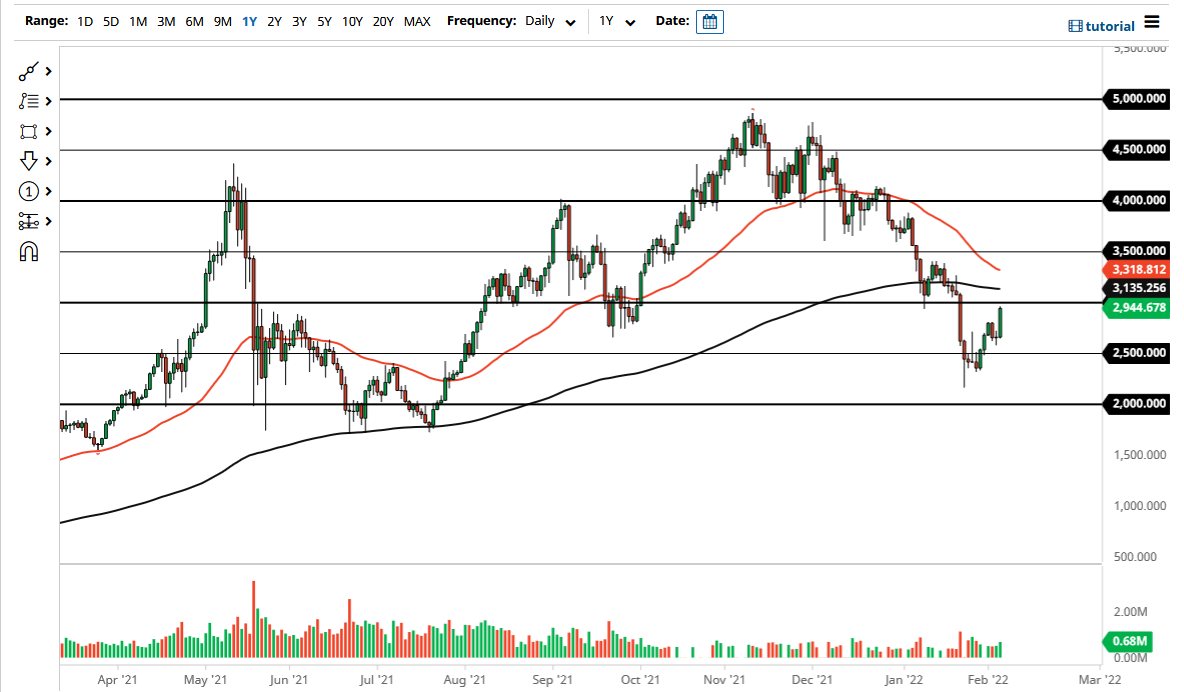

The Ethereum market rallied significantly on Friday to reach towards the $3000 level again. If we can break above $3000 for any sustainability, this is a market that could go much higher. Keep in mind that we are still recovering from a massive drop, and that does suggest that perhaps we could see a lot of volatility in the short term, as we are trying to form some type of base. Further adding upward pressure is the fact that Bitcoin took off to the upside, which of course helps the rest of the crypto markets overall.

It is worth noting that we probably have a bit of a short-term pullback ahead of us, but it is probably only a matter of time before we see buyers coming into pick this up. I think at this point we are starting to see a reassessment of crypto and the fact that the market has sold off so viciously. Remember, this might be a bit different than other selloff due to the fact that there is a lot of institutional money out there floating around in the crypto markets. It is possible that Ethereum simply got “too cheap” for some people to ignore.

That being said, the 200 day EMA is above and curling a little bit lower, so it does suggest that the downtrend is still technically intact, so that is another reason why think sellers may return. Nonetheless, it will be interesting to see whether or not the next low is higher than the one before it, as we have seen on short-term charts. If we do break above the $3000 level and the 200 day EMA, then I think it is only a matter of time before we take off to the upside and see an explosion in growth.

As always, you need to keep an eye on risk appetite in general, because it will directly affect what happens with crypto markets in general. As long as crypto markets are very noisy, you might as well take advantage of value when it appears. This is coming from a longer-term perspective, not a short-term trading perspective. I do not think you can do a lot of short-term trading in this market.