A temporary halt to the gains of the US dollar was an opportunity for the gold market to achieve gains at the beginning of trading this week. It reached the resistance level of 1824 dollars per ounce, which is stable near it at the time of writing the analysis. Gold futures extended gains, despite widespread concerns that the US Federal Reserve may accelerate quantitative tightening efforts due to a strong US jobs report for January. The price of the yellow metal retreated from a weekly gain of about 0.7%, but it is still down by about 0.8% since the beginning of the year 2022 to date.

As for silver, the sister commodity to gold, it is looking to test $23. Silver futures rose to $22.89 an ounce. Overall, the price of the white metal recorded an impressive gain of 1.5% last week, to reduce its loss over the year 2022 to less than 2%. In general, the yellow metal may be hiding amid the volatility in the global financial markets. Moreover, investors may expect a much higher-than-expected US inflation reading for January later this week.

On Thursday, the annual inflation rate in the US is expected to come in at 7.3%. If the result is accurate, it will be above 7% in December. However, rising consumer prices and a labor market in near full employment, may prompt the US central bank to raise interest rates significantly starting next month. The rise rate environment is usually bearish for metals because it raises the opportunity cost of holding non-yielding bullion.

Meanwhile, in terms of other factors affecting the gold market, the performance of the US Treasury market was mixed, with the benchmark 10-year bond yield dropping to 1.929%. US one-year yields fell to 0.875%, while 30-year yields rose to 2.237%.

Commenting on the performance of gold, Robert Rowling, market analyst at Kinesis Money, wrote in a research note, “Gold trading started the week in full swing with new gains after climbing higher, and successfully continued above the important psychological threshold of $1800 an ounce.” "While today is expected to be a quieter day for trading, gold's medium-term direction will be governed by how quickly the Federal Reserve decides to implement the more hawkish strategy that officials talked about more frankly last week," he added.

The US Dollar Index (DXY), which measures the performance of the US currency against a basket of major currencies, rose to 95.54. In general, the index comes out of a weekly loss of about 1%, making the currency negative during the year. A stronger profit is bad for dollar-denominated commodities because it makes them more expensive to buy for foreign investors. In other metals markets, copper futures fell to $4.467 a pound. Platinum futures fell to $1013.90 an ounce. Palladium futures fell to $2,219.50 an ounce.

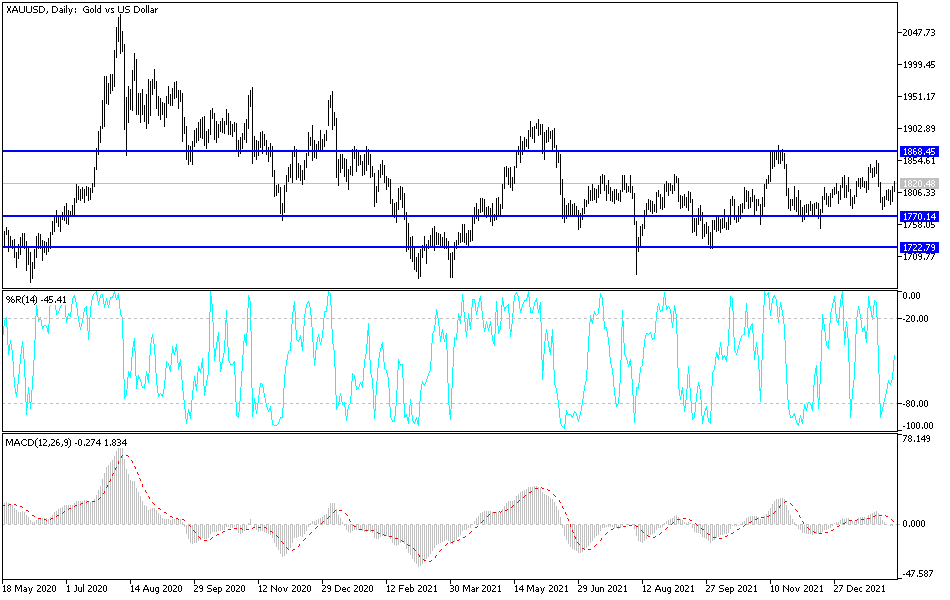

Technical analysis of gold: As I mentioned before, the general trend of the gold price will remain bullish if it is stable above the psychological resistance of 1800 dollars. This may support technical purchases to achieve stronger gains. The levels of 1818, 1827 and 1845 dollars are important targets for more control for the bulls on trend. It is already moving towards it, and the price of gold may remain in a bullish position until the announcement of US inflation figures. If they come stronger than expected, they will support the dollar and therefore negative for gold. On the other hand, the gold market will not give up its bullish view in the event of selling operations to reach the support of 1775 dollars an ounce.