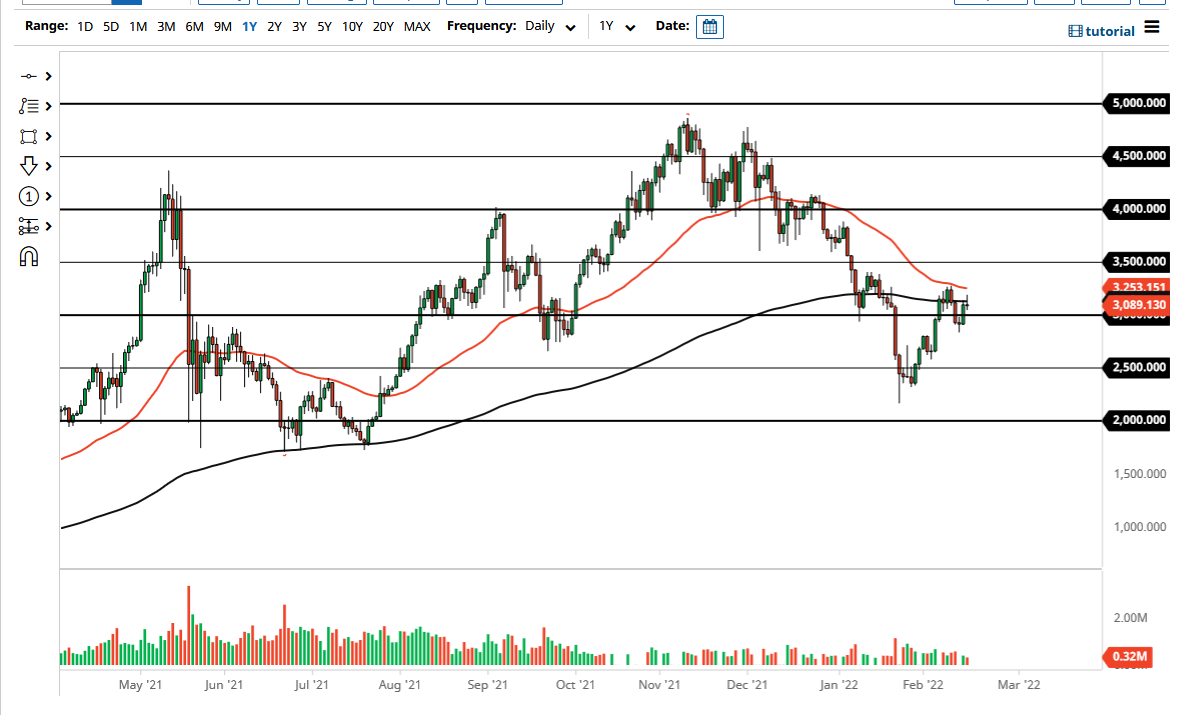

Ethereum rallied a bit early on Wednesday, only to turn around and give up all the gains as the 200-day EMA continues to be a technical issue for the market. It is also worth noting that the 50 day EMA sits just above and is flat as well, so it is possible that Ethereum could be entering a very quiet timeframe.

This makes a certain amount of sense because the markets had sold off so drastically before that the bounce probably is not completely trusted. I know that I do not completely trust the bounce, but I am a longer-term holder of Ethereum, so I look at the market through a different prism than most others. I simply look at these major pullbacks as an opportunity to buy more, so I am not as much of a “trader” as I am a longer-term “investor.”

That being said, it does look like the market is still going to try and catch its breath, as the $3000 level has brought in a lot of buying and selling. This is classic exhaustion near a major level, something that you see quite often. Adding more fuel to the fire are those technical indicators so we will have to wait and see whether or not that plays out as a significant barrier, or if it just lets the market go sideways.

If we were to break down below the bottom of the Monday candlestick, then I think Ethereum is very likely to go down to the $2600 level. On the other hand, if we can take out the 50 day EMA to the upside, it could send Ethereum searching for the $3500 level. Unfortunately for Ethereum, it needs Bitcoin to start moving in the proper direction to go higher as well, and Bitcoin needs a bit more economic certainty as the recent volatility has had a lot of institutional money running from it.

Longer term, I do think that Ethereum will capture the highs and go much higher than that. That being said, I cannot tell you how long it is going to take to get there, because quite frankly there is a lot of uncertainty out there that will continue to cause major issues. While Ethereum is not necessarily a currency, it gets knocked around like one.