Previous BTC/USD Signal

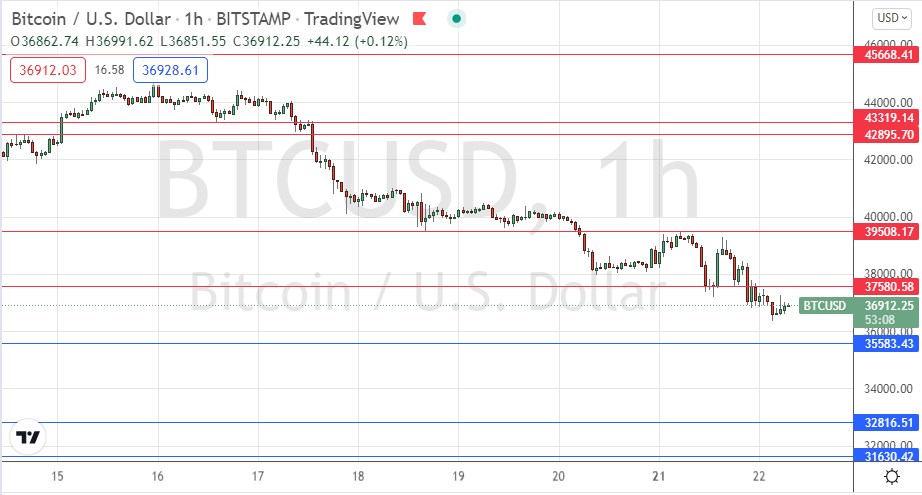

My previous signal on 10th February produced a nicely profitable short trade entry from the bearish rejection of the resistance level at $45,668.

Today’s BTC/USD Signals

Risk 0.50% per trade.

Trades may only be taken before 5pm Tokyo time Wednesday.

Long Trade Ideas

- Long entry after a bullish price action reversal on the H1 timeframe following the next touch of $35,583, $32,817, or $31,630.

- Put the stop loss $100 below the local swing low.

- Move the stop loss to break even once the trade is $100 in profit by price.

- Remove 50% of the position as profit when the trade is $100 in profit by price and leave the remainder of the position to ride.

Short Trade Ideas

- Short entry after a bearish price action reversal on the H1 timeframe following the next touch of $37,581 or $39,508.

- Put the stop loss $100 above the local swing high.

- Move the stop loss to break even once the trade is $100 in profit by price.

- Remove 50% of the position as profit when the trade is $100 in profit by price and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

BTC/USD Analysis

I wrote on 10th February that I thought the best approach for the day would be to trade reversals from either $42,446 or $45,668. This was an accurate and profitable call as we did get a reversal from $45,668 which has not been touched again, so one could have left that short trade to run to this day and be sitting in a lot of profit.

Bitcoin in particular and cryptocurrencies in general simply look bearish right now. It is important not to listen to inexperienced crypto enthusiasts who say the price can only go up and up. Although Bitcoin’s long-term future might be bright, and it is certainly here to stay, we have already seen that Bitcoin can lose more than half its value in a matter of weeks. This should make any investor cautious and any trader willing to enter short as well as long trades depending upon the circumstances.

Big claims are also made that Bitcoin is a hedge against inflation or stock markets. Yet we see that Bitcoin tends to be highly correlated with the movement of major stock markets. Bitcoin is a risky asset and behaves like one, and right now risky assets are not doing very well, as stock market fall quite strongly.

Technically, there is simply bearish momentum. We have seen Bitcoin decline for six straight days and today looks likely to be the seventh.

For these reasons, I would look to take a short trade from any bearish reversal at one of the key resistance levels I have identified above, if we get such a setup today.

If the price gets down to the $30k area, this is where we will see very significant support where we might see the momentum turn around.

Regarding the USD today, there are no scheduled releases of any items of high importance.

Regarding the USD today, there are no scheduled releases of any items of high importance.