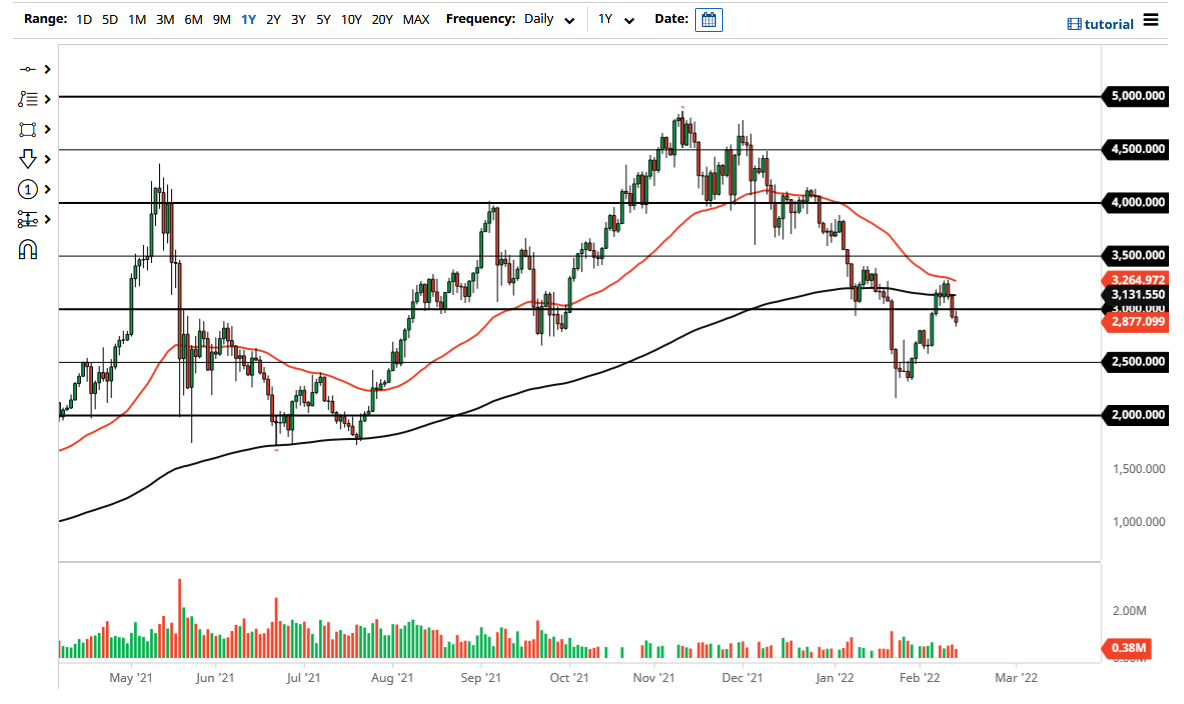

The Ethereum market initially tried to recover the $3000 level on Monday, but as you can see, we have rolled over again, and it looks like we are trying to drift lower. I would suspect the most poignant word to use here is “drift.” This does not look like a market that is melting down, rather it looks like a market that simply has no real catalyst to go higher at the moment. Perhaps that is a good way to look at most crypto markets, because they simply do not seem to be willing to hang on to gains at the moment. This is not to say that they never will again, it is just that we have seen a significant amount of malaise when it comes to the idea of owning crypto recently.

It should also be noted that Bitcoin does not look like it is very strong at the moment, although it is trying to stabilize. It is not until you see Bitcoin strengthen that you can take any move in the overall market with any sense of certainty. As Bitcoin goes, so goes the rest of the crypto markets. Most people know this, so they pay close attention to what is going on over in that market.

I am very bullish of Ethereum longer term. I make no bones about that, but I do realize that it will not go straight up in the air forever. That is not how this is going to play out, especially now that institutions are involved, because that is not how they play the game. Long gone are the days of 500% returns in a couple of weeks, although crypto still offers some of the best returns that you can get. As long as that is going to be the case, I do think that crypto could be a very interesting place to be. However, it is not really an asset that you should trade short term. Quite frankly, there just far too many noisy external pressures out there right now that you can get hurt by. Because of this, I am very cautious about trading crypto short term and look at most pullbacks through the prism of a potential investing opportunity. At this juncture, it looks like we could very easily slip back towards the $2750 level, which has seen a little bit of action recently. This is not to say that I think it has to happen, because I am quite well aware of the fact that we can break above the $3131 level, or the 200 day EMA, which would attract a lot of attention as well.