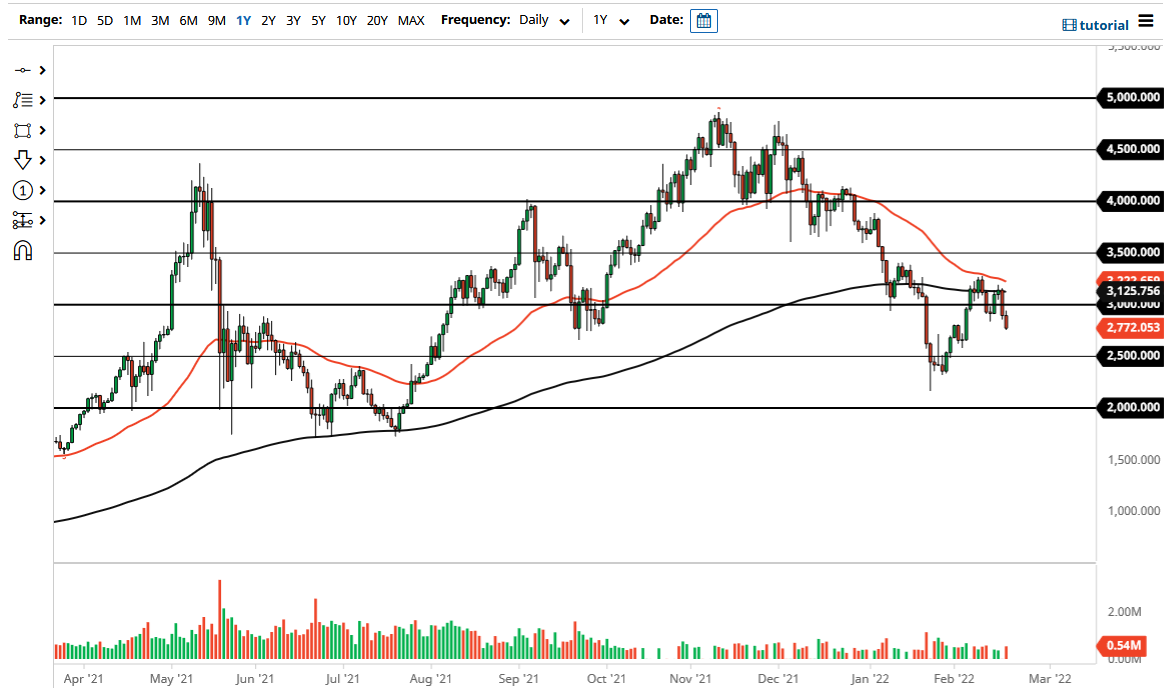

Ethereum initially tried to rally during the trading session on Friday but turned around to show signs of weakness. By doing so, it confirms the “M pattern” that I had been talking about during the previous session. Because of this, it looks like we are ready to break down a bit and it is more likely than not that we are going to continue reaching towards the $2600 level. After that, the $2500 level could very well be targeted, an area that has been support in previous attempts.

The 200 day EMA sits above the most recent drop, and the 50 day EMA is getting ready to break down below there to form the so-called “death cross.” Ultimately, that is a longer-term negative signal, but it is obviously a late one. If you are waiting for that signal to short the market or even get out of it, that is roughly $2000 too late. That being said, people will pay attention to it and it will probably get a few headlines here and there.

One of the biggest problems that Ethereum is going to have is the fact that it is a risk asset, and quite frankly risk assets have been getting hammered as of late. The markets continue to be very noisy and therefore I think is probably only a matter of time before volatility shakes more people out. I would not be surprised at all to see this market go looking towards the $2000 level as we are seeing tightening monetary policy, and that of course attracts quite a bit of concern when it comes to being far out on the risk curve like we have right now. If we were to break down below the $2000 level, then we could break down rather nastily.

On the other hand, if we were to turn around a breakout above the 50 day EMA, then it is likely that the market could go looking towards the $3500 level. After that, we could see this market looking towards the $4000 level. Nonetheless, I do think that we have further to go to the downside and as I like Ethereum for the longer term, I hope we get a crypto winter so I can start piling money into this market for the next move higher.