The DAX futures have gapped higher to kick off the trading session on Friday as a bit of relief has come back into the markets now that the situation in Ukraine seems to be somewhat localized. The market is rallying towards the €14,550 region, where we had a gap from the previous session when the market panicked from the invasion.

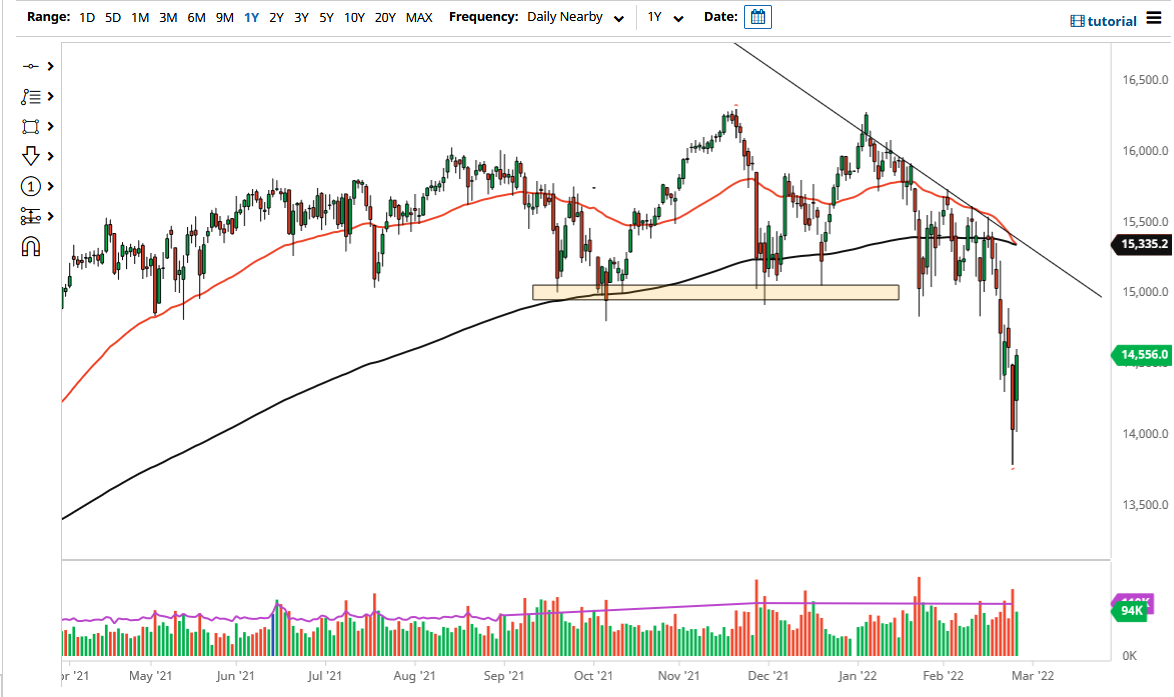

When you look at the longer-term chart, you can see that the 50 day EMA is getting ready to cross below the 200 day EMA, forming the so-called “death cross.” This of course is a longer-term selling signal, and therefore I think it is likely that we will continue to see longer-term traders look towards the downside. The DAX had been struggling before the Russian invasion of Ukraine, so I think at this point it is only a matter of time before we see sellers come back in. It through that prism that I am looking at the markets, and I do realize that we probably have a little bit more to go in order to find the push of the selling pressure. The €15,000 level is an area that I will be paying particular attention to due to the fact that it was previous support and should now offer resistance.

To the downside, I believe that the €14,000 level underneath offers a certain amount of interest, but we have broken down below that level previously, so the next time that we try to take that level out, it is possible that we will continue going much lower. If that does in fact happen, will almost certainly be a major “risk off move” going forward. The DAX is the biggest index in the European Union, so as the DAX goes, so does the rest of the EU stock markets.

I do not have any interest in buying the DAX at the moment, although we could get the occasional significant bounce. If we were to break above the €15,000 level, may start to look at the market through different prism, but right now it is very likely to be a noisy market to say the least. I am looking for signs of exhaustion to short, especially if we do get a little bit of a bounce.