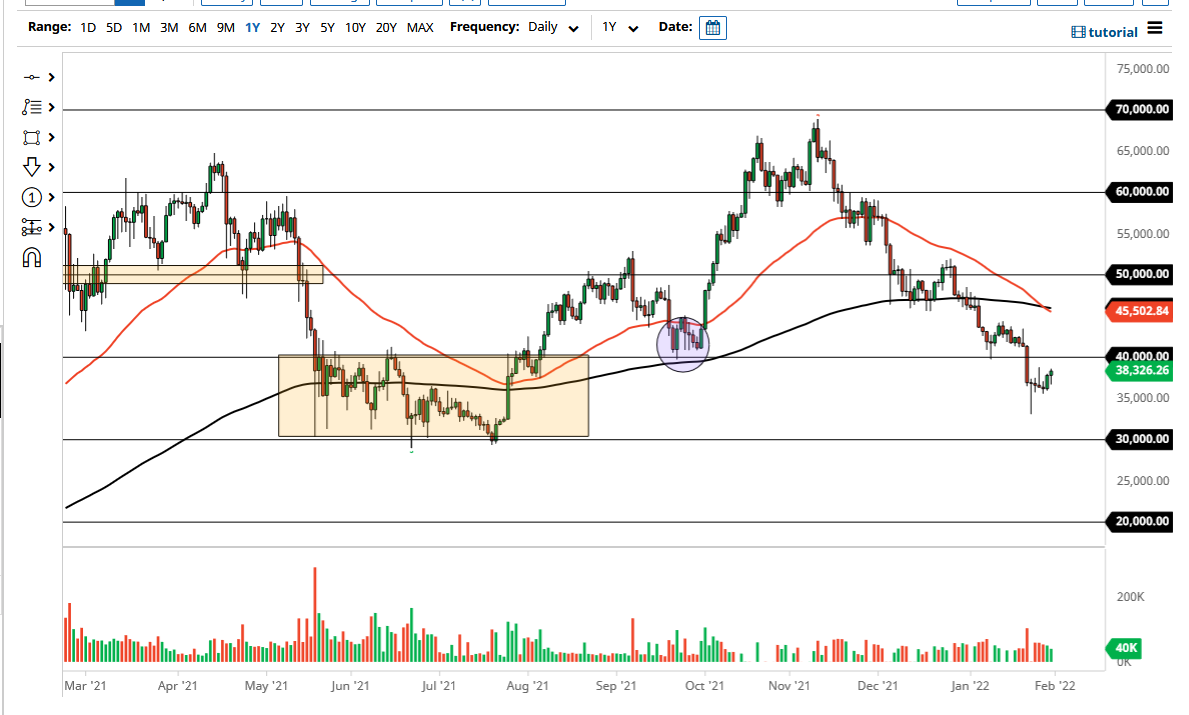

The Bitcoin market pulled back just a bit on Monday, only to find buyers underneath to pick the coin up. At this moment, we are breaking above the $38,000 level. If we can break above the shooting star from the past week, it is very likely that we could go towards the $40,000 level, which is a large, round, psychologically significant figure, and an area that previously had been massive support. Whether or not “market memory” comes back into the picture and offers resistance is yet to be seen, but that is typically what will happen in this scenario.

Keep in mind that crypto has been hammered and is considered to be a “risk asset”, so we need to see some type of stability first in order to put a lot of money to work. Breaking above that shooting star from last week certainly could send buyers into the market, but it is really not until we clear the $42,000 level that I think this market will take off. At that point, we could make a serious push towards $45,000, and breaking above that makes it more of a “buy-and-hold” type of situation.

Keep in mind that a bottoming process is just that: a process. In other words, if you are bullish of crypto like I am, you need to be very patient. You do not jump “all in” with a huge position, because you understand that there will be the occasional pullback. This will be especially true during the bottoming process, but eventually you will see momentum jump in. This is when retail starts to come in and push the market higher, thereby causing a bit of a run to the market. With this, that is when you can gain from accumulation. However, there is nothing to stop this market from dropping right back to 35,000. This is why you accumulate slowly.

If we do break down below the massive hammer from last week, then it is possible that we could go looking towards the $30,000 level, where I would anticipate a lot of support as well. Breaking down below that then opens up a bit of a “crypto winter”, but it does not appear that we are quite ready to freak out like that. If we do, I will certainly be accumulating later on down near the bottom.