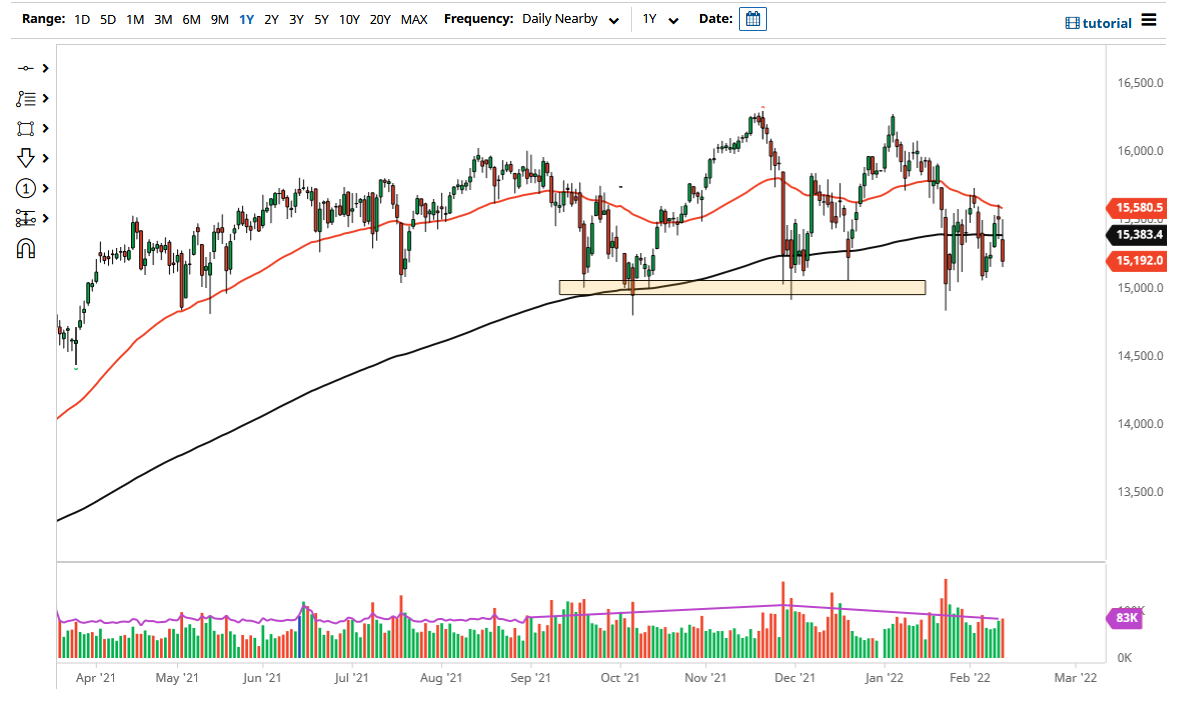

The German DAX Index gapped lower to kick off the day on Friday, turned around to fill that gap, and then fell apart. By doing so, it shows that there is a lot of negativity out there, and we may very well go looking towards the €15,000 level underneath. That is an area that has been supportive for a while so it certainly would make sense to see support and/or buyers in that general vicinity.

I also point out the fact that the support level actually runs down to the €14,800 level. Because of this, the market is likely to see more of a “zone of support” that could lift the markets going forward. That being said, the market is very likely to continue to pay close attention to that area. If we break down below that €14,800 level, I think that will be the sign that the DAX is going to pull apart. At that point I would anticipate a move down to the €14,500 level.

The 200 day EMA is above us now, but it is very likely that the 50 day EMA is now a massive resistance barrier. If we were to turn around and break above, there then it would also suggest that perhaps the DAX is ready to recover. There is a lot of noise in this general vicinity so I do not necessarily think you can do a lot of longer-term trading. I think you are more than likely going to see consolidation and choppy behavior until we get some type of clarity when it comes to risk appetite and where we are going into the future.

Keep in mind that there are a lot of concerns out there when it comes to the Ukraine situation, so the DAX will be a major conduit of financial expression, especially as it is the largest stock index in the European Union. Monday will be a very important day, because we will have to see whether or not Russia truly does decide to invade Ukraine, because if it does, that will send stock markets around the world reeling to the downside. However, if they do not take any aggressive action, or if tensions start to drift a little bit lower, it is possible that the market could turn around and try to reach towards the top of the short-term range.