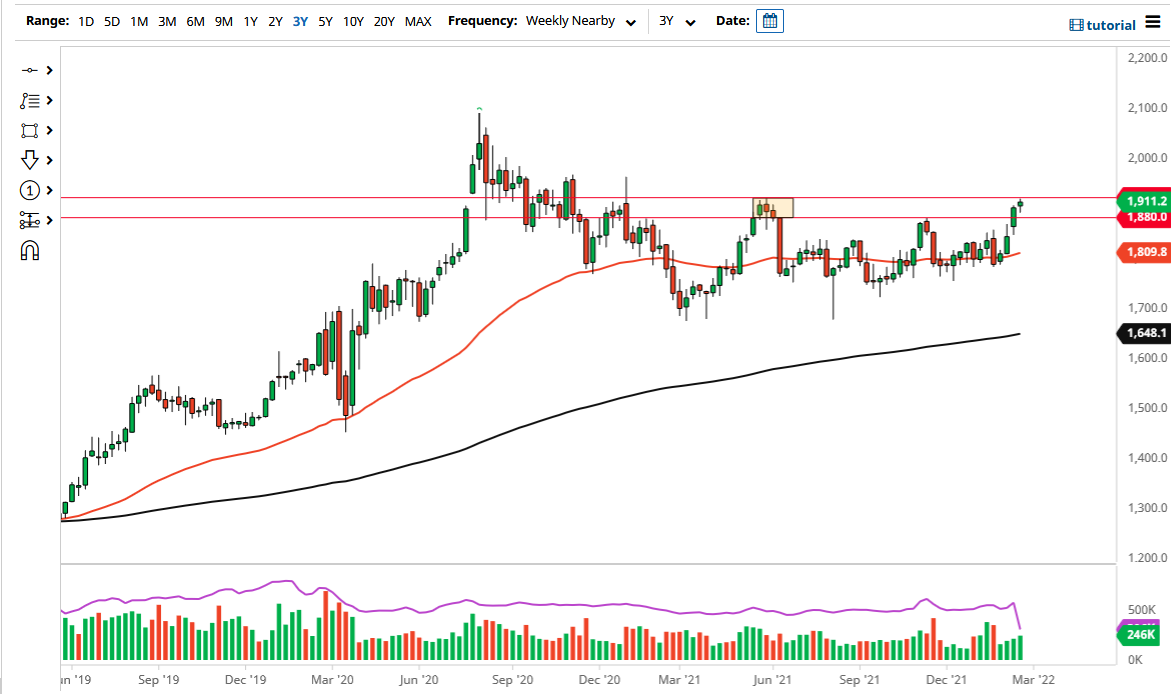

Gold markets have exploded to the upside during the month of February as global geopolitical risks continue to capture the headlines, right along with inflationary headwinds. Because of this, I think gold will continue to go higher, but we have a major resistance barrier just above that may take a lot of work to break through. With that in mind, it could very well be a very choppy start to the month of March, perhaps even offering a bit of a pullback.

As things stand currently, it is very difficult to bet against the value of gold, so I do not really have any interest in shorting this market, unless we see a complete capitulation by the Federal Reserve. Gold has gotten a bit of a boost because of the Russia/Ukraine crisis, but we had been rallying before. A lot of the rally ahead of this was due to inflationary fears; it is just that Vladimir Putin put everything into high gear.

Do not expect the Russians to back down easily, because when you look around the financial markets, both gold and oil are skyrocketing. These are both commodities that Russia has quite a bit of, so they are getting paid to cause fear. That being said, I do think eventually this will get settled one way or the other, and eventually the market will make a bigger move.

On signs of a Russian withdrawal, gold could very well fall $20 or even $30. That being said, it is probably going to end up being a nice buying opportunity as there are still a lot of inflationary and growth problems around the world, and that does create an environment in which gold is very attractive. Furthermore, if the market were to break above the $1920 level, gold then would become more of a “buy-and-hold” market, perhaps reaching as high as $2100 over the longer term. Certainly, the $2000 level will be targeted initially, but it is a large, round, psychologically significant barrier so I would anticipate a bit of profit-taking.

As far as a scenario where I would be selling gold, we would need to see the Federal Reserve come out against the idea of hiking rates aggressively, as well as the Russian/Ukrainian tensions calm down. If that situation settles itself out and the Federal Reserve looks unlikely to hike rates, then you might have an argument for gold falling rather hard. Currently, it certainly looks as if the Federal Reserve is going to tighten.