The price of gold was flat after a three-day advance, as investors were reacting to a drop in US corporate employment ahead of the key US jobs report, along with global geopolitical tensions. The rebound gains for the gold price this week reached the resistance level of 1810 dollars an ounce before settling around the 1805 dollars an ounce. This is before an important event to update the monetary policy of both the Bank of England and the European Central Bank.

Since the break above the full figure in July 2020, the price of gold has fallen below 19 times on a closing basis, only to regain its footing. Last year, the typical value of gold, based on a regression study that includes dollars, real rates and exchange-traded fund holdings, has fallen by about 10%. However, the price of the yellow metal fell by only 2%. There is clearly a large buyer who considers the metal a long-term investment.

According to what was recently announced, US corporate salaries fell last month by the largest amount since the early days of the pandemic, due to the spread of the Corona virus variant “Omicron”, according to data from the ADP Research Institute. The statement came ahead of Friday's US employment report from the Labor Department. Meanwhile, the United States has given the green light to send a stronger military message to support Ukraine in its confrontation with Russia.

Overall, the decline in US jobs helped provide some basic support for gold, according to Nicholas Frabel, global general manager at Sydney-based ABC Bullion. "The market feels like it's near the upper side of the near-term trading range," he said. Bullion is held above $1,800 an ounce as investors anticipate the Federal Reserve's hike in US interest rates in March, while volatility in stocks and geopolitical tensions provide support for the safe-haven asset. The consolidation of this level, especially with the fundamentals turning to the downside, indicates that there is a large buyer somewhere in this volatile environment.

The rally in global equities appeared to teeter on Thursday after mixed earnings from tech leaders and as traders await more clues about how quickly central banks will tighten monetary policy, with decisions coming out of Europe and the UK on Thursday.

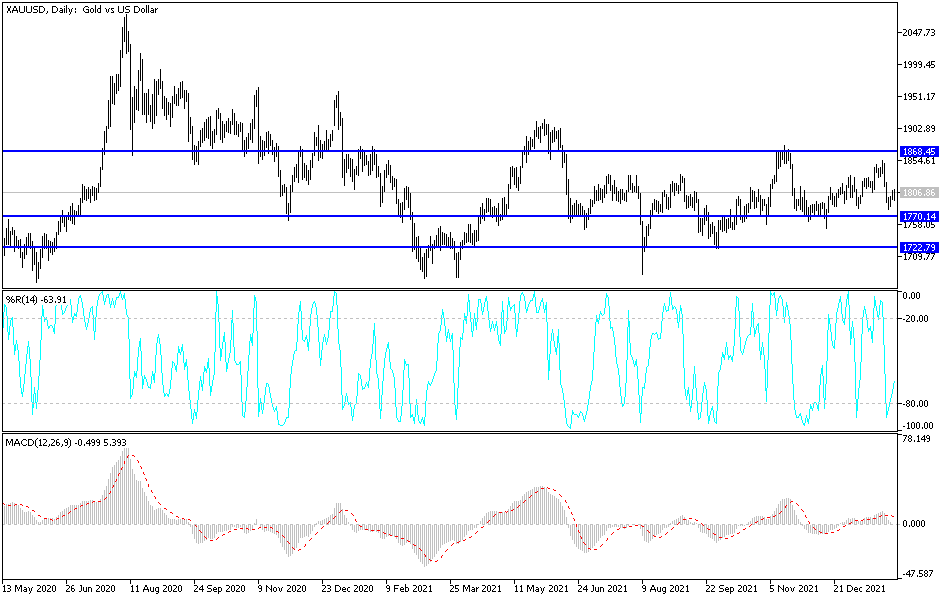

According to the technical analysis of gold: So far, the stability of the price of an ounce of gold above the psychological resistance level of 1800 dollars is still an opportunity for the bulls to launch higher. This may need more momentum and if it happens, the resistance levels 1818, 1827 and 1845 dollars per ounce may be the next targets for the bulls. On the other hand, more signals from global central banks to a strong chain throughout the year, more times to raise interest rates, the gold market will be forced a lot.

According to the performance on the daily chart, the support level of $1,775 per ounce will remain the most important for the bears to continue to dominate the trend. I still prefer buying gold from every bearish level.