Global fears of the consequences of a Russian military action in Ukraine increased the demand of investors to buy safe havens, gold, most notably. Despite the strength of the dollar, the price of gold moved towards the resistance level of 1880 dollars an ounce, the highest for the gold market since June 2021. The price of gold was subjected to profit-taking operations amid a state of cautious reassurance from Russia’s announcement of the withdrawal of some of its forces. Therefore the price of gold fell to the level of 1845 dollars per ounce before settling around the level of 1855 dollars per ounce at the time of writing the analysis.

The price of gold nearly flattened around its recent gains as investors sought clues on whether recent developments in geopolitical tensions over Ukraine will sustain demand for safe-haven assets. The attractiveness of bullion as a store of value and a hedge against inflation has driven its prices up, despite diplomatic efforts to defuse the situation in Ukraine. Commenting on this, Goldman Sachs analysts led by Jeffrey Currie said in a report that gold and oil provide the cleanest hedges for geopolitical risks.

Russian President Vladimir Putin responded to US warnings that Russia could invade Ukraine within days by holding televised meetings with his foreign and defense ministers, emphasizing de-escalation of tensions and continuing efforts to find a diplomatic solution. Moscow has repeatedly denied it was planning an invasion.

Potential headwinds for non-interest bearing bullion are growing bets on a more aggressive tightening by the US Federal Reserve. In this regard, St. Louis Fed President James Bullard said that the US central bank needs to move forward with its plans to raise US interest rates to confirm its credibility in fighting inflation.

In an interview with CNBC on Monday, Bullard reiterated his view that the US central bank should raise interest rates by 100 basis points by July 1. However, Kansas City Fed President Esther George said the bank should take a systematic approach to removing easing but be careful not to "exaggerate". Commenting on the gold market. “Gold is starting to gain strong interest as the need for protection against Fed policy mistakes, geopolitical risks and growth concerns grows,” said Edward Moya, senior market analyst at Oanda Corp. As for gold, but if that does not hold, the bullish momentum could take prices to the $1,900 level.”

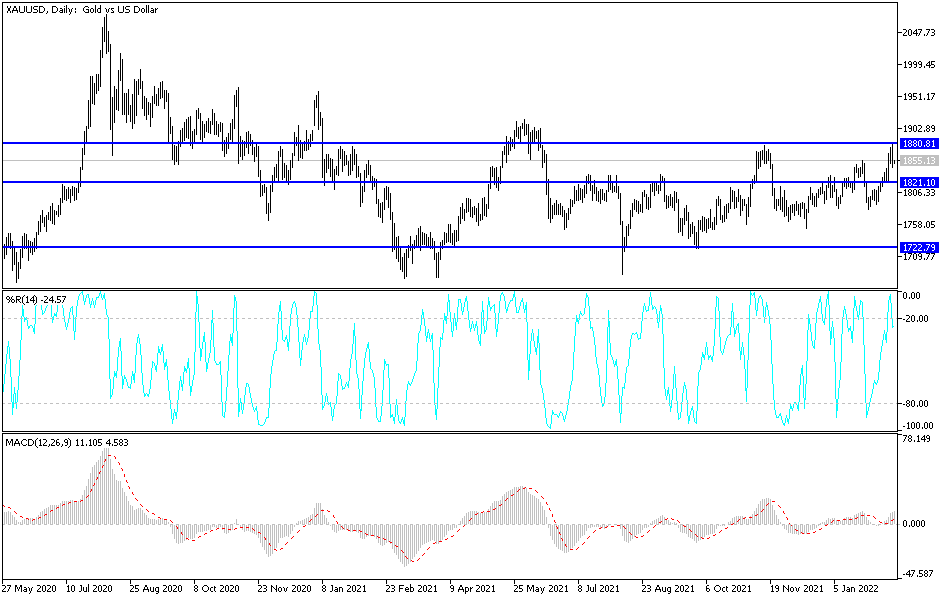

According to gold technical analysis: So far, the general trend of gold is still bullish, as long as it is stable above the psychological resistance of 1800 dollars an ounce. There will be no reversal of the general trend to the downside without a breach below it to reach the $1,775 support, according to the performance on the daily chart below. On the other hand, the 1880 resistance area will support the bulls to move towards the next psychological resistance, 1900 dollars an ounce. The US dollar, as well as gold, will be affected by the announcement of US retail sales figures and the Federal Reserve's indications today towards the future of raising US interest rates.