The US dollar is strong. Fundamentally speaking, it will be enjoying high demand in the medium term.

This is thanks to the directions given by the Federal Reserve System at the meeting in January. We got to know that in February and March the QE program would be winded up, and at the meeting in March the Fed is likely to raise the interest rate by 50 base points at once. On the whole, expectations about the interest rate this year are quite aggressive: the Fed can raise it four or five times.

All the actions already taken or planned by the Fed are aimed at beating high inflation. This is good news for the dollar.

As soon as the regulator starts lifting the rate, it will also start cutting down on the balance. Market liquidity will be shrinking, which is also good for the USD.

At the same time, macroeconomic data shows that the American economy is stable apart from the growth of prices. The labor market is stable, businesses are more active than a year ago, consumers are also quite energetic. This means the economy will easily survive the toughening of the monetary policy. Nothing threatens the dollar.

Tech Analysis of EUR/USD

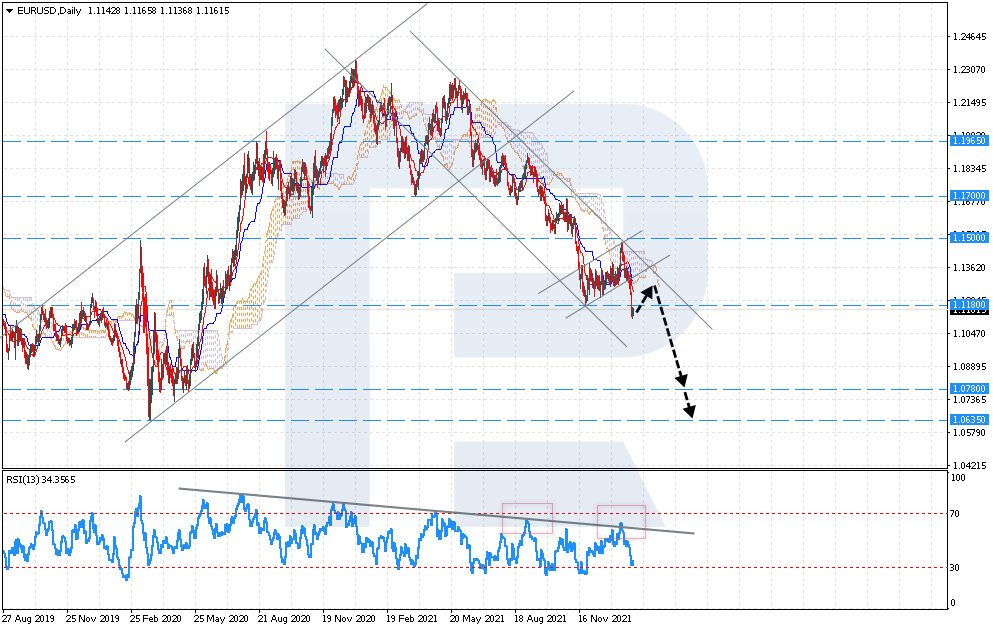

EUR/USD keeps going by a downtrend. On 14 January 2022, it tried to break through the upper border of the Ichimoku Cloud but the quotations soon returned under the Cloud and resumed the decline. Now the pair is testing the support level; there is potential for developing a minor bullish correction with a test of 1.1210. The next goals of the decline are 1.10780 and 1.0635. Another bounce off the resistance line on the RSI is a strong signal for such a scenario. As we can see, this line began in the middle of 2020 and remains a strong resistance line for buyers. Only a breakaway of this line and securing above 1.1500 will mean that the downtrend is over and is likely to change for a bullish trend.

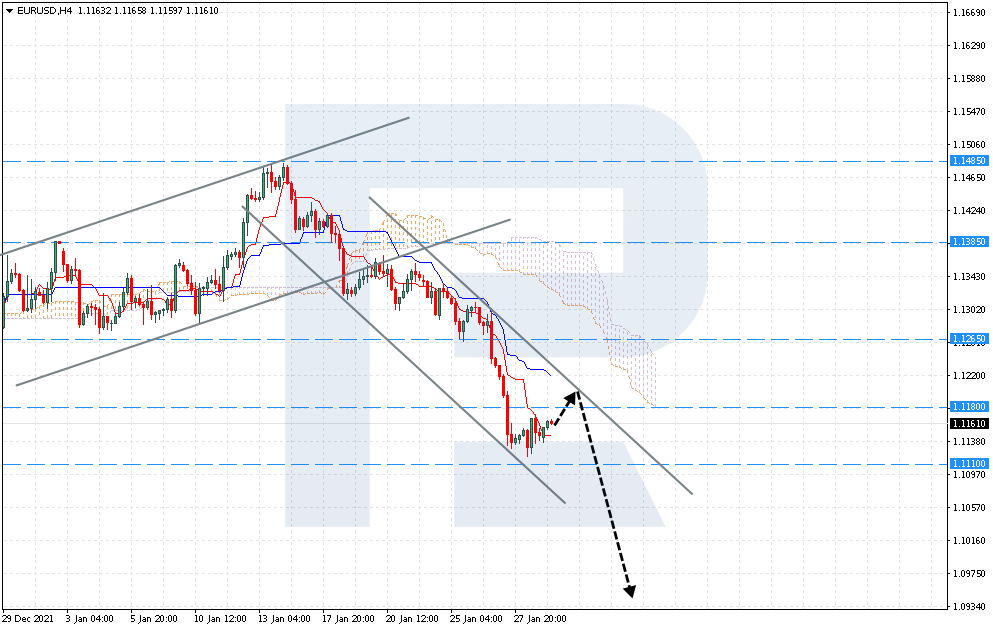

On H4, the quotations are declining inside the bearish channel. The prices keep pushing off the signal lines of the Ichimoku Cloud, which means the current downward momentum is strong. A correction to the upper border of the bearish channel and further falling are quite possible. On smaller timeframes, a Diamond pattern can form. Hence, the decline will be confirmed by a breakaway of the support level and securing under 1.1100.

Closing Thoughts

Summing up, I would note a strong downtrend in the pair with possible goals at 1.10780 and 1.0635. Now the prices are trying to secure under the support level. If the bears do not let the quotations grow above 1.1210, this will mean the decline continues. The bearish trend can be interrupted only by a breakaway of 1.1500. However, for now, sellers remain strong.

Open a RoboMarkets account here.