The US dollar saw a resurgence during the month of January, as inflationary pressures are forcing the Federal Reserve to tighten monetary policy. At the end of the month, we saw a rather strong acceleration of this trend, and this does lead me to believe that the US dollar will continue to strengthen against the rand during the month of February.

Inflation tends to hurt hit emerging markets much harder than it does some of the more developed ones, and I do believe that South Africa will be in the crosshairs. Keep in mind that a lot of Forex traders use the South African rand as a proxy for the entire continent, which will be hurt by the Federal Reserve raising rates. However, in the inflationary headwinds that we see in the United States, it is likely that the Federal Reserve will feel that they have no choice but to raise rates. Although the Federal Reserve is supposed to be in theory an independent body, the reality is that there is a lot of political pressure on them coming from the Joe Biden White House to do something about inflation. That means raising rates.

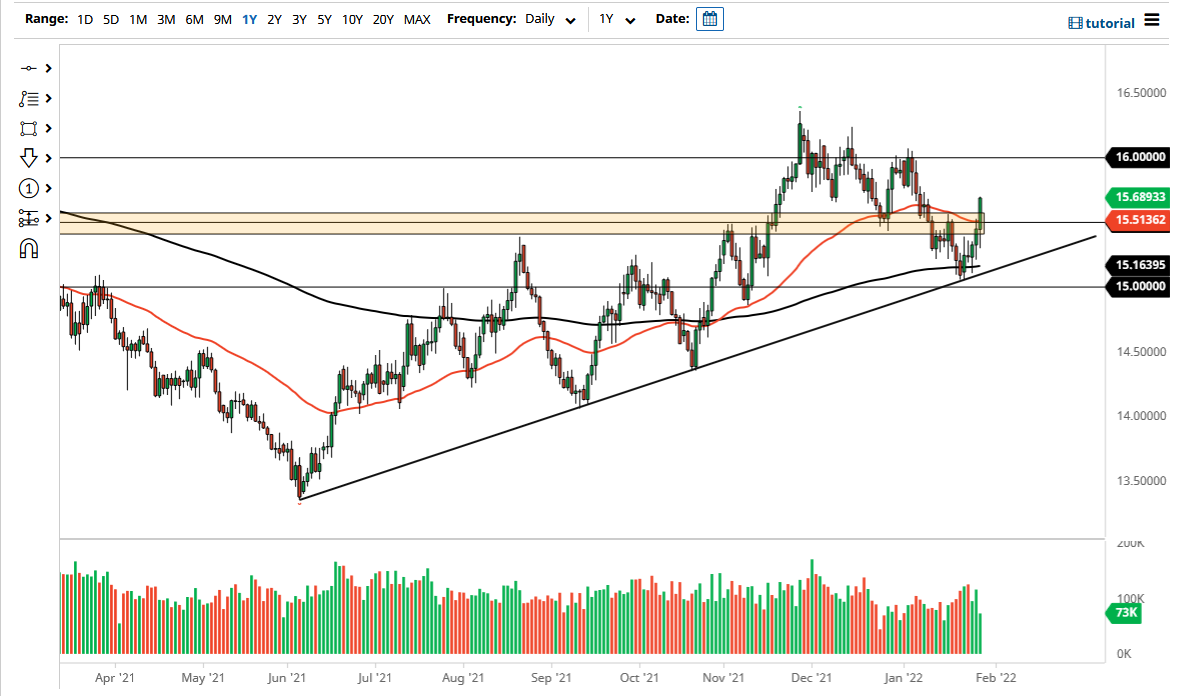

This will continue to strengthen the US dollar going forward, as the bond market in America has already been priced in, at least for rate hikes. Jerome Powell during the last week of the month suggested that they were in fact going to not only raise interest rates but reiterated the idea of running down the balance sheet, meaning that rates will naturally stay higher for the foreseeable future in America. That makes the US dollar much stronger and slows down growth. If growth slows down in the United States, the demand for commodities will drop, which will directly affect South Africa as it is considered to be a proxy for Africa, but more importantly, a commodity currency. You already see commodities across the board dropping, with maybe the exception of crude oil. There are different dynamics at play in that market, but clearly, we are in a dollar-positive environment, and they do not think that is going to change over the next 30 days as the Federal Reserve hasn't even started its tightening yet. With that being said, it is more or less going to be a “buy the dips month” from what I see.