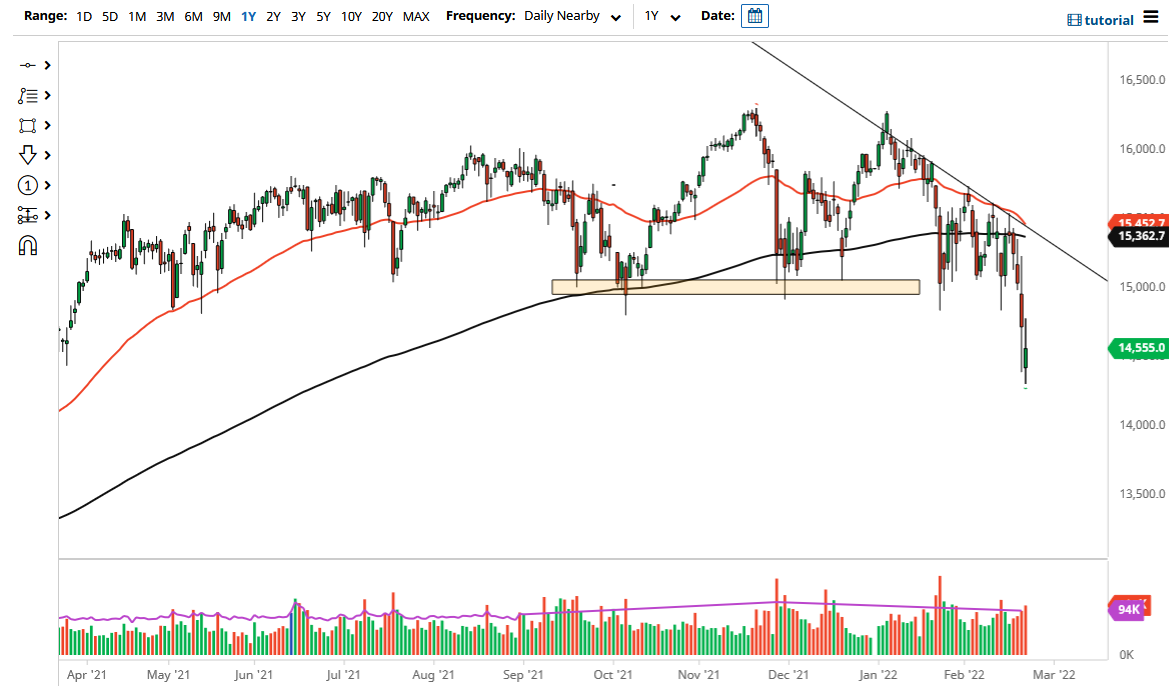

The German index gapped lower to kick off the trading session on Tuesday, mainly due to the fact that there are so many tensions along the Ukrainian border. Obviously, the market is very sensitive to what goes on there, simply because Germany is geographically close more than anything else. Beyond that, the Europeans run to Germany first when it comes to trading, so it does make quite a bit of sense that we would see extreme sensitivity to the Ukraine/Russia problems.

You can see that we filled the gap during the trading session and then turned around to fall. We have formed a bit of an inverted hammer, although it is a pretty ugly and volatile candlestick. I do believe that the market will eventually go looking to lower levels, simply due to the fact that we had smashed through such important support. That does not mean that it will be noisy, it most certainly will be. Having said that, the market is probably one that traders will continue to short on rallies, just as we had seen during the day on Tuesday.

If we were to turn around and break down below the bottom of the candlestick for the session on Tuesday, then the market is likely to go looking towards the 14,000 region. Underneath there, a trapdoor opens, and we really start to see a lot of ugliness. As far as buying is concerned, it is very difficult to imagine a situation where I would be bullish of this market for any real length of time, at least not until the situation in the Ukraine changes. Europe looks like it is slowing back down again anyway, so really at this point in time I think we may have to simply look at this as a potential market to avoid to the upside, at least until we get fundamental reasons, and of course recapture at least the 15,000 level, which was where the previous support was.

Volatility is going to be the main attraction for almost all markets, so I do not see how the DAX avoids any of this. Ultimately, I just do not want to get long any type of risk asset involving Europe at the moment, but I will let you know if that changes anytime soon.