Despite the important and influential events that the gold market was exposed to last week, the gold price showed a distinguished performance as it jumped to the resistance of $ 1815 an ounce before closing trading stable around the level of 1807 dollars per ounce. The selling operations that the yellow metal was exposed to last week did not exceed the support level of 1788 dollars for an ounce. Currently, gold futures are struggling to determine direction, as the excellent US jobs report for January defied market expectations. This contributed to the rise of the US dollar, and the yellow metal is trying to stabilize above the $1800 level, which supports a stronger move higher.

Gold prices recorded a weekly gain of 0.5%, but it is still down about 1.5% since the beginning of the year 2022 to date. Silver, the sister commodity to gold, also struggled to stay in positive territory. Silver futures rose to $22.385 an ounce. Accordingly, the white metal recorded a weekly loss of 0.5%, in addition to its decrease since the start of the year 2022 to date by more than 4%.

The US jobs report for January stunned everyone, including the White House, which warned of a poor job read. According to official figures, in January, the US economy created a total of 467,000 new jobs, a number much higher than even the White House had expected. The market was expecting only 150,000 jobs. According to the Bureau of Labor Statistics (BLS), the nation's unemployment rate rose to 4%, up from 3.9% in December. The market had expected a reading of less than 3.9%. Last month, the labor force participation rate rose to 62.2%, average hourly wages rose 0.7% month-on-month, and average weekly hours decreased to 34.5.

Compared to other job reports, most job growth was in a few industries: leisure and hospitality (+151,000), professional and business services (+86,000), and retail (+61000). Payrolls haven't changed much in most other sectors, such as construction, financial services, mining, government, and manufacturing.

However, financial markets were not entirely enthusiastic about the better-than-expected news, mainly because it will likely provide the Fed with more impetus to further quantitative tightening.

Even in an environment of rising prices, some experts say that gold could still be attractive from the chaotic stock market. In this regard, Robert Rowling, market analyst at Kinesis Money, said in a note, “While gold is usually under threat in an environment where interest rates are high due to its lack of yield, its attractiveness as a haven asset in times of crisis and stock market declines suggests that investors are not, they still see value in holding gold and it is too early to write the story of the economic recovery.”

Other factors affecting the gold market. US Treasury yields were positive. Including the 10-year bond yield, which rose by 0.078% to 1.905%. One-year bond yields rose to 0.852%, while 30-year yields jumped to 2.197%. Incremental returns are usually bearish for precious metals because they raise the opportunity cost of holding unproductive bullion.

The US Dollar Index (DXY), which measures the performance of the US currency against a basket of major currencies, rose to 95.57, from an opening at 95.31. Despite its strong performance at the end of the week's trading, it recorded a loss of 1.75%. Since the beginning of the year 2022 to date, the US dollar index DXY has decreased by 0.4%. In general, a stronger profit value is a bad thing for dollar-denominated goods because it increases the cost of their purchase for foreign investors.

In other metals markets, copper futures fell to $4.465 a pound. Copper futures fell to $1020.00 an ounce. Palladium futures fell to $2,297.00 an ounce.

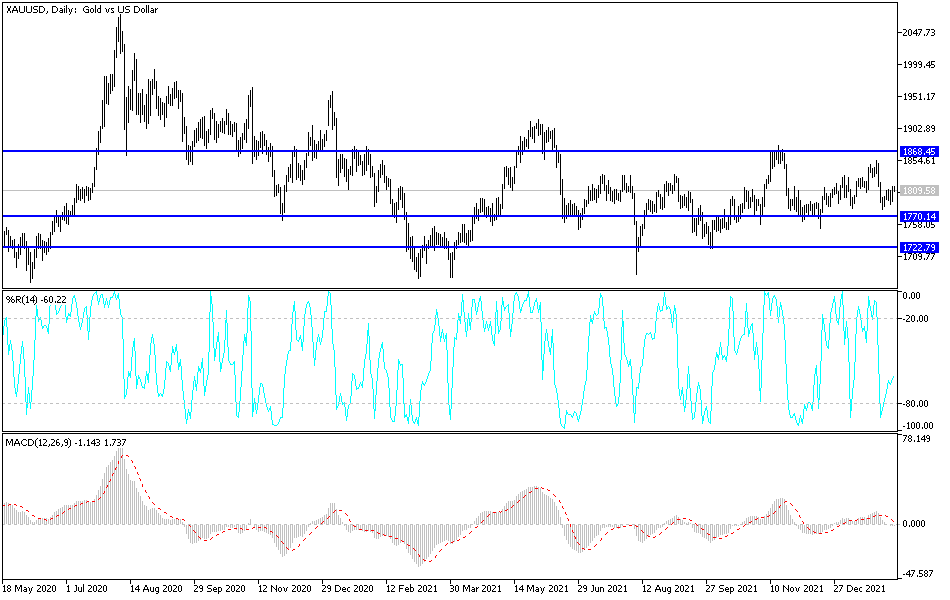

According to the technical analysis of gold: There is no change in my technical view of the performance of the gold price, as stability is above the psychological resistance of 1800 dollars an ounce. This will continue to support the upward trend and support the movement of the bulls towards higher and stronger levels. The closest to it are 1818, 1827 and 1845 dollars. On the other hand, the support level will remain at 1775 dollars, according to the performance on the most important daily chart, to change the outlook of the gold price to a bearish one. I still prefer buying gold from every bearish level.