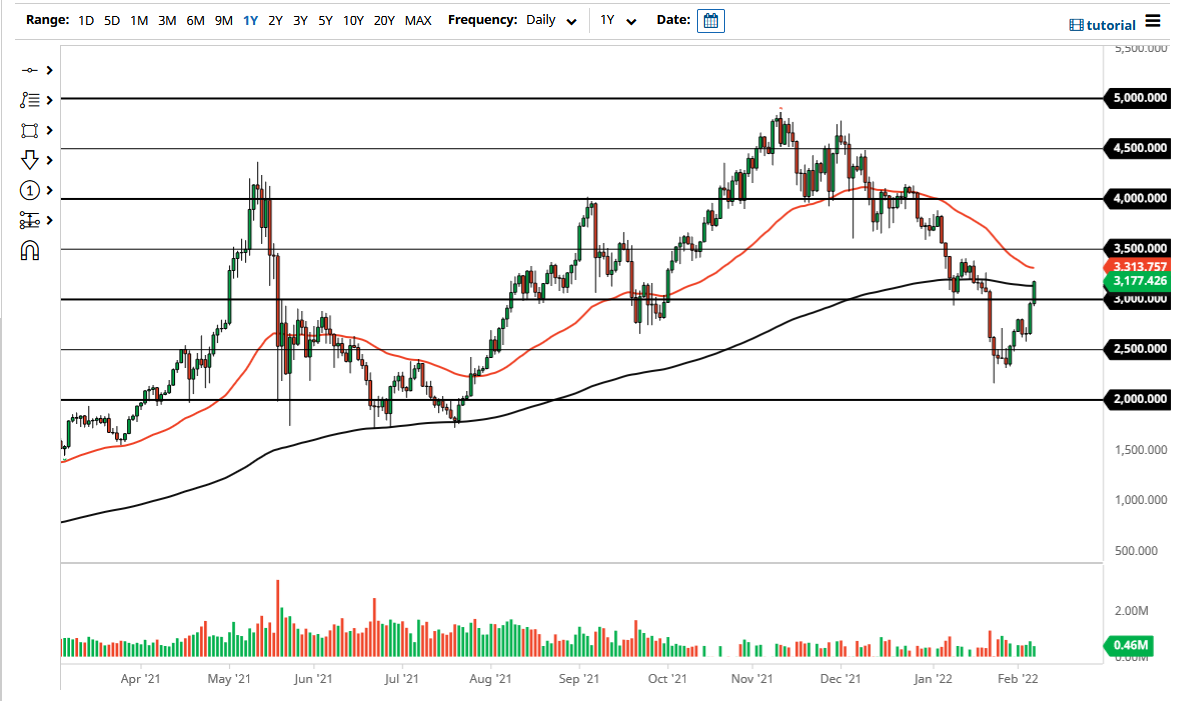

Ethereum took off to the upside on Monday, breaking above the 200-day EMA yet again. At this point, we have wiped out the last selloff from the downside move, so clearing that does open up the possibility of a move much higher. This has been explosive, but I would think that needs to see a little bit of a pullback in order to build up momentum. Having said that, this is crypto, and things can get out of hand really quickly.

If we were to break down below the $3000 level, then it is likely that we could see further selling, but I think the bottom is just about put in here. That does not necessarily mean that we will turn around and go straight up in the air, but I think we are in the midst of trying to turn things around. Think of this as a large ship: it does not simply cut back and forth, you need to have a big wide swing. The Ethereum market seems to have found the $2500 level as the floor, which I find quite interesting considering just how bearish everybody was right around that time.

Breaking above the 50 day EMA would be very bullish and open up the $3500 level, and potentially an even bigger move. Longer term, I do believe that Ethereum continues to go much higher and reaches towards the $5000 level above, which is a large, round, psychological significant number and barrier. If we can break above there, then it becomes a “buy-and-hold situation” going forward. To be honest, that is how I feel about Ethereum anyways, as I am an investor and not a trader.

If we were to break down, then we could go into a “crypto winter”, but that probably requires a breakdown below the $2000 level to confirm it. If we do something like that, then I will be buying Ethereum for the next couple of years in order to build up a massive position. Unfortunately, I do not think I will get that opportunity, so at the end of the day you have to trade the market that you are given, and in this case, we are given a very bullish market. Simply looking for pullbacks will more than likely be the best way to go.