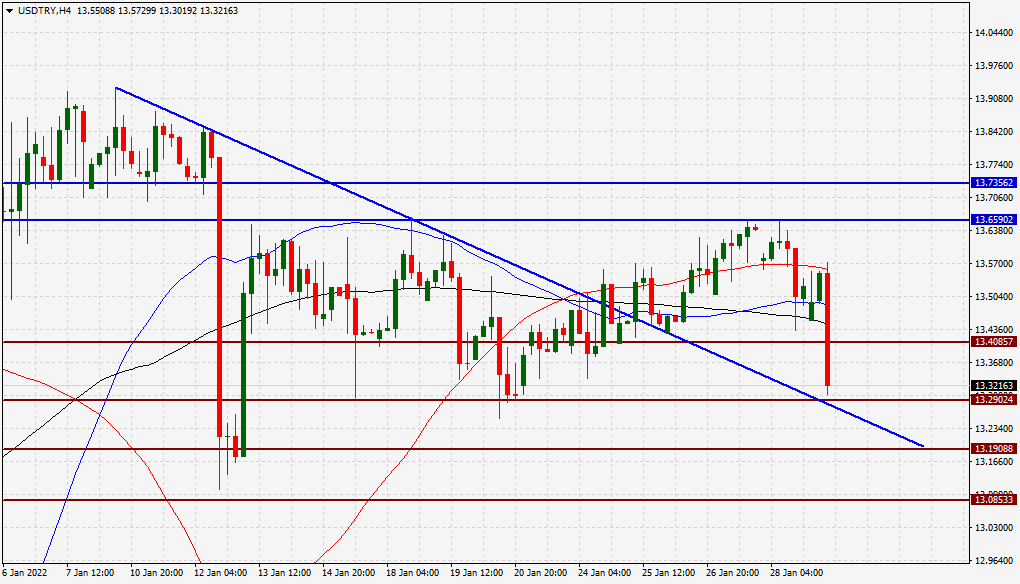

On the technical front, the price of the Turkish lira rose against the dollar during today's early trading, as the lira broke the support levels that are concentrated at 13.45 and 13.40. The Turkish lira settled at the highest levels of the last support centered at 13.30, 13.19 and 13.08. On the other hand, the lira is trading near the resistance levels that are concentrated at 13.65 and 13.73.

The lira is still trading in a limited range despite the big movement today, as it trades up and down around the 50, 100 and 200 moving averages, on the four-hour time frame. We expect the lira to decline after it retested the broken trend line on the four-hour time frame, which is located on the chart. Please adhere to the numbers in the recommendation with the need to maintain capital management.