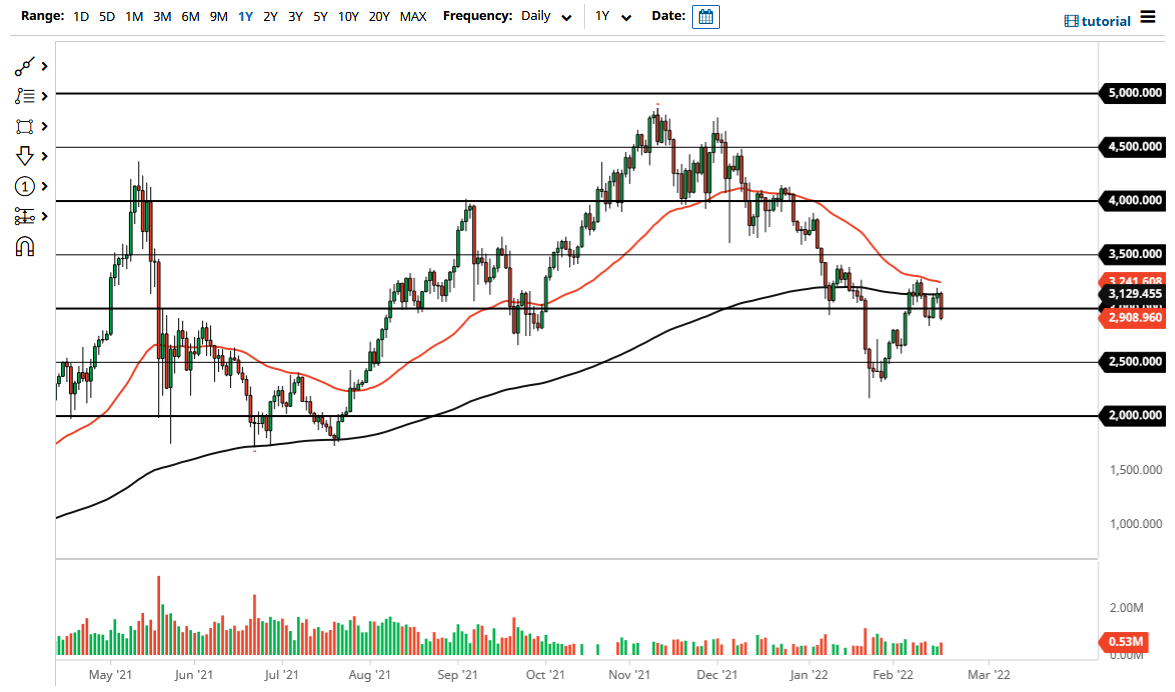

The Ethereum market has fallen rather hard during the trading session on Thursday, as we continue to see a lot of “risk off” behavior around the world. With that being the case, it does make a certain amount of sense that we would see the markets favor the downside, because quite frankly Ethereum is considered to be a “risk asset.” The 200 day EMA sits at the top of the candlestick, so it looks as if the 200 day EMA is in fact trying to hold as resistance. If we break down below the hammer from the Monday session, that opens up a move much lower.

If we do get that lower move, I believe that the $2600 level gets targeted, followed by the $2500 level. Ultimately, I think that is probably what happens after the momentum that we have seen over the last couple of days, but now the question is whether or not we could go down to the $2000 level? If we do, the market will barely be hanging on by its fingernails to any type of situation beyond “crypto winter.”

With the Federal Reserve tightening monetary policy, you have seen a flood of money go flying out of risk assets. Beyond that, markets have ran from risk assets as geopolitical situations continue to get even troublesome, not just the Ukraine/Russia situation, but quite possibly the China/Taiwan situation once the Olympics it ends. All things been equal, this is a market that is either trying to build a bullish flag, or it is getting ready to break down rather significantly. It does look to me more likely than not we are probably going to break down because quite frankly there are so many things out there that traders are concerned about that it would not be surprising at all to see this market break down right along with anything else related to crypto. Quite frankly, crypto is the last thing that people want to be involved in if the world is falling apart, especially institutional money.

If we do turn around and take out the 50 day EMA to the upside, that would be a very bullish sign, but I do not necessarily think that is going to be the case, so that is something that I would anticipate being less than a 20% chance based upon the most recent action.