The difference between success and failure in Forex trading is very likely to depend mostly upon which currency pairs you choose to trade each week and in which direction, and not on the exact trading methods you might use to determine trade entries and exits.

When starting the trading week, it is a good idea to look at the big picture of what is developing in the market as a whole and how such developments and affected by macro fundamentals and market sentiment.

The Forex / CFD market is currently showing some strong trends, so it’s a good time to be looking at trading Forex.

Big Picture 6th February 2022

Risk sentiment improved somewhat over the past week, with most major global stock market indices ending the week at least slightly higher. The Forex market saw the US dollar sell off against its long-term bullish trend, but there is also strong positive momentum in the euro, while several energy and soft commodities (WTI Crude Oil, Gasoline, Soybeans, Cotton, Corn) climbed to reach new highs.

Last week’s Forex market was dominated by the European Central Bank’s refusal to rule out a rate hike in 2022, the Bank of England’s 0.25% rate hike to a new interest rate of 0.50%, and a considerably stronger US non-farm payrolls net gain although US unemployment rate rose from 3.9% to 4.0%. We also saw stronger than expected Canadian GDP and jobs growth in New Zealand. OPEC decided again for yet another month to boost its production of oil by another 400k barrels, as crude oil rises to new multi-year high prices.

In the Forex market, the US dollar weakened last week, with the US Dollar Index (USDX) falling back from its highest level in 18 months. The Swiss franc was the biggest loser of the week in the Forex market, while the euro strengthened the most of all major currencies.

Last week was the second consecutive week in which the number of new global confirmed coronavirus cases fell. It may that the omicron variant pandemic has begun to recede, at least on a global level.

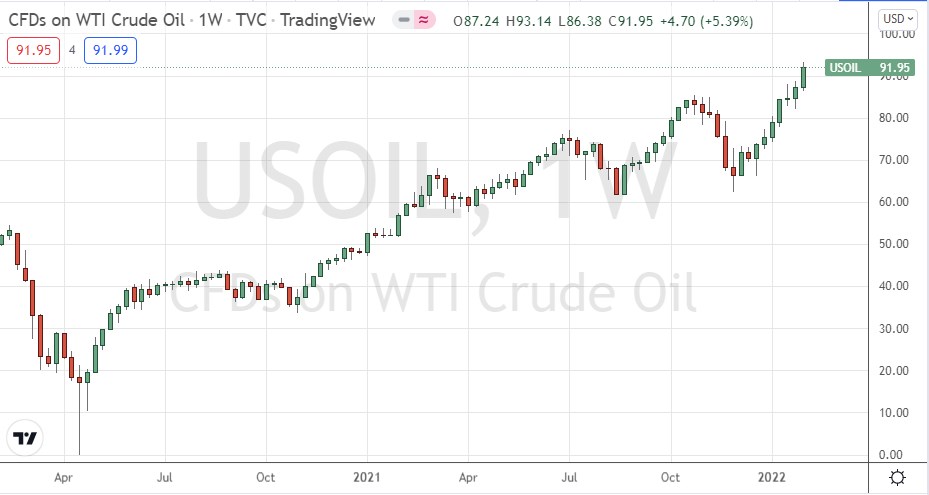

I wrote in my previous piece last week that the best trades for the week were likely to be long of WTI Crude Oil and short of the EUR/USD currency pair. This was a good call on WTI Crude Oil as it rose over the week by 5.40% to close at $91.95. Unfortunately, the EUR/USD currency pair rose by 2.72%, so the averaged profit for the week’s best trades was 1.34%.

Fundamental Analysis & Market Sentiment

The headline takeaways from last week were:

The ECB put a hawkish surprise into the market last week, by refusing to rule out a faster pace of rate hikes including at least one hike during 2022.

The Bank of England raised its base rate by 0.25% to 0.50%.

US non-farm payrolls grew by a net 467k, much higher than the forecast of 110k.

OPEC again increased production of crude oil by a further 400k barrels per month.

The coming week is likely to see a lower or maybe similar level of volatility compared to last week, with markets seeing localized trend movements with little overlying theme, except perhaps that of high inflation and negative real interest rates. The coming week will be quite slow in terms of economic data releases, with nothing due except US CPI (inflation) data. However, this can be a highly important data print for markets and will be watched closely. A month on month increase of 0.4% is the consensus forecast.

Last week saw the global number of confirmed new coronavirus cases fall again. Approximately 61.3% of the global population has now received at least one vaccination.

The strongest growths in new confirmed coronavirus cases overall right now are happening in Afghanistan, Armenia, Austria, Azerbaijan, Bahrain, Belarus, Bhutan, Brazil, Brunei, Chile, Costa Rica, Egypt, Estonia, Georgia, Germany, Guatemala, Hungary, Indonesia, Iran, Iraq, Japan, Jordan, South Korea, Kuwait, Lebanon, Lithuania, Netherlands, Oman, Romania, Russia, Singapore, Slovakia, Slovenia, Turkey, the UK, and the Ukraine.

Technical Analysis

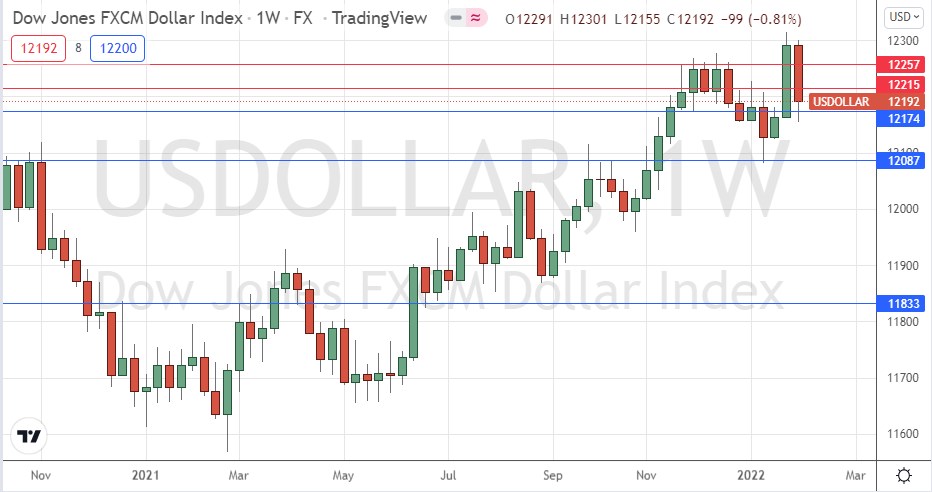

U.S. Dollar Index

The weekly price chart below shows the U.S. Dollar Index printed a large bearish candlestick last week, establishing new lower resistance levels at 12215 and 12257 (the latter looking more reliable). This represents a bearish retracement following last week’s highest weekly close seen in 18 months. The price is also potentially supported by the support level at 12174.

If the support level at 12174 continues to hold, the long-term bullish trend will be likely to resume.

Overall, it seems clear we have a very bullish picture in the USD over the long and medium terms, so it will probably be wise to trade in the direction of long USD over the coming week, at least in the Forex market. In other markets, it is likely that the USD will not be a key driver of price movements.

WTI Crude Oil

For the fourth week running, WTI Crude Oil made its highest weekly close in 7 years last week and printed a relatively large bullish candlestick which looks healthy. The price closed within the top quarter of the candlestick’s range, suggesting a further rise to come despite OPEC’s continued production increases. There are bullish signs, and I continue to see WTI Crude Oil as an interesting buy.

Soybeans

The prices of several agricultural “soft” commodities have been rising strongly in recent weeks, arguably driven by higher inflation rates and negative real rates of interest which we are seeing across many countries.

Of the soft commodities, soybean futures have been rising especially strongly over the past three weeks. Last week’s strong price rise ended with the highest weekly close since June 2021, with the price rising firmly towards the end of last week.

It makes sense to look for long commodity trades during this period of high inflation, although be aware that volatility of soft commodities can be very high, so it is important to trade these in relatively small position sizes.

Bulls should be aware that the 1600 price area might act as resistance, as it was pivotal during the summer of 2021 which the price was making new long-term highs.

I see soybeans as an interesting buy.

Bottom Line

I see the best opportunities in the financial markets this week as likely to be long of WTI Crude Oil and Soybeans. Forex traders may find long euro trades to be most fruitful over the coming days.