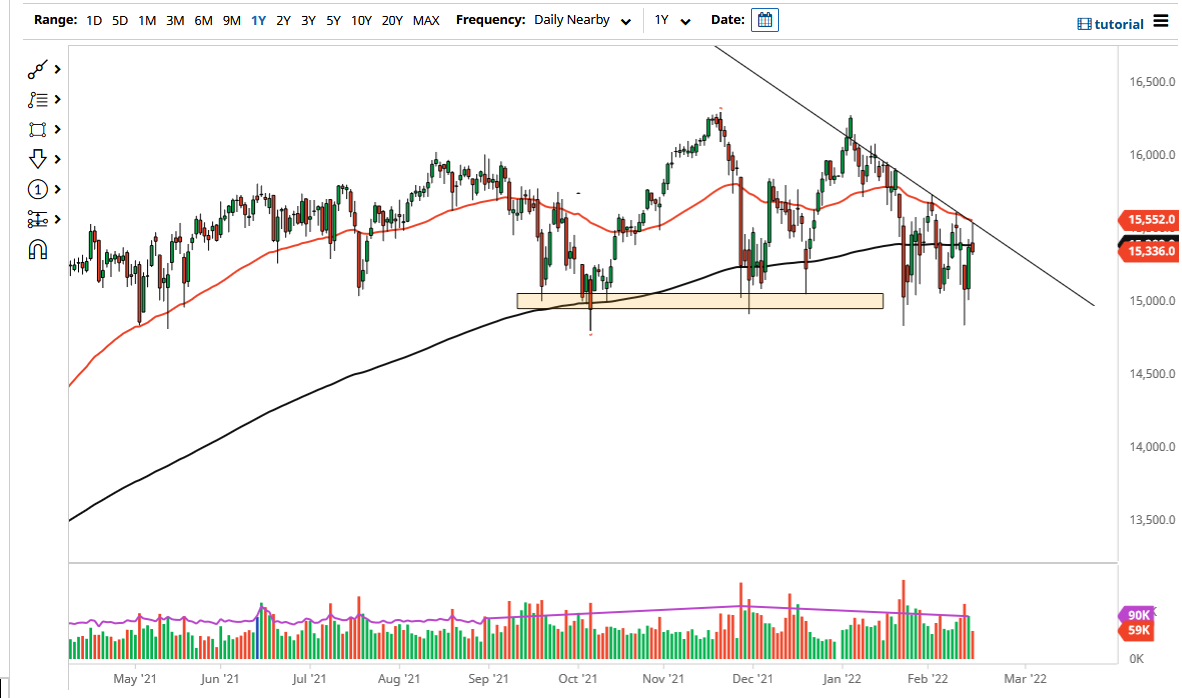

The German DAX Index rallied initially on Wednesday to reach towards the 50-day EMA and the downtrend line that you see on the chart. By reaching towards that level and then pulling back, we ended up forming a bit of a shooting star. That is a negative candlestick, which shows signs of exhaustion. Furthermore, when you see the 50 day EMA dropping the way it has, that does suggest that the market is starting to fade a bit. For what it is worth, the body of the candlestick is right at the 200 day EMA as well.

As you can see, we have been consolidating for a while, but it seems like every time we rally, the buyers do not have quite the momentum that they did the previous time. Because of this, it looks like we are going to continue to see pressure yet again, and I think we are trying to chip away at the 15,000 level underneath. The 15,000 level extends all the way down to the 14,800 level, which is a major area of support as well. I think of the overall attitude of the market is one that is concerned, especially due to the fact that the geopolitical situation overall is very unstable. Keep in mind that Germany is a first place people put money to work when it comes to the European Union, so it does make sense that we would see traders either running to or from Germany based upon what is going on at the Ukrainian border.

Beyond all of that, there are concerns about growth worldwide, as it is starting to slow down. With that being the case, I think it is probably only a matter of time before sellers really start to break this thing down. Having said that, if we were to break above the 15,600 level on a daily close, then we could go looking towards the 16,000 level. That being said, it would take a lot of momentum and good vibes to make that happen. When you look at this chart, pay close attention to that level underneath, it could be key as to what happens next because if we break down below it, that would be a very big move just waiting to happen.