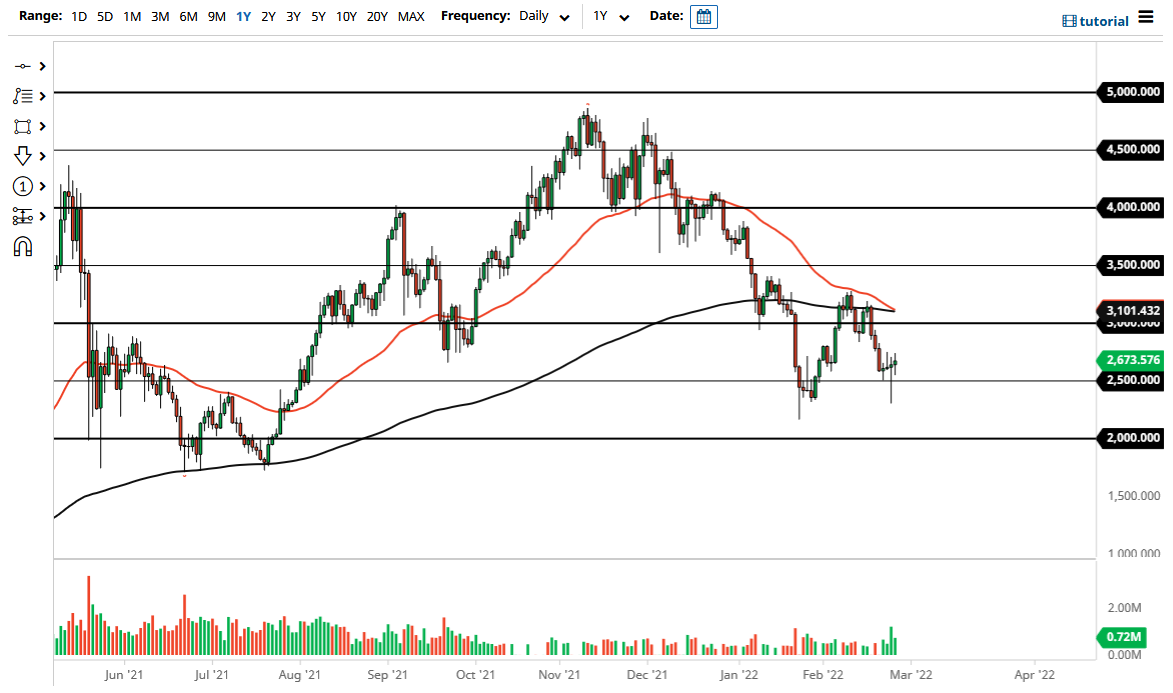

The Ethereum market initially pulled back just a bit during the trading session on Friday but found plenty of buyers just above the $2500 level to keep things stable. In fact, as I write this article, the Ethereum market is currently trading at the $2700 level. This is an area that seems to be like a magnet for price over the last three days, so therefore it does make a certain amount of sense that we have seen the market return to that level.

If we were to break above the highs of the last couple of days, then it allows Ethereum to go looking towards the $3000 level, which is obviously a large, round, psychologically significant figure. The $3000 level will take a significant amount of effort to break above, but if we do then it would obviously be a very good sign. It would confirm the “double bottom” that the Ethereum market is trying to make right now. That being said, you can also make an argument for negativity due to the fact that we are getting ready to form the so-called “death cross”, but a lot of times that is a late signal.

If we turn around a break down below the bottom of the hammer from the Thursday session, then Ethereum will more than likely go looking towards the $2000 level. The $2000 level has been significant support and resistance multiple times in the past and will attract a lot of attention from a headline perspective. If we were to break down below there, then we are looking at a move down into “crypto winter.” That is when the markets did almost nothing in and they go to sleep for a long time. At that point, I would become aggressively accumulative of Ethereum in general.

I think the only thing that you can count on is a lot of choppy volatility, because we still have a lot of issues out there when it comes to crypto in general, because not only do we have geopolitical concerns, but we also have the Federal Reserve looking to tighten monetary policy. As long as that is going to be the case, it does work against the value of risk appetite such as crypto. Rallies at this point will more than likely still be potential selling opportunities.