The West Texas Intermediate Crude Oil market went back and forth on Tuesday but has given up some of the gains to show signs of exhaustion. There was a drone attack in the United Arab Emirates which of course had the volatility spiking, but at the end of the day, it looks as if people are trying to come to grips with the idea that perhaps we have come too far in too short a time. Any pullback at this point should probably be thought of as a potential buying opportunity, but time will tell. If we can get that pullback, I think a lot of value hunters would come back into the picture.

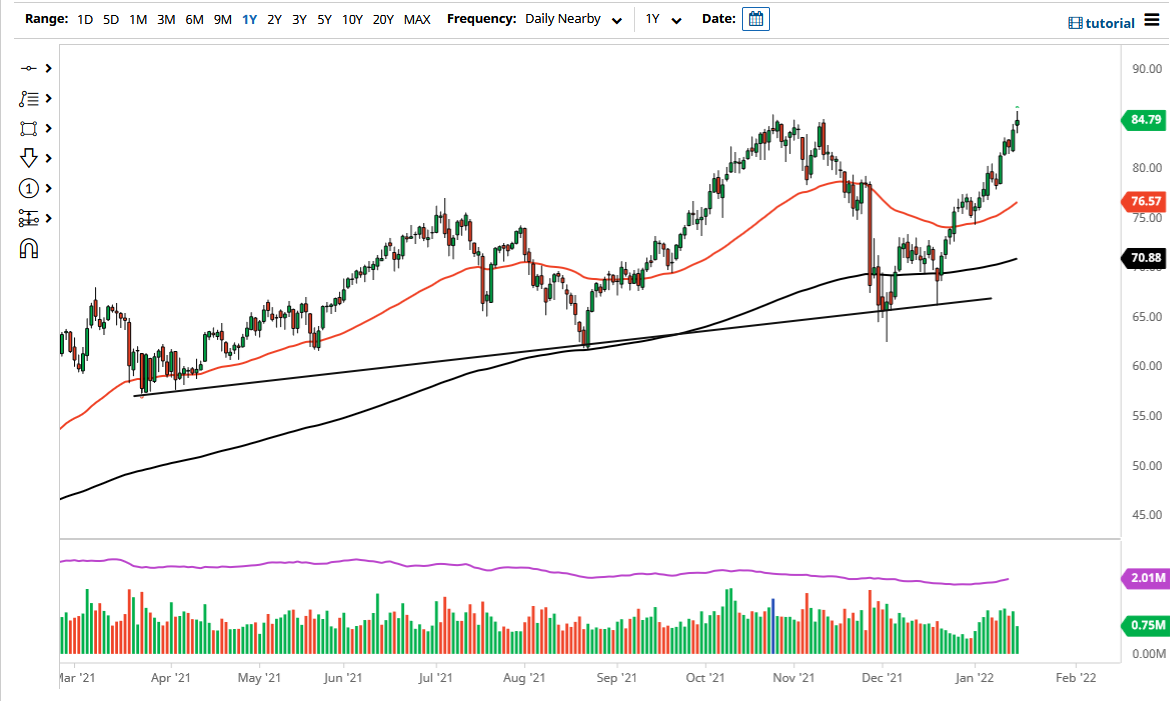

To the downside, I see the $82.50 level offering support, right along with the $80 level after that. Ultimately, this is a market that I think will eventually make up its mind for a bigger move, but right now I do not think that we can continue in this vein. After all, there are only so many people out there to buy oil, so you need to keep that in the back of your head as well. Nonetheless, I think there are plenty of people who are willing to take advantage of any signs of value. The 50 day EMA is currently at the $76.56 level and curling higher. This could offer a bit of dynamic support, as the 50 day EMA is an indicator that a lot of people pay close attention to. Having said that, I do not even think we will get that far to the downside, because I think $80 would attract a lot of attention as well.

Ultimately, we could simply break above the top of the candlestick for the trading session on Tuesday, making this more of a parabolic move, but I would not like to be involved in that, especially as the candlestick for the day was more or less only slightly positive and did give back quite a bit of the gains. This is a market that seems it needs some type of pullback in order to attract more momentum. Either way, I will simply do what the market tells me, as per usual.