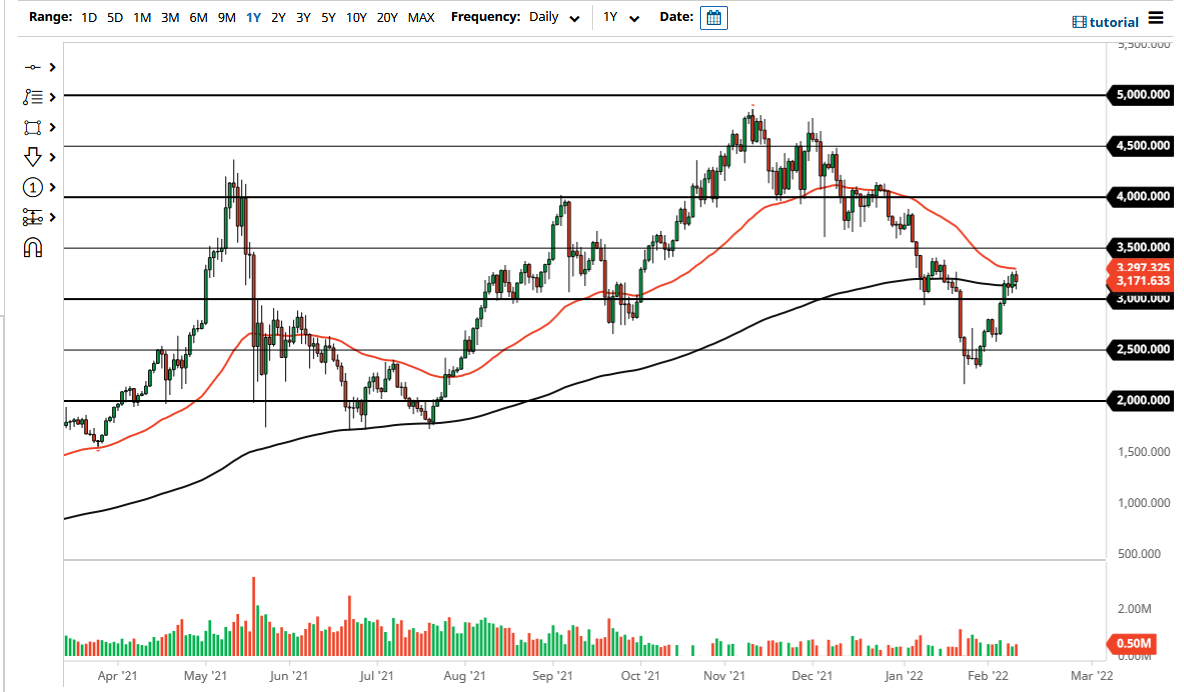

The Ethereum market fell initially during the trading session on Thursday to reach down below the 200 day EMA, before turning around and showing signs of hesitation. Looking at the 50 day EMA just above, it seems as if it is offering a bit of resistance, just as the 200 day EMA underneath is offering support. Furthermore, the $3000 level underneath offers support, so this is a very interesting place that we find ourselves in.

If we were to break down below the $3000 level, I think we are going to see a significant selloff, perhaps reaching down towards the $2500 level. That would be a continuation of the overall negativity that we have seen for a while, and it would make a certain amount of sense considering just how volatile markets have been in, not just in crypto but everything else. The market breaking above the 50 day EMA could open up the possibility of a move towards the $3500 level above. At that point, I think then the entire trend changes, and it is very obvious that we are trying to figure out where to go longer term. We have had a nice rally at this point, so a little bit of a pullback probably makes sense regardless of whether you are bullish or bearish.

If the US dollar continues to strengthen overall, that could work against the theory and, because it is going to work against the value of risk appetite in general, including crypto. Granted, Ethereum has a real use case unlike many other crypto coins, but at the end of the day this is a market that is going to fall right in line with Bitcoin and the overall attitude of crypto in general. I do like the theory longer term, and I am a holder, but I am not necessarily willing to jump in with a ton of money right now and that on a massive turnaround. Quite frankly, the market is not behaving the way it has over the last 13 years, and that will bleed over into the crypto markets. Whether or not we get a “crypto winter” is a completely different question, which quite frankly I would love to see so I can accumulate a massive position for the turnaround. The Federal Reserve monetary policy is something that you need to get very familiar with.