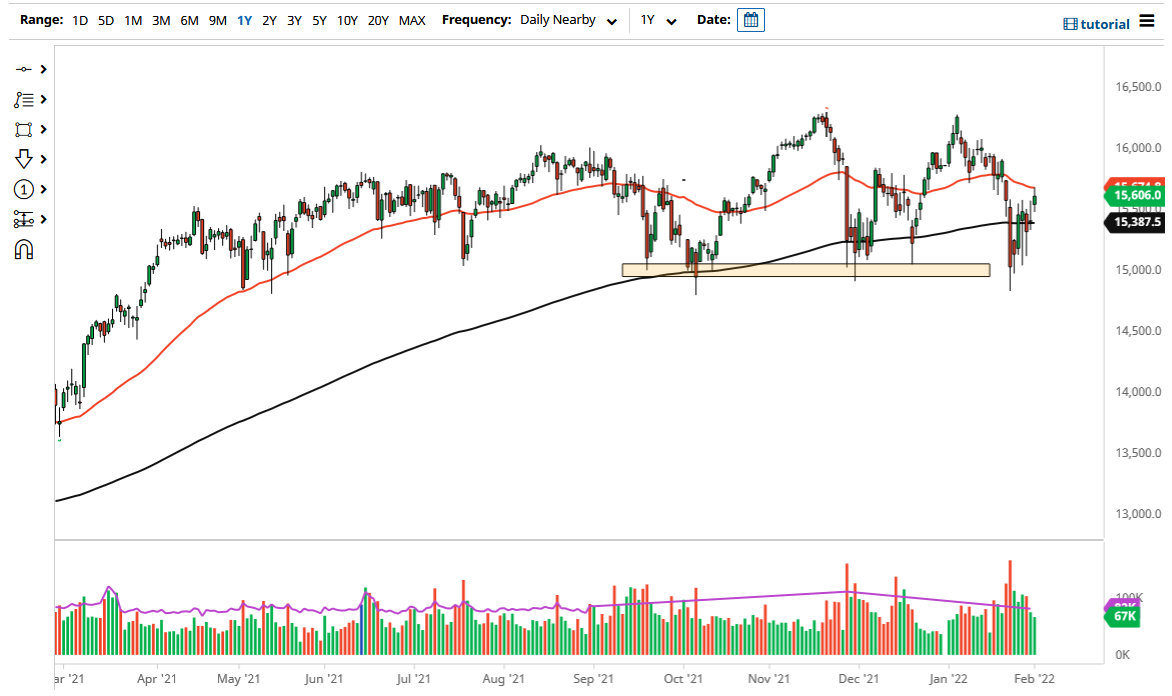

The DAX Index rallied a bit on Tuesday but did pull back from the 50-day exponential moving average. This is an indicator that a lot of people pay attention to, so it should not be a huge surprise to see it causing a little bit of a reaction. Whether or not we can continue to see upward momentum is a completely different question, but the fact that we have formed a gap at the open suggest there is a certain amount of buying to be done.

We could get a little bit of a pullback at this point, but that pullback will more than likely be a welcome buying opportunity based upon value. The 200 day EMA should offer support, as it sits right about the bottom of the gap as well. In other words, I do think that a lot of people are going to be paying close attention to this market and looking for an opportunity to find bullish setups. I do think that the DAX will probably outperform most of Europe anyway, as it typically does. It is the “blue-chip index” of the continent, so it is the first place money goes looking towards.

If we can break above the 50 day EMA, then it is likely that we could go looking towards the €16,000 level, but there is a lot of noise between here and there. After that, then you are talking about the highs at the €16,250 level. On the other hand, if we were to turn around and break down below the 200 day EMA, it could open up fresh selling and a move down towards the €15,000 level. The €15,000 level is crucial for the longer-term trend, as it gives us so much support recently. Breaking below that support level would be very negative and could send this market tumbling quite drastically and into the abyss. This would be a major “risk off move”, and probably be accompanied by fresh selling in indices across the continent, if not the world.

All of that being said, there should be a significant amount of noise underneath that could put this market in a little bit of a bullish attitude, as we had recently spent quite a bit of time accumulating right around the 200 day EMA.