Oil markets have been very volatile during the month of February, but by the time we started to close out the final week, it should be noted that the gains were fairly temperate. This is a bit surprising considering that Russia has invaded Ukraine, and there of course was a natural reaction that the price of oil was going to go higher.

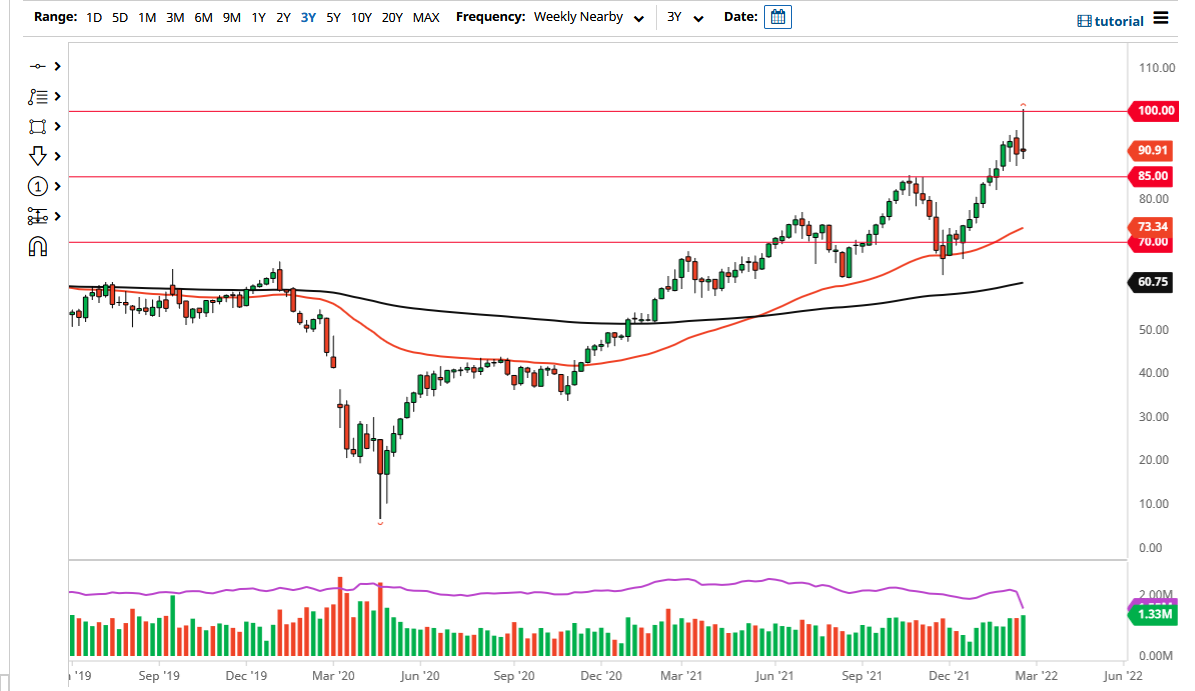

However, Western democracies seem to have stepped aside and let Russia get on with an invasion, and therefore the idea of a larger ground war in the European Union seems to have been averted for the time being. Because of this, we have seen crude oil drop back down, after the WTI market reached towards the $100 level. This panic bid for crude oil is more than likely going to kick off a little bit of a pullback, but the crude oil markets are the same as they have been for months, meaning that they are a “buy on the dip” type of situation.

Crude oil is already having quite a bit of trouble with supply, as the market is reopening everywhere and demand is picking up. As long as demand continues to pick up, we will have trouble catching up with supply. There is talk of the US releasing oil from its Strategic Petroleum Reserve, but at this point in time it is not very likely to affect price for more than a few days. Any pullback at this point should be thought of as a gift, and therefore I would be more than willing to look at lower pricing as an opportunity to get back into a market that has a longer-term uptrend ahead of it.

On the other hand, if we do get some type of massive melt up, that will probably be due to the conflict in Ukraine intensifying, or perhaps due to some type of sanction against the Russian government that makes oil more difficult to send around the world. We have clearly seen that Western governments are not willing to part with the oil, so that seems to be unlikely. $85 underneath could be a support level, followed by the $80 level. I look at this market as one that you are simply trying to find a “good price to take advantage of.”