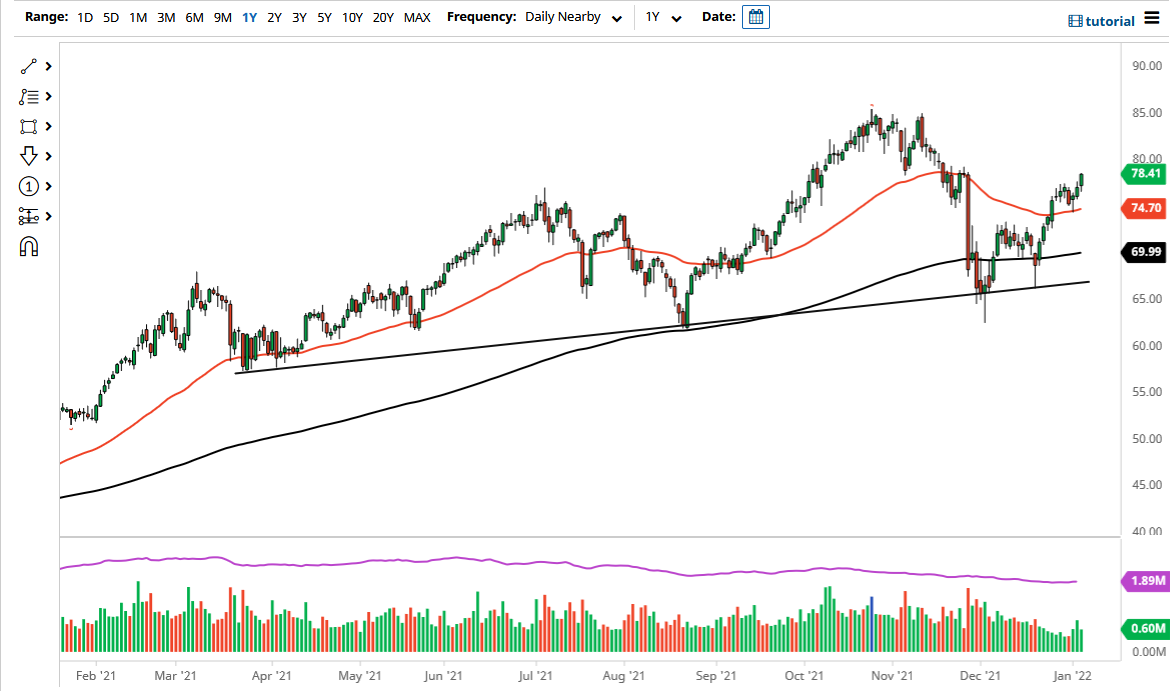

The West Texas Intermediate Crude Oil market initially pulled back on Wednesday, but then turned around to rally significantly and take out the $70 level. That being said, the market continues to see a lot of pressure just above, as the big, huge wipeout candlestick will be interesting to pay close attention to, and if we can take out that major red candlestick from a couple of weeks ago, then it is likely that we could go looking towards the $80 level. If we can break above there, then the market is likely to go looking towards the $85 level.

Pullbacks at this point should continue to offer value going forward, as the 50 day EMA is at the $74.69 level and is starting to curl higher. That should offer a little bit of a “floor in the market”, but I do not necessarily think that it is like the absolute bottom. If we could break down below there, then it is very likely that the $73 level would be even more supportive due to the fact that the area had been significant resistance.

Crude oil continues to rally significantly, despite the fact that OPEC has already stated that they are going to continue to increase output. That being said, there are conditions deteriorating in the output of Nigeria and Libya, as well as a few other smaller producers. Perhaps this is part of the reason why we are seeing oil look bullish despite the fact that there should be more of it. Ultimately, it comes down to the idea of demand picking up as well, so this still sets up for a move to the upside. In fact, you could even make an argument that we just broke out of a bullish flag, which measures for a move towards that $85 level so it all kind of ties in quite nicely together, so I like the idea of buying short-term pullbacks. I have no interest whatsoever in shorting oil, especially if the US dollar starts to drop in value. If it does, that should continue to add fuel to the fire as well, so this is a very bullish market and that should continue to be the case going forward, at least as far as I can see into the intermediate term.