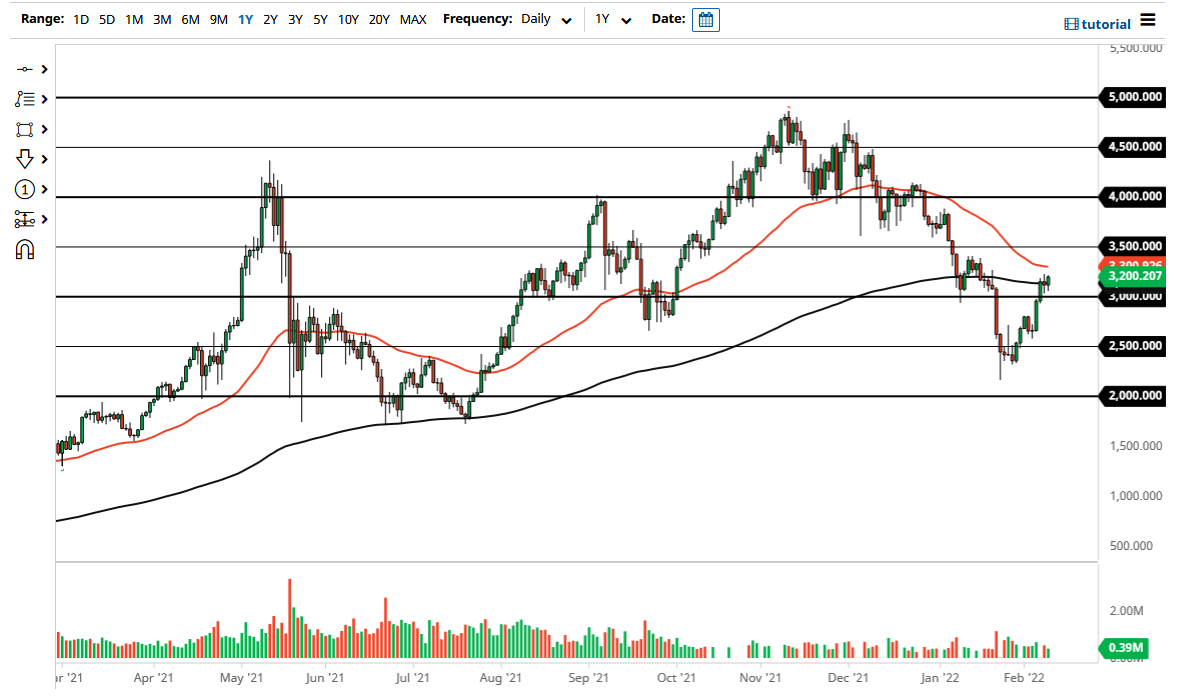

The Ethereum market had a choppy session on Wednesday as we continue to hang around the 200 day EMA. The $3200 level attracts a certain amount of attention in and of itself, so it is not a huge surprise to see that we have been essentially sideways over the last couple of days. The question now is whether or not we can continue to go higher, and whether or not risk appetite continues to pick up?

The $3000 level underneath could be a potential support level worth paying attention to, because if we break down below there it is likely that we could continue to go much lower. At that point, I think it would continue the overall downtrend, but Ethereum has stopped melting down. Whether or not we are done with the overall downtrend is completely different, and with the CPI numbers coming out on Thursday, I would anticipate a lot of influence coming from the US dollar.

Keep in mind that a lot of people pay close attention to inflation and how it affects central bank monetary policy. Recently, we have seen crypto markets get hammered due to the idea of tightening monetary policy, as risk appetite wanes in that scenario. Because of this, it is very likely that we will see a lot of noisy behavior during the day on Thursday, and if the CPI numbers come out very hot, that will almost certainly cause problems with not only Ethereum, but crypto in general. Keep in mind that although we have had a nice bounce, we have come nowhere near changing the trend. The market will more than likely continue to see a lot of volatility regardless of what happens next, but keep in mind that if the CPI numbers come out rather sluggish, that might end up sending risk assets such as crypto much higher. Either way, Thursday is going to be crucial, and it looks like so far we are currently seeing people bet on the “whisper number” that J.P. Morgan stated as being lower than anticipated. If we do get a reason for loose monetary policy, it is possible that crypto could be one of the bigger beneficiaries as it is so highly influenced by risk appetite.