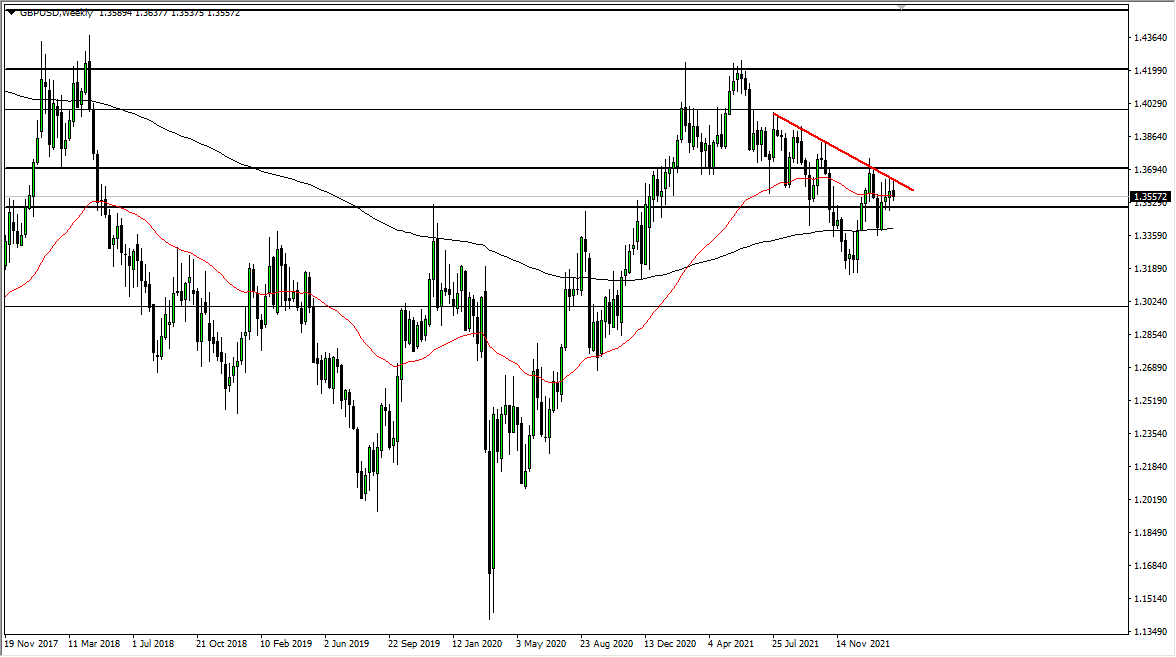

The British pound has tried to rally during most of the month of February but continues to find quite a bit of resistance above. I believe that sometimes the market screams at you, and other times it starts to whisper. As things stand currently, it looks like a sideways market that is struggling to break above the top of a trendline. However, the market may be whispering that it simply does not have the momentum to go higher. I believe that if this market breaks down below the 1.35 level on a daily close, that may kick off fresh selling.

Both central banks are rather hawkish at the moment and people are struggling to price in a differential when it comes to interest rate hikes. After all, monetary policy being tied out of both countries tends to favor both currencies, and you are currently seeing a fight between two relatively strong currencies. This is much clearer when you look at the way the GBP/JPY and GBP/NZD pairs behave, right along with the USD/JPY, and the AUD/USD pair. In other words, you see overall strength in both of these currencies against others.

Another problem that you may have with this market is that recently we have seen a flight back to the carry trade when traders buy one currency and sell another in order to pick up the interest rate differential. There is not much of a differential here, so there is no carry trade blowing it in one direction or the other. However, there is one thing that could come out and really get this market moving, and that would be the fear trade. If that is the case, the US dollar will win hands down.

Alternatively, if we do see this market break above the downtrend line on the chart and, perhaps more importantly, the 1.37 handle, you could see the British pound really start to take off. At that point, it becomes more of a “buy-and-hold scenario”, where we would perhaps go as high as the 1.42 level over the longer term. As things stand right now, it is hard not to notice that there are long wicks above the weekly candlesticks for the entire month of February. It certainly looks as if it is starting to “lean to the downside.” Because of this, I will be paying very close attention to the 1.35 handle.