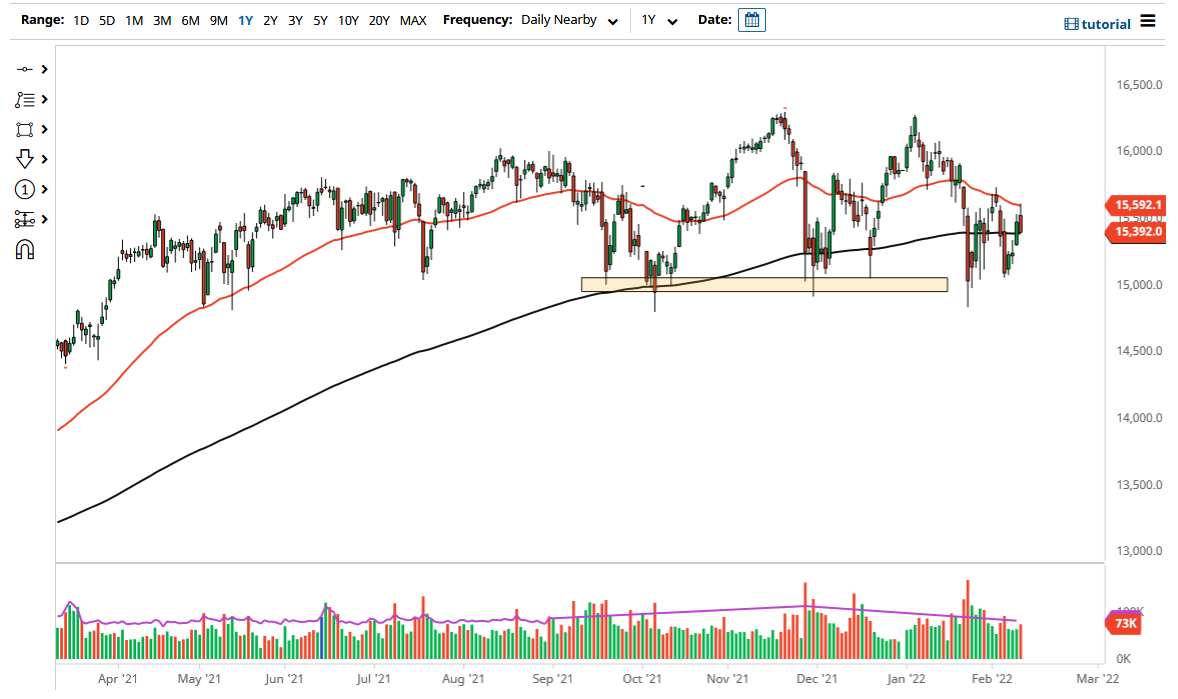

The DAX initially rally during the trading session on Thursday but has found the 50 day EMA to be a bit too much, as we have pulled back rather significantly. At this point time, the market looks as if the 200 day EMA is getting tested as support, but the fact that we are closing at the very bottom of the candlestick does not bode well for it holding. I think at this point in time we are starting to see more consolidation than anything else, perhaps with the support being found near the 15,000 level underneath.

If we were to break above the highs from last week, that would be very bullish, but right now it looks like we need to consolidate more than anything else. After all, the market has had a lot of volatility over the last couple weeks, essentially going back and forth between the 15,600 to the 15,000 level below. In other words, we are reaching around trying to figure out whether or not we can build up enough momentum to go higher. If we can break higher, then the market could go looking towards 16,250 above, where we had seen a lot of resistance. At this point time, the market continues to see a lot of noisy behavior, and therefore it is difficult to imagine a scenario where anything is going to be enough of a “sure bet” that you should be putting much money into the market at any particular one time.

Unfortunately, I think that the volatility is only going to get worse, not better. Because of this, it is very likely that we will eventually find our way down to the 15,000 level again. If we were to break down below the 14,800 level, then we could see a massive flush lower. We are building something that could be described as a bit of a topping pattern, but obviously it is early to talk about that. One thing is for sure though, the candlestick for the trading session on Thursday is underwhelming to say the least, so therefore I think we probably have more selling going into the day Friday. I do not necessarily think we get a massive breakdown, but clearly there is no reason to think that the market is suddenly going to take off to the upside as well.