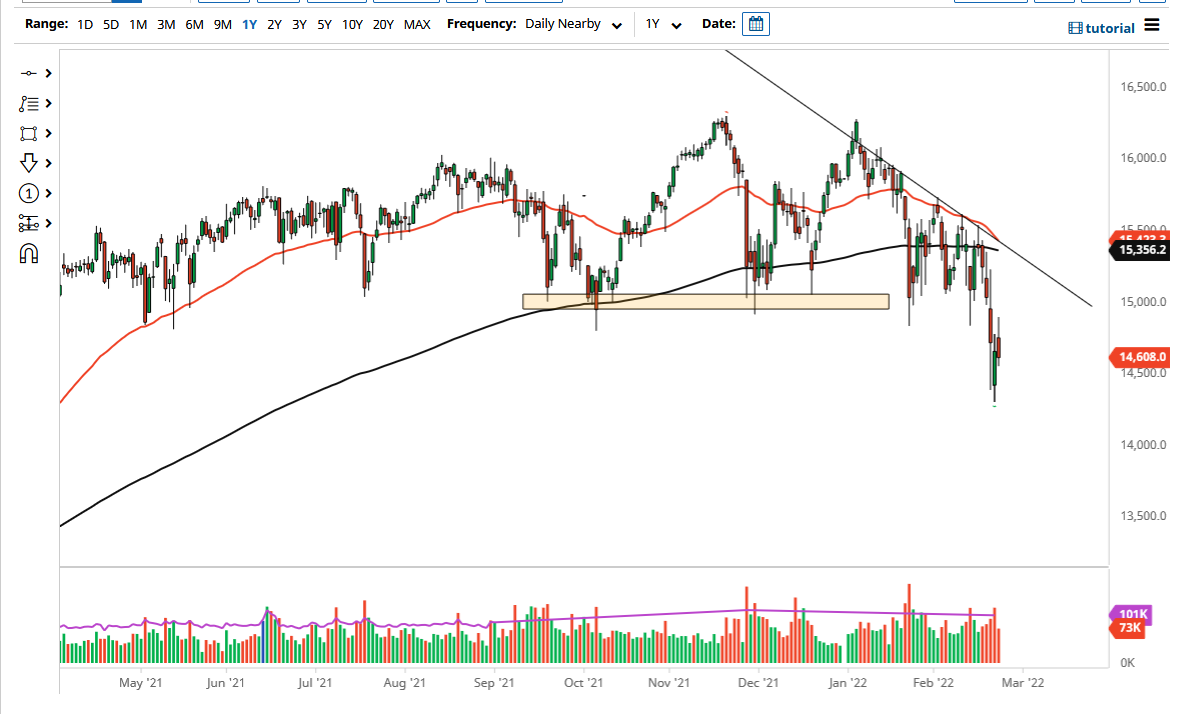

The DAX initially tried to rally on Wednesday to reach towards the €15,000 level. That being said, the market then turned around to show signs of exhaustion, and it is likely that we will continue to drop. In fact, the candlestick shows a bit of a shooting star, and it looks like we are going to continue going lower. The €14,500 level currently offers a bit of support, and if we can break down below there, then it is likely that we could go much lower, breaking down below the bottom of the candlestick from the Tuesday session.

The bottom of the candlestick is near the €14,250 level, and if we can break down below there, it is likely that we will go looking towards the €14,000 level. The €14,000 level being broken to the downside would open up more of a floodgate-type of dumping of the DAX. This could be a very realistic scenario, especially if Russia does in fact push the issue and drive into Ukraine, which would of course cause a lot of fear around the world, especially the European Union. The DAX is the first place that money goes into in the European Union, so it does make sense that will be the first place where we see a bit of a reaction.

If we break above the top of the candlestick during the trading session, and perhaps even the €15,000 level, then we might see a bit of a relief rally, but you can see we are getting ready to form the so-called “death cross”, where the 50 day EMA drops below the 200 day EMA. It should also be noted that the 50 day EMA is creeping right along with the downtrend line, so I think there is plenty of selling pressure out there and I do not want to buy the DAX anytime soon.

However, if we were to see Russia pull back from Ukraine, then we more than likely would get a significant relief rally. That being said, the economic numbers coming out of the European Union continue to be very dire, so it is difficult to imagine that a rally would be anything other than an opportunity to start shorting again.