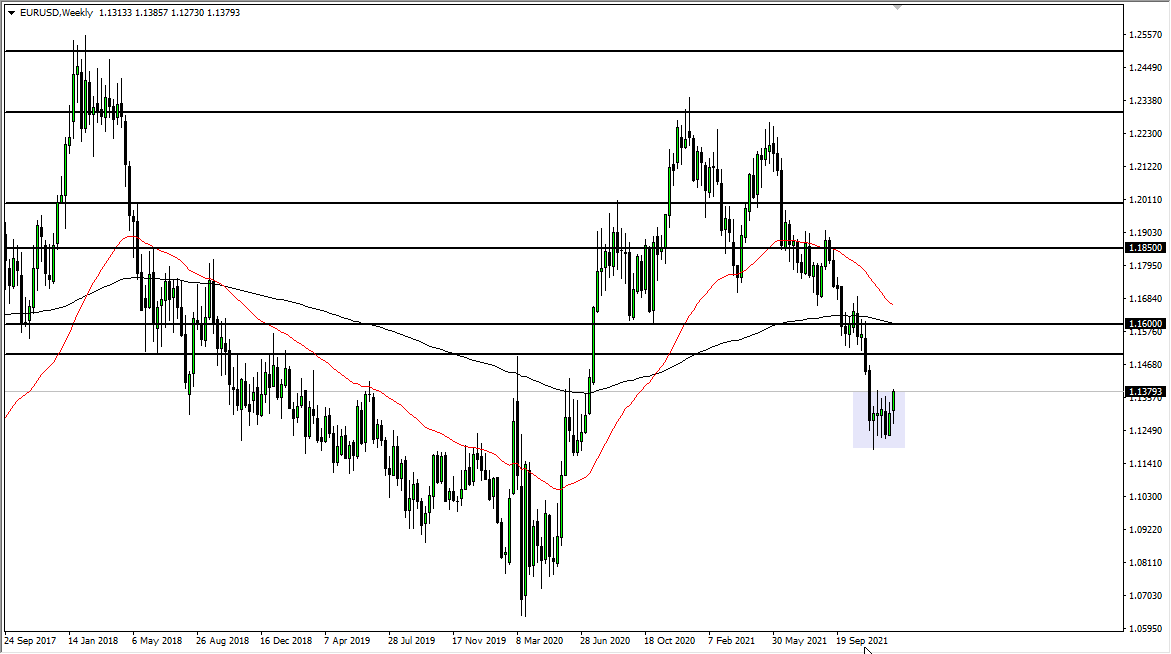

EUR/USD

The euro initially fell during the previous week but then ended up closing at the very top of the range that we have been in. This is a little bit of a “heads up” about the thinking of traders as we step into the new year. There is a very good chance that we will break the top of the range for the week and continue to rally a bit, and I am seeing a bit of US dollar weakness across the board. With that in mind, the initial target will be the 1.15 handle. Keep in mind that Friday is non-farm payroll, so it might be a slightly choppy week for the first few days.

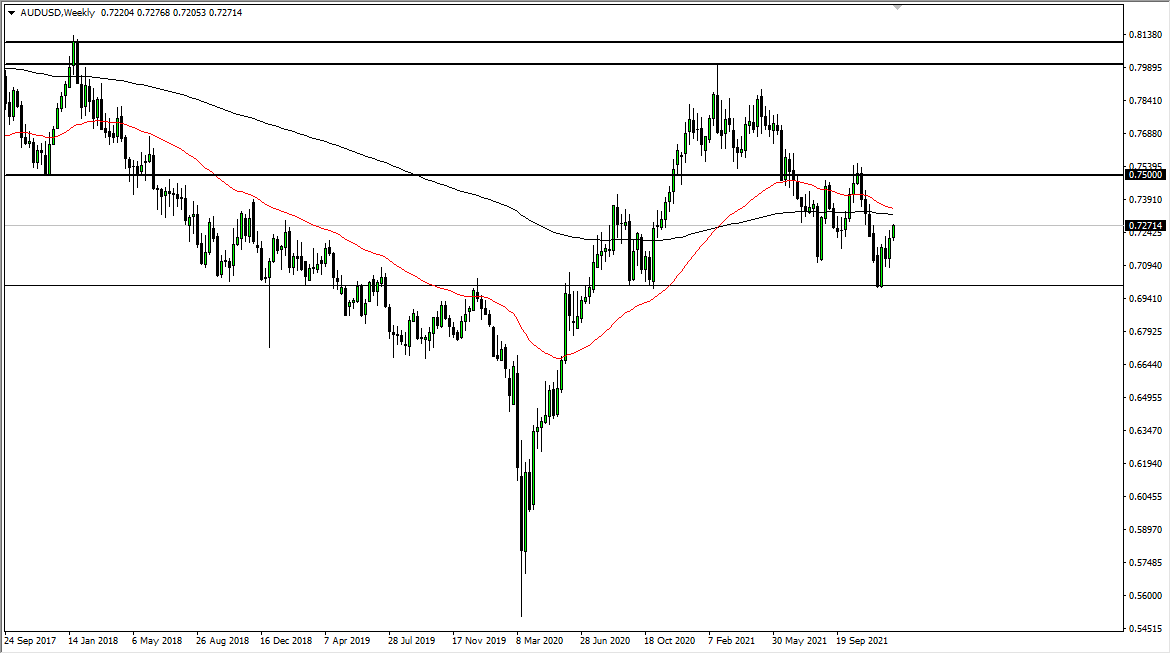

AUD/USD

The Australian dollar rallied last week to continue its grind higher. The fact that we closed at the very top of the weekly candlestick does suggest that perhaps we will try to continue, but we also noted that several of the candlesticks for the week ended up forming long wicks to the upside. It is because of this that I believe that even if we do have a positive week here, the upside is somewhat limited when it comes to the Aussie dollar itself. To the downside, I would look at the 0.71 level as a very significant support level.

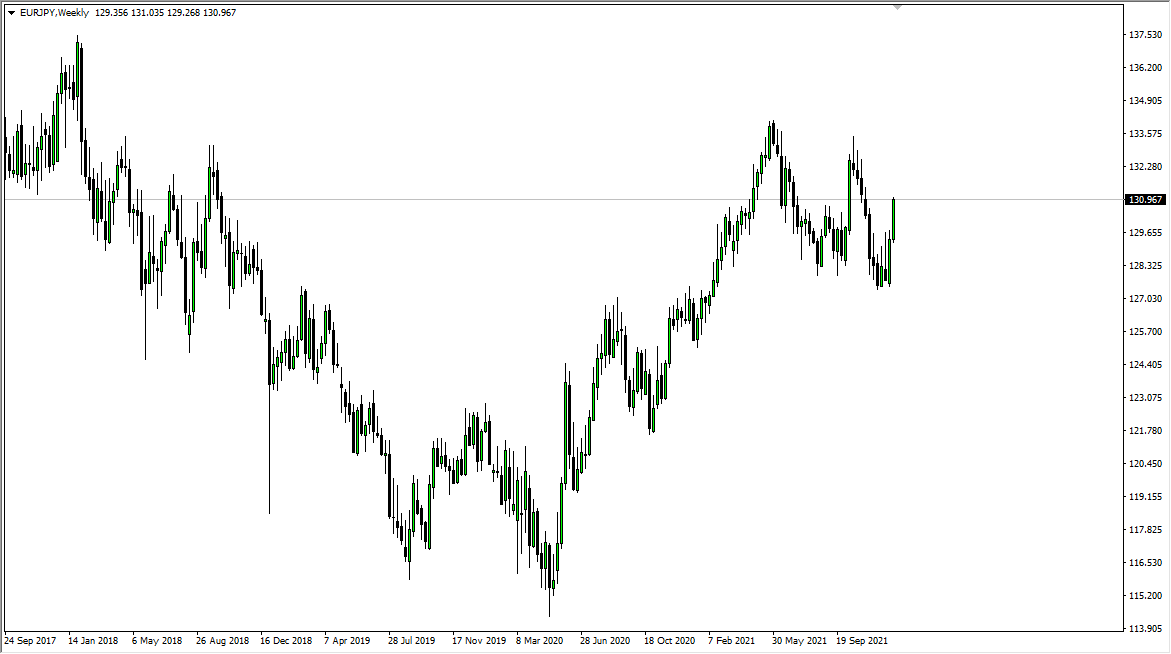

EUR/JPY

The euro has had a very strong week against the Japanese yen, closing near the ¥131 level. It now appears that the Japanese yen itself is in trouble so this could continue going forward, at least into this week. At this point, I would not be surprised at all to see this market make a serious attempt to get to the ¥133 level, especially if we end up having more of a “risk on week”, which I do think will probably be the case as traders put money back to work after the holidays.

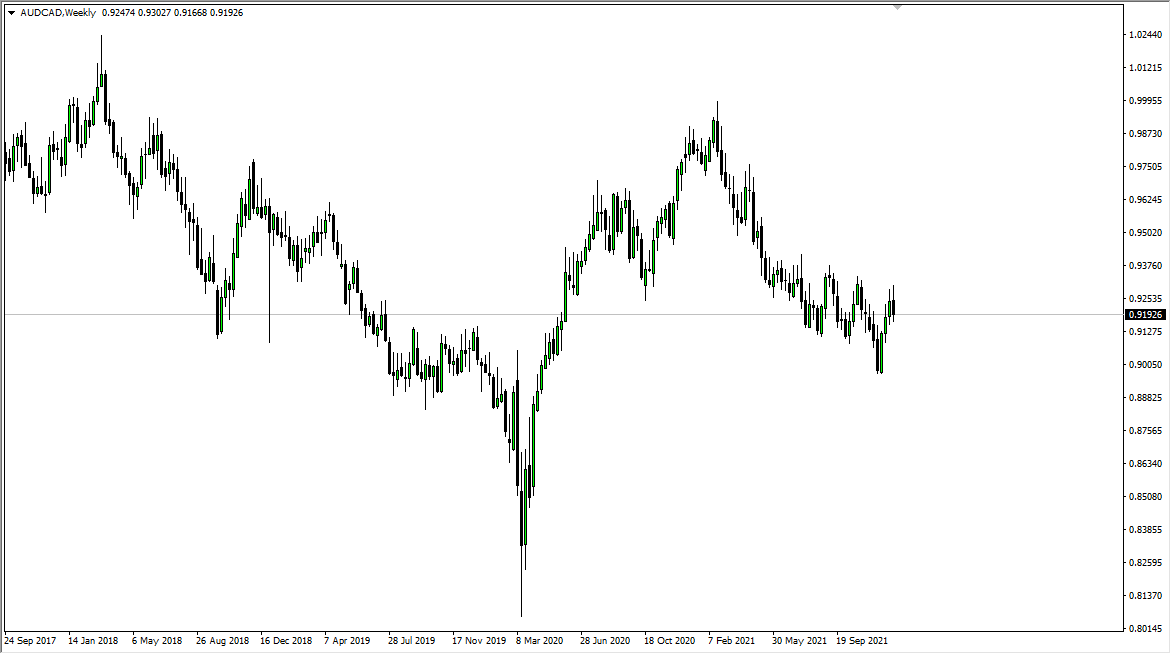

AUD/CAD

The Australian dollar initially tried to rally against Canadian dollar this past week, but as you can see, we continue to see a lot of selling pressure near the 0.93 handle. We have been grinding lower for a while and it now looks like we are getting ready to rollover to continue the overall downtrend. This does make a certain amount of sense, considering just how strong crude oil suddenly is. At this point, I anticipate that this market will revisit the 0.90 level.