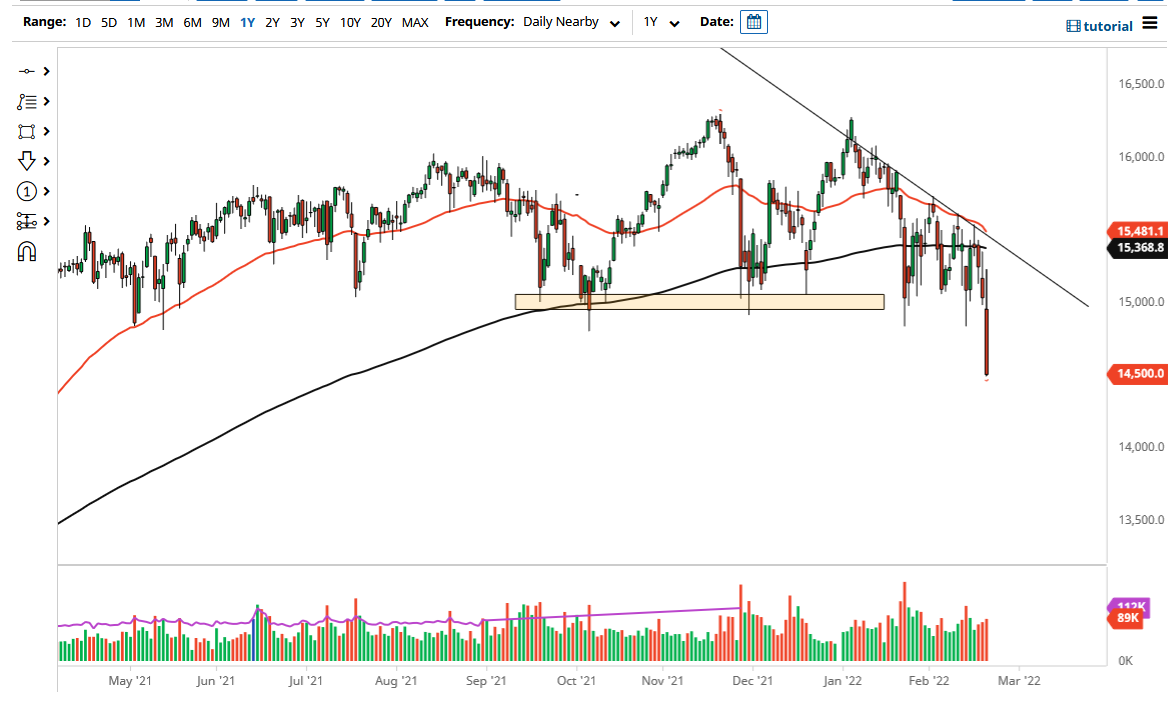

The DAX Index initially tried to rally at the open on Monday, but as we continue to see tensions flare up on the Ukrainian border, this has Europeans selling everything that they are touching hand over fist. The DAX is one of the first places that European investors get involved in, so this will be the first place they pull out of as well. By closing how we did, and sitting just above the 14,500 level, we are most certainly looking at a very tenuous position.

By the end of the day, the DAX was down 3.45%, and looking very much like a market that was going to go lower. Because of this, I think if we break down below the 14,500 level, then we will see even more selling, perhaps sending the market down to the 14,000 level which would attract a certain amount of attention due to the fact that it is a large, round, psychologically significant figure and an area that has been important previously.

It is worth noting that the euro has fallen apart during the day as well, as it initially tried to rally but the German economy put out a significant amount of negative news as well, as the inflation numbers during the day came out at the hottest levels since 1947. In other words, this is a market that will continue to see plenty of reasons to go lower from what I can tell. Do not get me wrong; we could very well have a significant bounce, but the 15,000 level above should be a hard ceiling at the moment.

This looks very much like a market that is ready to crash, and as a result I think we have much more pain ahead. In fact, as I write this article, it certainly looks as if 14,500 is starting to give way already. As the futures break down below that level, the cash market will lead the way even lower. At this point, indices across the continent are crashing, as the Moscow index has lost roughly 20% in short order. In other words, fear has complete grip of the EU and the general vicinity overall. What happens on Wall Street will be interesting, because we will have to wait and see whether or not this follows through. If so, we could have a big move globally.