The euro has had a rather tough month of February, as concerns about war on the Ukrainian border have caused a flight to safety. Furthermore, we have seen a lot of volatility due to the fact that Christine Largarde finally admitted that there was inflation in the European Union, and it was something that the European Central Bank was aware of. Traders immediately priced in the possibility of two interest rate hikes by the end of the year.

However, European Central Bank members almost immediately started to push back against that idea, and then we started to see the euro drift a little bit lower. Finally, as the possibility of a large-scale war on the European continent showed itself, people started to flee from Europe overall when it comes to finance. We have seen a complete repudiation of all things European, but I must admit it has been in a relatively orderly fashion. The euro has fallen, the DAX has fallen, as well as the CAC in Paris. All of this shows that people are looking to pull money out of the region.

Adding more fuel to the fire is the fact that inflationary problems in the European Union seem to be picking up, while growth is slowing. The question now is whether or not the EU is going to be facing stagflation. Honestly, it is probably something that we are going to see worldwide. In an event that the world is looking for safety, they will go running towards the US dollar as the US Treasury market is the most liquid market available. It is the safest place to put money because it is essentially the same thing as cash, but offers somewhat of a yield.

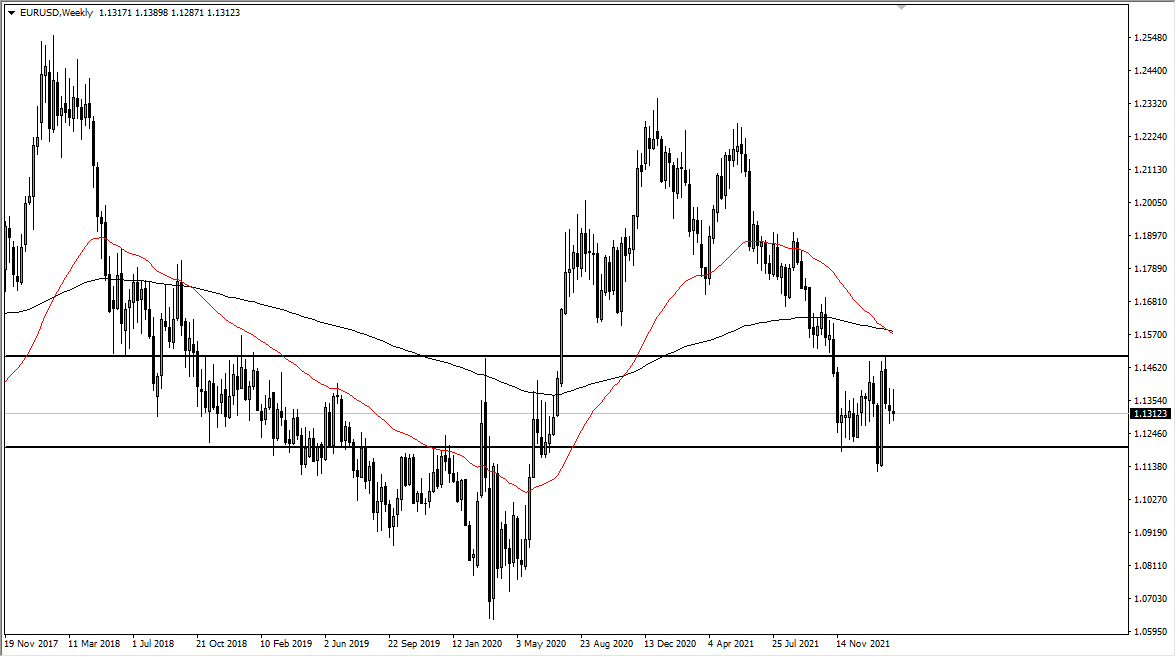

Finally, speaking of the United States - the Federal Reserve is likely to hike interest rate several times between now and the end of the year, and has even explicitly said so. Whether or not they can is a completely different story, but at the end of the day it is what the market and the Federal Reserve believe right now. If that is going to be the case, it is very likely that this market will still favor the greenback. A breakdown below the 1.12 level could open up the doors towards the 1.10 level. Until something fundamentally changes, rallies will probably be sold into.