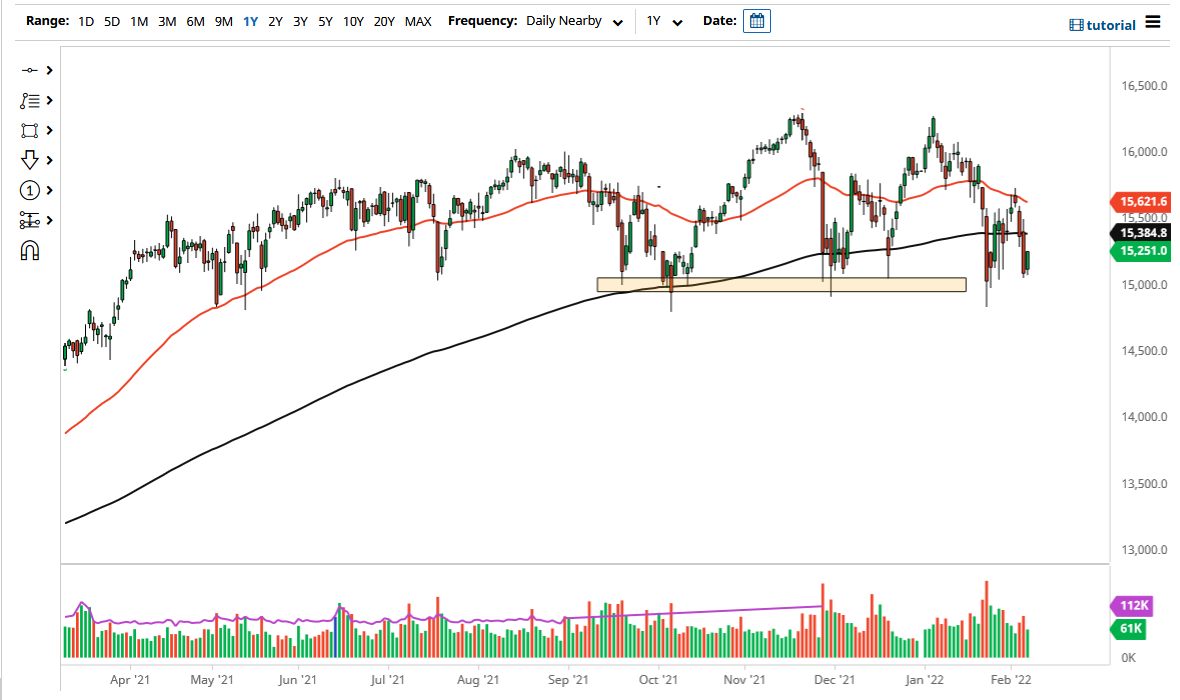

The German DAX Index bounced just a bit on Monday as the crucial support region has held. It is just above the €15,000 level and dropping below there to about the €14,850 level. Because of this, it looks like the market is going to try and continue its overall supportive action, and it is worth noting that this is a level that has been tested several times. We recently have made a “lower high”, so that is something to be concerned about, and you could make an argument for a head and shoulders pattern.

If that head and shoulders pattern does in fact kick off, then it could mean a move down to the €13,500 level, but at this point you cannot try to “front run the pattern.” Going forward, we have more of a “risk on attitude” around the world that will probably send the DAX looking towards the 200 day EMA just above at the €15,384 level. With that being the case, it is very likely that we will see the market bounce around in order to continue the consolidation, so I think we probably will in fact make a lot of back and forth movement.

The market will continue to be noisy to say the least, but if we can break above the 200 day EMA, then it is likely we will go racing towards the €15,650 level where we had previously seen a bit of selling pressure, and breaking above there then could send this market towards the highs again. Obviously, there is a lot of noise out there when it comes to the idea of whether or not the ECB can honestly raise rates as much as the market thinks, because that is difficult for stocks in general.

Ultimately, the market will have to make a bigger decision, but it is going to be very difficult to hang on to a lot of the volatility unless you keep your position size relatively small. Furthermore, you have to be able to ride out all of that noise, which is going to be crucial in order to realize any true gains. The market has a clear support level that you need to pay attention to, and perhaps even profit from its resiliency if it does in fact continue to hold.